Advice to Rising VCs and Founders Navigating The Correction

Revolution

MARCH 1, 2023

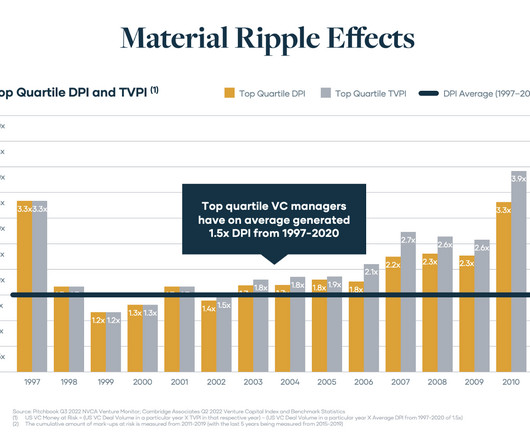

VC dollars are at risk, we conducted a historical analysis of top quartile fund managers over the past quarter century (as far back as we could access reliable Cambridge Associates data). We looked at the analysis in two parts: the 1997–2010 time period and the 2011–2020 time period. But what could that look like?

Let's personalize your content