12 ‘flexible VCs’ who operate where equity meets revenue share

TechCrunch

JANUARY 14, 2021

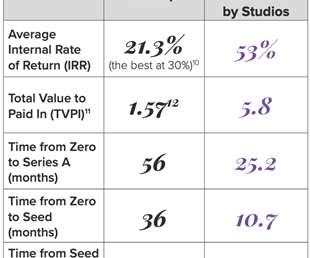

Jamie Finney is a founding partner at Greater Colorado Venture Fund , where he blogs about his work on VC and small communities. Flexible VC: A new model for startups targeting profitability. Flexible VC: A new model for startups targeting profitability. In the future, everyone will be famous for 15 followers. Jamie Finney.

Let's personalize your content