We’d like to give a shout-out to Morgan Cheatham’s blog post “Anatomy of the Data Room” for a fantastic perspective on what a data room is and why it matters. Here, we’ve chosen to go deep on the biotech virtual data room (VDR), and how it can be a strategic asset for biotech teams. We hope both pieces together offer complementary views into some of the very best elements of virtual data rooms across biotech, healthcare, and many other markets!

The biotech industry is built on one of the cleanest go-to-market strategies in existence: if you make a safe drug that really works, patients are likely to receive it and payors are likely to pay for it. This simplicity is of course shrouded in the complexity of biology, and demands that biotech companies thoughtfully de-risk existential concerns throughout the drug development lifecycle. But how can biotech teams effectively communicate to investors and partners how they will, with each round of financing, incrementally reduce the risks of discovering and developing successful new drugs? One powerful avenue is through the use of an exceptionally well-curated, comprehensive, and accessible virtual data room (VDR)! VDRs don’t just support external financing campaigns, but can also serve as valuable tools for pharma-facing business development deals in growing biotech companies. One of the most common questions we get from early stage founders is “what should I put in my data room?” Here, we’re sharing an actionable guide for biotech leadership teams as they start the process of building or renovating their own data room.

What must be included: the MVP of VDRs

So what are the essential must-haves in your VDR? Based on our evaluation across hundreds of biotech VDRs at a16z Bio + Health, we’ve assembled a list of what we believe should be included in the “MVP” (minimal viable product) of VDRs. Together, these documents will help distill not only your vision for the current fundraise, but more broadly the long-term differentiation and trajectory of your company.

Company overview deck

If you’re under CDA with an investor, this is where to add your expanded confidential pitch deck (typically, you’ve already shared a non-confidential deck over email). In this confidential deck, consider providing as much information as possible to accelerate the diligence process, including details about any underlying technical platform, your intended near-term pipeline targets and substantive program-specific data (e.g., key in vivo data results).

Deep dives on your programs

For each program, develop a series of vignettes that address each of the following: the current market/unmet need, competitive landscape, why your company has a differentiated insight or modality advantage when pursuing this particular target, and the full extent of preclinical and clinical data available.

Gantt chart for the fundraise

Where does this round of funding get your team? What milestones do you intend to hit along the way (e.g., platform validation; or, 2 DCs; or, 1 program entering the clinic with a follow-on pipeline; or, early clinical POC data)? Adding a Gantt chart for the fundraise that neatly arranges your intended trajectory across all programs will achieve two important goals: it provides thoughtful rationale for the current funding requirements, and also reveals how your platform and pipeline will mature over the next round.

Business development strategy

While rare for earlier stage companies, those that have secured BD partnerships should consider including as much detail as possible around the structure of your partnership and how it is progressing. This helps investors understand sources of BD partner excitement, early partner feedback, what additional non-dilutive funding may exist, and also indicates what types of downstream economics are likely when valuing partnered programs. If you’re building a horizontal business model (e.g., not building your own pipeline and rather seeking to enable a partner biopharma organizations), projections on deal volume and average deal size are a must.

Intellectual property

Here the goal is to help diligence teams understand what the company’s IP position is and demonstrate a clear-eyed recognition of the differentiation and defensibility of your platform. Include copies of any patents or trademarks that have been filed, as well as IP licensing or option agreements that have been executed. It can also be helpful to show the summary of a freedom to operate (FTO) analysis, to show investors that pre-existing IP or other in-flight filings are unlikely to represent a competitive threat.

Finance

While the Gantt chart outlines the high-level use of proceeds and associated progress during the next financing round, this is where additional granularity is appropriate. How has money been spent to date, and how do you plan to spend it going forward? How is the company’s go-forward budget split across platform investments and program-specific spend? How much of the total financing is allocated towards the lead program? What is the split between pre-clinical and clinical R&D expenditures? These are all common questions you’ll hear from biotech investors. Specific documents that can help communicate the answers to these questions include:

Use of proceeds

What is the rationale for the amount you are raising and how do you plan to spend it? This is a simple table in which each row represents a spend category, and the sum of each row is roughly the quantum of capital which you are currently raising. It divides the total financing proceeds into G&A functions (both headcount and categories like real estate), platform R&D, and program-specific R&D (often further subdivided by each stage of development, CMC, etc). This budget is important to demonstrate to investors that you are planning ahead and have a realistic view of the runway that new capital will support.

Financial statements (historical and forecasted)

Some companies choose to include historical and forecasted income statements in the data room. This level of detail can help investors understand what the most capital intensive aspects of your company have been, and, importantly, how that may change in the next phase of company building.

Capitalization table

Adding a current cap table can help investors understand important financing details such as whether there remains a sufficient quantity of option pool equity for future hiring, how founder equity is shared among multiple founders, and what the relative distribution of company equity across existing investors looks like. It is also OK to wait to share this particular piece of information until an investor expresses clear interest, and a desire to move towards consideration of a term sheet.

Bonus content that helps your VDR really shine: the nice-to-haves

This section includes additional ways to streamline the data sharing process and highlights unique ways to demonstrate a robust vision for company growth.

