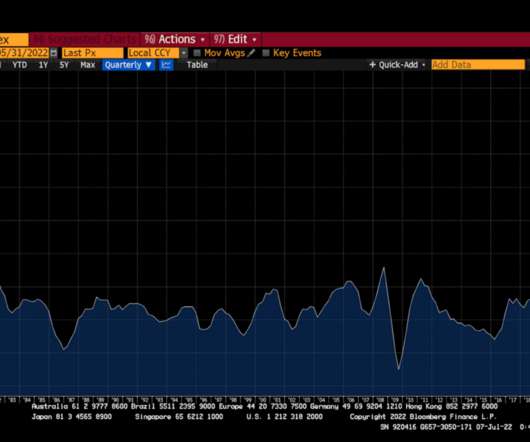

When will IPOs return? The past may hold some clues

TechCrunch

JANUARY 4, 2023

Natalia Holgado Sanchez is head of capital markets at Secfi , an equity planning, stock option financing and wealth management platform for startup executives and employees. The crisis of 2002: The dot-com bubble. That spurred investments in riskier assets. That spurred investments in riskier assets. Contributor.

Let's personalize your content