Are SAFE’s Truly Everywhere? The Role of SAFEs in Angel-Stage Deals

Angel Capital Association

APRIL 30, 2023

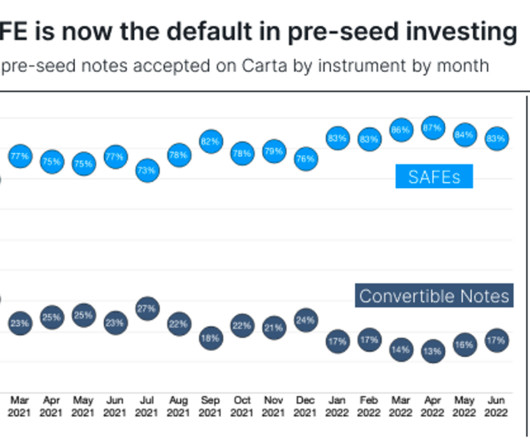

Y Combinator, a leading incubator, invented the original (pre-money) SAFE (Simple Agreement for Future Equity) in 2013 to provide an easy, fast and cheap way to fund the dozens of startups comprising a Y/C batch. SAFEs remain prevalent for incubator and earliest stage startup hub deals, stages typically prior to major angel investing.

Let's personalize your content