At Last – An Asset Class Achieving High Ownership at Low Cost

Angel Capital Association

FEBRUARY 19, 2021

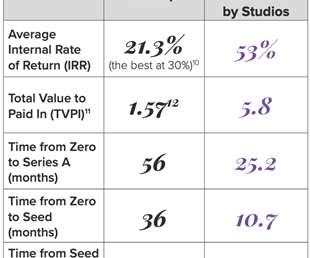

By: Nick Zasowski, Director at Global Startup Studio Network Startup studios are gaining steam across the angel investing landscape. Studios do this by using repeatable frameworks (imagine a factory) to test these ideas and back them with funding and resources in order to launch and grow powerful, scalable startups.

Let's personalize your content