Venture Capital and the Art of the Deal: More of the Same

Angel Capital Association

SEPTEMBER 7, 2021

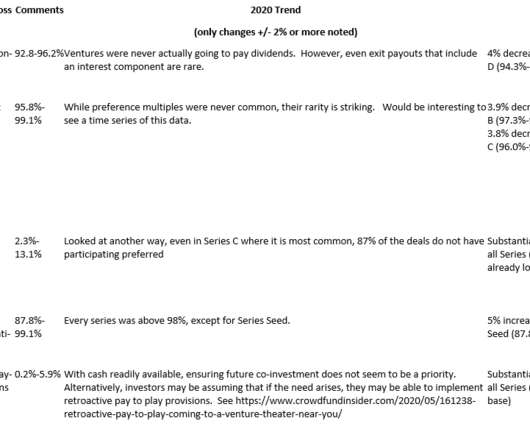

By: Dror Futter, Legal and Business Adviser to Startups, Venture Capital Firms and Technology Companies. Based on recent data provided by the National Venture Capital Association in partnership with Aumni, the market for venture capital deal terms seem to be that kind of store.

Let's personalize your content