Current State of Angels and Boards of Directors

Angel Capital Association

JANUARY 3, 2024

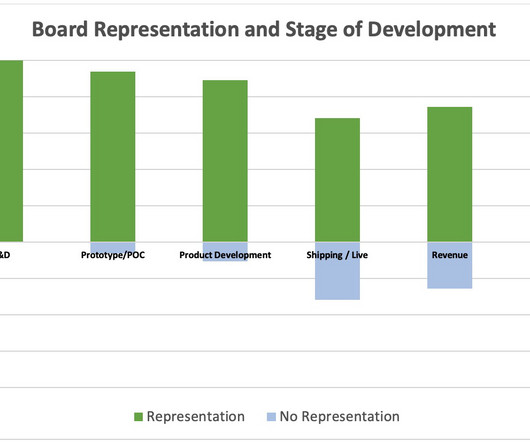

Angels often make their first real impact post-investment by helping a portfolio company develop a “real” Board, by insisting on documented processes, key metrics and measures and a more rigorous approach to corporate oversight and accountability. In the latter case, returns improved by 20%. with an average of 5.7 Director seats.

Let's personalize your content