Make no bones about it, Fuzzy expands reach into pet care market with capital infusion

TechCrunch

NOVEMBER 22, 2021

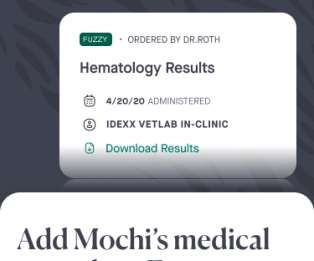

The company, founded in 2016, provides 24/7 live chat and telehealth, ship-to-home prescriptions, vet-curated items in its e-commerce marketplace and educational content and programs. In addition, 25% of the capital was raised from underrepresented communities, Bhettay said. Fuzzy live chat via its app. Image Credits: Fuzzy.

Let's personalize your content