At Last – An Asset Class Achieving High Ownership at Low Cost

Angel Capital Association

FEBRUARY 19, 2021

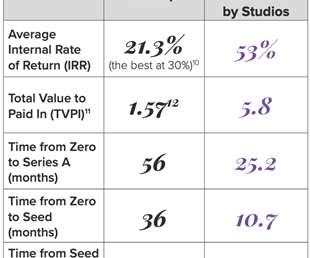

By: Nick Zasowski, Director at Global Startup Studio Network Startup studios are gaining steam across the angel investing landscape. Studios are causing this precise disruption to the traditional ways of building companies and how to invest in them. With numbers like they are reporting, it’s easy to understand why.

Let's personalize your content