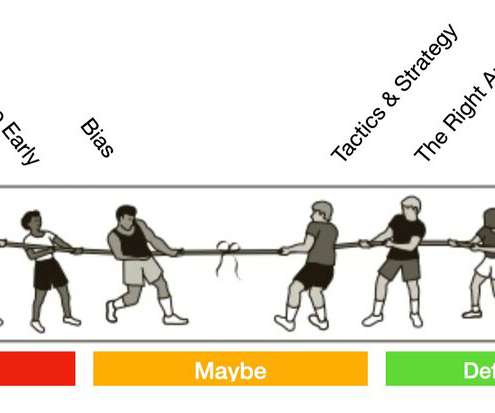

As a startup founder, you really need to understand how venture capital works

TechCrunch

AUGUST 17, 2022

At TechCrunch, it often seems as if every other startup story is about yet another fun company raising satchels full of venture capital. One is as a pitch coach for startups, and the other is as a reporter here at TechCrunch, which includes writing our fantastically popular Pitch Deck Teardown series.

Let's personalize your content