The Changing Venture Landscape

Both Sides of the Table

SEPTEMBER 10, 2021

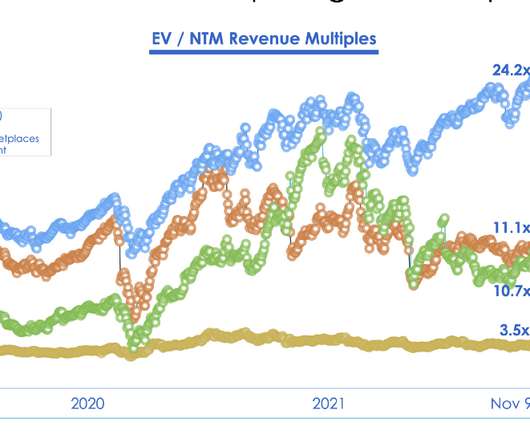

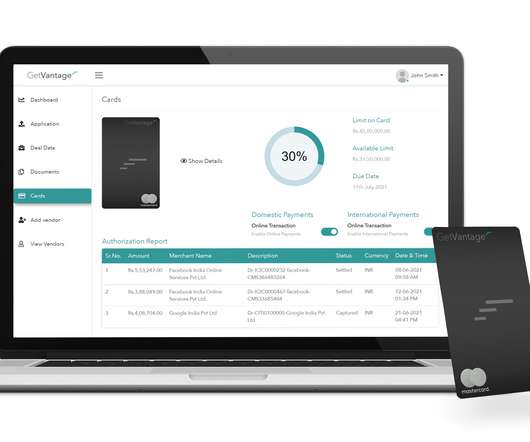

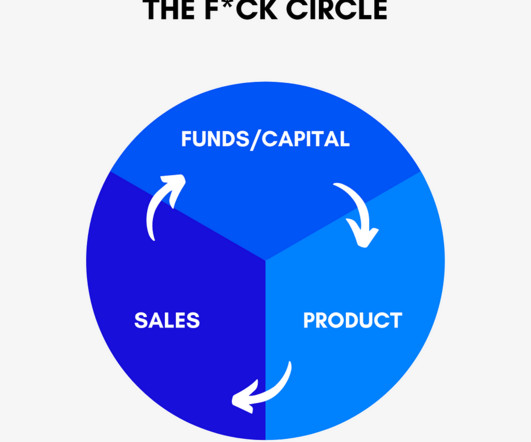

And the loosening of federal monetary policies, particularly in the US, has pushed more dollars into the venture ecosystems at every stage of financing. how on Earth could the venture capital market stand still? What Has Changed in Financing? even before the pandemic itself has been fully tamed. Of course we can’t.

Let's personalize your content