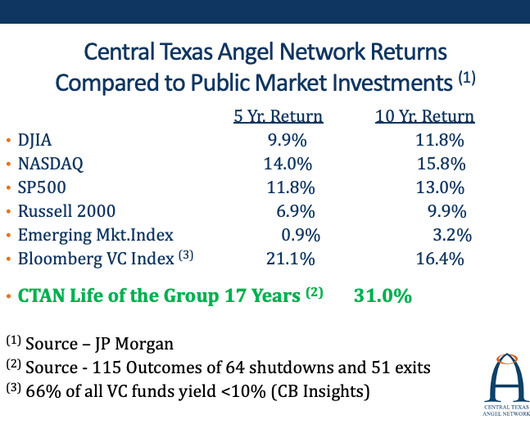

“Home Runs” Are as Instrumental to Success in Angel Investing ?as They Are in Public Market Investing

Angel Capital Association

NOVEMBER 30, 2023

We have all heard the importance of having one or more of our angel investments noted as a “home run” In terms of a return exit. Generally speaking we can define a home run for an angel investor as a company having a very successful return multiple at the time of their exit, generally with a return multiple of 10.0x

Let's personalize your content