Why I Angel Invest

Angel Capital Association

AUGUST 13, 2021

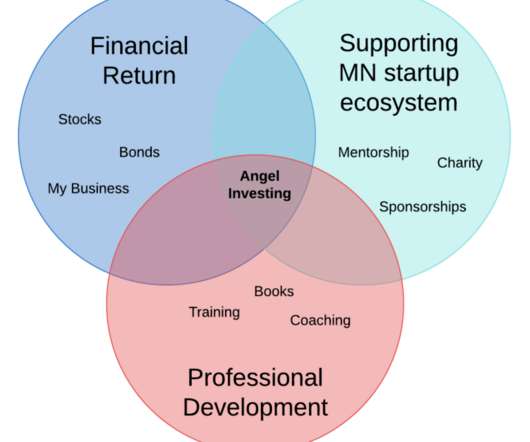

I’m sharing my thought process because perhaps it will nudge some of you to angel invest too! I consider myself a furiously curious person, and angel investing is one of the most rewarding ways I’ve experienced to satisfy this curiosity. THE ORIGIN I was the Founder & CEO of InboxDollars from 2000 to 2019.

Let's personalize your content