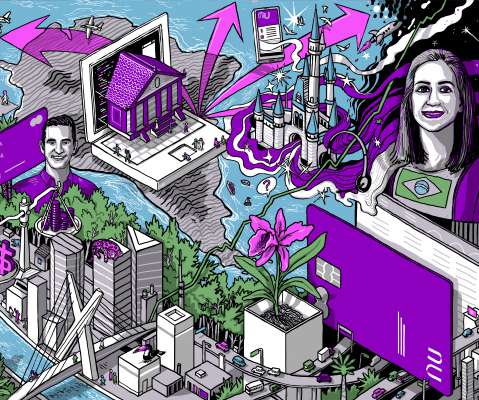

The Breakout Tech Company Of 2018

Haystack

NOVEMBER 25, 2018

Whereas in 2016 I struggled to come up with one, and whereas in 2017 it was obvious it was Coinbase, with 2018 comes the most money poured into U.S. In 2018, it was that kind year. This is the company, in my opinion, which only first appeared on the radar of most investors in 2018.

Let's personalize your content