Background reading

What are the publications or other background information that investors or partners will need to catch up on in order to thoroughly evaluate your platform and/or programs? Make it easy on them and provide it here. This may include foundational work from academic founders or related work in the field more broadly.

Pipeline prioritization framework

Top-down or bottom-up? Have you “turned over every stone” for all targets amenable to your modality or platform construction, or did you take an indication-centric approach to building your pipeline? Walking investors through the decision process leading to your current pipeline programs informs your broader strategy, and reveals how you may add additional future programs.

Raw data

Some investors may want to see what the spread in plotted data looks like outside of a deck-polished graph. Providing access to raw data for few key experiments to enable plot replication will send a positive signal on your underlying position on data transparency.

An “investment memo”

Part of the investor’s job is to establish a case for why an investment in your company should be considered. Typically, this takes the form of a written description outlining the strengths, current areas of focus, vision for the biggest form of your company, and the ways in which this opportunity is differentiated from the competition. Developing your own investment memo may help further crystallize your vision and longer-term ambitions while also allowing you to flex a long-form written description on the upside for your approach.

Anonymized FAQs from prior and/or current diligence processes

Not all investors home in on the same diligence questions, and not all potential BD partnerships will be concerned with future pipeline development. However, collating the output of prior and current ongoing diligence Q&A may reveal previously unforeseen strengths in your approach, and will certainly exhibit the technical breadth and depth of your team in providing the responses. It can also save you from repeatedly answering the same diligence questions!

Investor-specific Q&A docs from this diligence process

Frequently, investors or BD partners will ask you to respond to one or more sets of written diligence questions. It’s helpful to document these questions and your responses, and share those investor-specific Q&A sets in the VDR (with viewer permissions allowing the documents to be visible only to that specific investor). While you have undoubtedly already shared these responses by email or live discussion, it’s helpful to see all the correspondence documents in one place.

Legal agreements

Although there’s no need to flood the data room with every legal document signed throughout the company’s existence, it’s helpful to share relevant documents outlining your company’s major IP filings, external contractual agreements (e.g., academic technology in-licensing terms, sponsored research agreements, business development contracts) and obligations going forward (e.g. substantial real estate lease agreements).

Human Resources

The HR section should include consulting agreements, recruiting agreements, and any specific board/director expertise not already covered in your confidential investor deck. Some companies also choose to provide a deep-dive on their full organization here, with CVs of key leaders; this is not necessary, but can occasionally be additive.

What to exclude

To ensure you’re spending more time on science, and less on VDR construction, there are a few things that are typically unnecessary and you may consider specifically excluding them or pushing back on investors who ask for such information too early in the financing process.

Items not covered under CDA

If it isn’t outlined in the executed CDA, it likely doesn’t need to be included. Don’t overshare irrelevant corporate information.

Ultra-sensitive information

Documents under attorney/client privilege shouldn’t be included in your VDR. Additionally, do not share protein or nucleic acid sequences or chemical structures for your lead molecules. The same holds for very specific details about your platform, such as exact library composition, or an exhaustive list of all targets discovered. These data can be shared with additional protection with a smaller handful of investors who have expressed strong interest in investing and are conducting deeper, confirmatory diligence.

Board minutes & board decks

Board minutes are often too general and don’t significantly aid in due diligence. Similarly, previous board decks are outdated and might not reflect the current and future direction of your company. Unless an investor specifically asks for them, it’s usually OK to omit both.

Litany of “extra” legal docs

Office leases for small spaces, employee offer letters, etc. are essential pieces of the operating pie, but won’t typically sway an investment/partnership decision and can be excluded unless specifically requested.

How to execute

The vendor you select, the hierarchical organization, and security/tracking privileges are all important considerations to keep in mind when getting your VDR off the ground. Remember, the goal of your VDR is to facilitate communication with potential investors and/or partners and therefore you should be optimizing for clear, organized information that is easy to navigate.

Vendor considerations

We recommend you research and choose a vendor that covers your needs. Example vendors include Egnyte, ShareVault, Box, DocSend, Citrix, ShareFile, Datasite, and many, many others. Regardless of which you choose, make sure to clearly communicate to investors that they should expect to receive a data room access email (and who from)—these are often sent to spam or lost in the deluge of daily emails, so make it easy for them to find!

