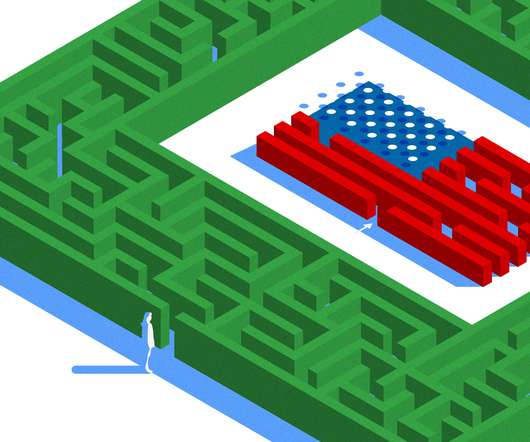

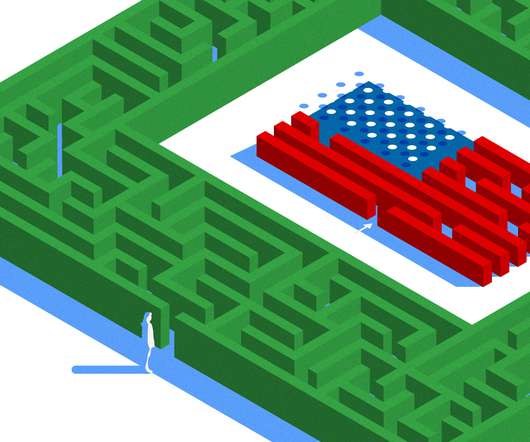

Investing in a More Inclusive Innovation Economy

Revolution

FEBRUARY 13, 2023

Since the beginning of modern venture capital investing — a relatively nascent asset class — the industry has been biased toward funding what it knows best: founders with familiar demographics (white, male) in familiar geographies (Silicon Valley).

Let's personalize your content