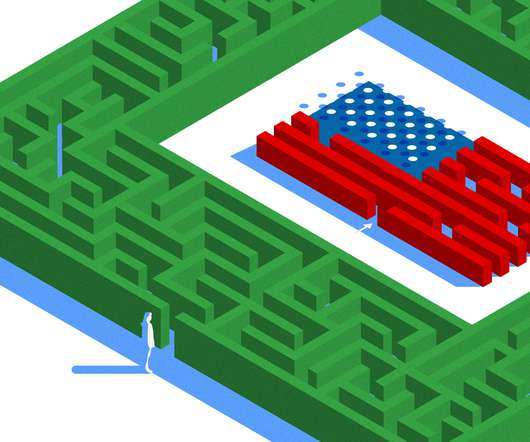

Do you agree with “Fail fast?”

Berkonomics

AUGUST 29, 2024

Reduce further expenditures of remaining capital and protect the assets purchased with the original investment. A personal story of failing fast My favorite story of a fast failure was of a technology incubator started in the year 2000 with optimistic money from several angel investors, including me.

Let's personalize your content