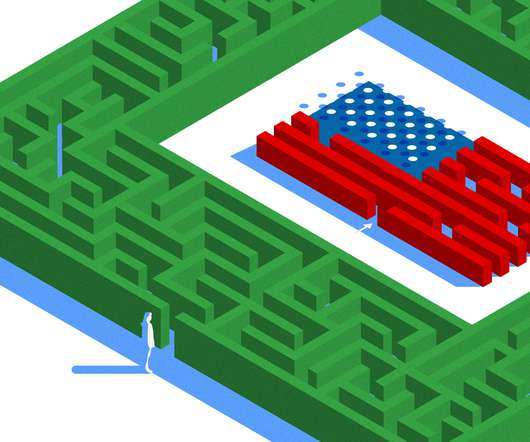

The Screwy Logic of Crowdfunding and Venture Fund Regulation

This is going to be BIG.

MAY 11, 2012

Jersey Shore Ventures anyone?). Until you realize that vetting and helping companies is actually really hard--or did you not notice all the news that venture capital as an asset class doesn't beat the market. Who wouldn't want in on the next Union Square Ventures or First Round Capital funds? tanning salon/seed fund combo.

Let's personalize your content