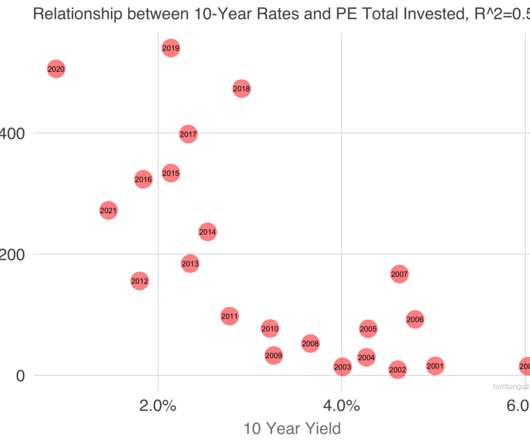

Venture Capital, Withering & Dying

Tomasz Tunguz

FEBRUARY 9, 2023

Amy Cortese published “Venture Capital, Withering & Dying” in the New York Times on Oct 21, 2001. So far this year, 29 venture-backed companies have tried initial offerings, compared with 252 in 2000. Venture capital funds lost 18.2 Venture capital funds lost 18.2

Let's personalize your content