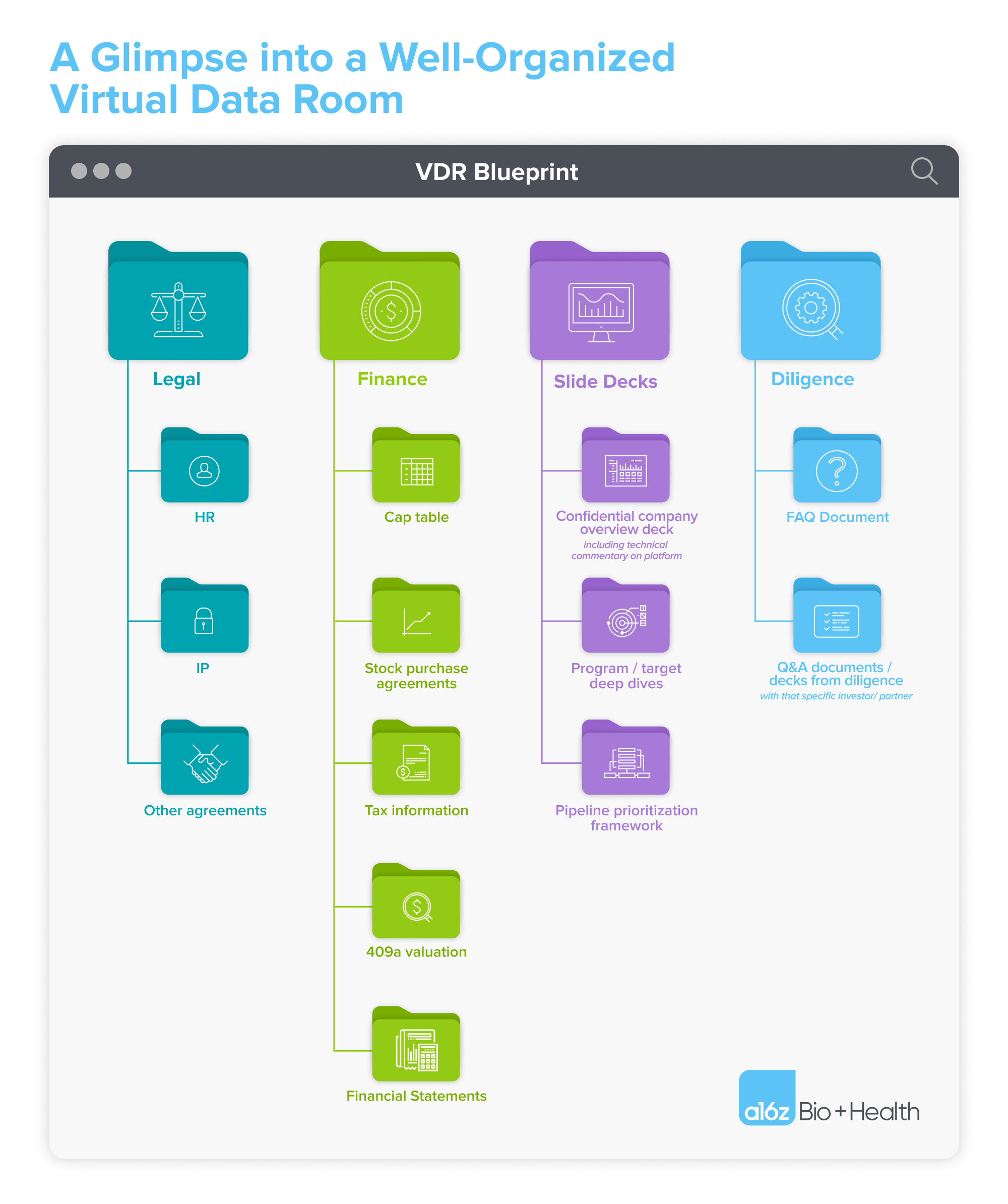

Hierarchical organization

Your file system should follow an interpretable logic. More directories are better than fewer, denser ones. Make it easy for the person doing diligence to find what they’re looking for. Additionally, automated indexing is a plus and will help avoid clogging the VDR with deprecated document versions.

Access and tracking

Universal access to a VDR is unnecessary. Limiting access to very specific subsets of investor/partner team members is appropriate. Adding document watermarks and view-only permissions will also drive transparency. Lastly, tracking metrics on access history with time-specific logs is often a great way to clarify just how serious an investor’s interest is, and who specifically from their team has been spending time digging into your data.

Sharing lead compositions

Late into the diligence process, investors may want to understand some finer-grained details on your lead molecules. It’s understandable to be hesitant in sharing molecular structures or sequences. One mechanism to assuage concerns regarding novelty or differentiation is to set up a 3rd party review process with a trusted consultant. Typically, these consultants can share their analysis back with potential investors in a way that directly answers investor questions and fairly highlights areas for development.

Conclusion

A thoughtfully constructed virtual data room is critical for biotech companies wanting to clearly convey their vision and strategy to potential investors and business development partners. By including key documents covering platform, programs, milestones, IP, finances, and more, founders can readily share the information required for diligence in an organized, trackable manner. Ultimately, a robust VDR helps derisk biotech companies and ensures your precious time and capital can remain focused on science and patients. With the right preparation and execution, virtual data rooms enable management teams to open their doors to key partners on the journey of transforming promising science into approved medicines that improve lives.

-

Bryan Faust is an investing partner on the Bio + Health team, focused on life science investment opportunities.

-

Becky Pferdehirt is an investing partner on the Bio + Health team, focusing on early stage companies building technology platforms for therapeutic discovery and development.

-

Vineeta Agarwala is a general partner on the Bio + Health team at Andreessen Horowitz, focused on biotech, digital health, and life sciences tools/diagnostics.