Constrafor, a construction procurement company, goes ‘SAFE’ route with new capital

TechCrunch

APRIL 24, 2023

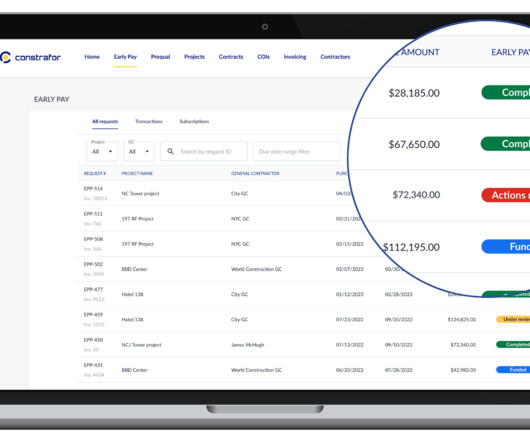

Ghauche and Douglas Reed started Constrafor, a SaaS construction procurement platform, to provide embedded financing and software for general contractors to manage their subcontractor workflow. Constrafor grabs $106M in equity, credit to finance construction subcontractors The company raised $106.3

Let's personalize your content