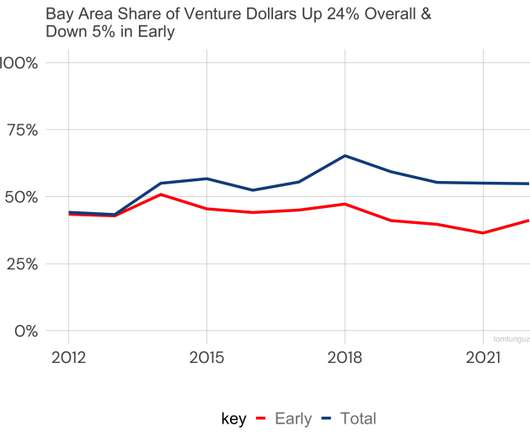

Just How Troubled is the Bay Area Startup Scene?

Tomasz Tunguz

OCTOBER 3, 2022

There’s a prevailing narrative that the health of the Bay Area startup ecosystem faces challenges. San Francisco’s share of startup rounds by count has fallen from its perch ten years ago. In 2021, San Francisco Bay Area startups raised $126b. In 2019, US startups raised $126.4b.

Let's personalize your content