Amit Anand

With Grab’s announcement of its imminent Nasdaq listing and GoJek merging with Tokopedia to form tech giant GoTo, casual international observers could be forgiven for believing that Southeast Asia’s tech universe only comprises similar companies. However, these companies only represent the highlights of what is a blossoming startup ecosystem.

Southeast Asia is hitting a sweet spot. It remains at a relatively nascent phase expansion in the technology industry but is at the same time developed enough to have a 400-million-strong internet user base. By late 2021, approximately 80% of the Southeast Asian population (aged 15 and above) will be digital consumers, according to a report by Facebook and Bain & Company.

Unsurprisingly, tech startup growth is booming as well. More than 35 tech startups across e-commerce, fintech and SaaS have achieved unicorn status in Southeast Asia, which has over 200 significant startups. As per Jungle Ventures’ calculations, the total value of the region’s digital companies is around $340 billion today and is estimated to grow to $1 trillion by 2025.

Further, Southeast Asian companies are breaking IPO records. Both Grab and GoTo’s valuations hover around the $35 billion to $40 billion mark. Sea is the 65th most valuable company in the world with a market cap of $187 billion, while Bukalapak was Indonesia’s largest-ever IPO at $1.5 billion at a market cap of $8 billion. There are many more waiting in the pipeline hoping to join this illustrious club of Southeast Asian tech decacorns.

Vertical e-commerce is climbing the vine

E-commerce will continue to accelerate in Southeast Asia — the sector is projected to grow 80% year on year and double in five years to $254 billion from $132 billion in 2021, according to the Facebook and Bain report. Shopee, Lazada, GoTo and Bukalapak are testament to the phenomenal growth opportunities available, and they are still growing.

While initial e-commerce success came from retail-focused companies such as Shopee and Lazada, the next value creation wave is emerging through vertical e-commerce.

Carro, which achieved unicorn status this year, offers an automotive marketplace in addition to supplementary products such as financing and insurance. Others like Livspace, Pomelo, Zalora and Sociolla are serving the home goods, fashion and personal care industries, respectively, and raising millions of dollars in funding. Their success is underpinned by the fact that at a product category level, Southeast Asia is still in the early stages of online retail penetration.

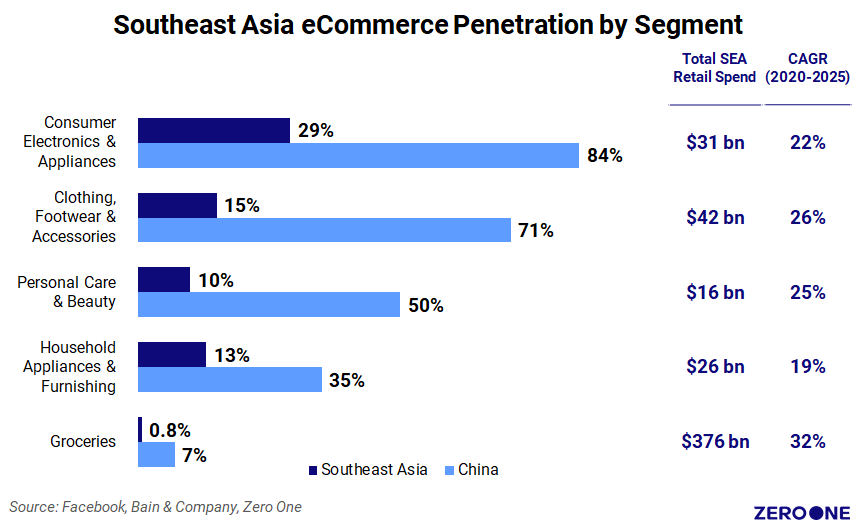

Based on the chart below, just “catching up” to the same level of penetration as China in verticalized segments increases the e-commerce opportunity by four to five times across the region.

Fintechs and digital banking services

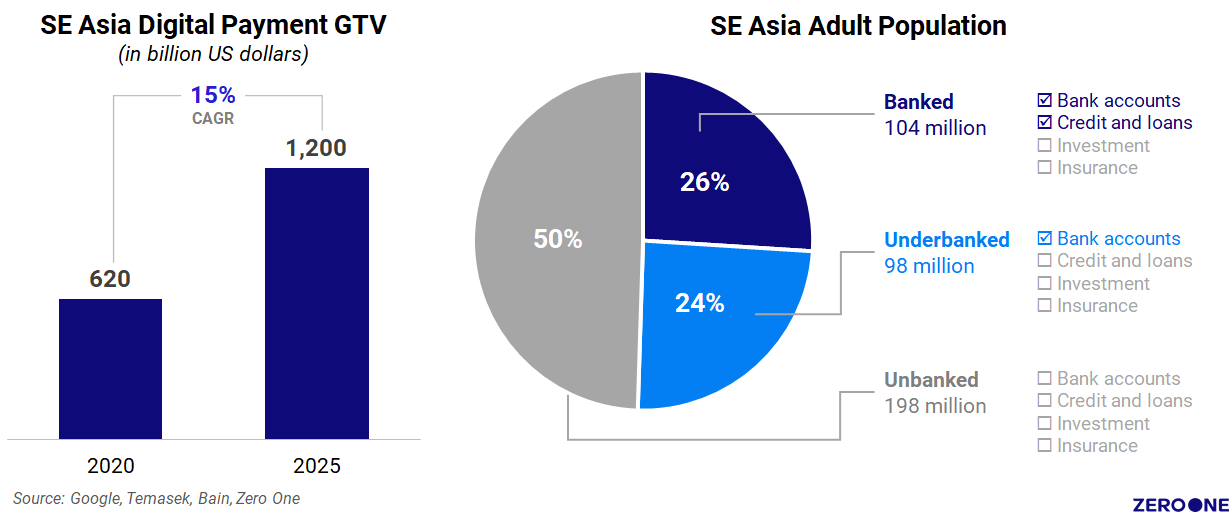

As seen below, Southeast Asia’s digital payment gross transaction value (GTV) was estimated to be $620 billion in 2020 and is expected to reach $1.2 trillion by 2025. But despite strong e-wallet adoption, over 70% of adults in Southeast Asia remain either underbanked or unbanked due to various cost and geographical limitations. This large, underserved population creates an opportunity for fintech startups to fill the gap.

Buy now, pay later (BNPL) is a fintech space many investors are following, with the sector’s total deal value doubling in just a year from $270 million to $445 million in 2021, according to Tech in Asia. Prominent businesses include Indonesia-based Kredivo, which went from seed to IPO in five years and is now the largest fintech company in Southeast Asia after listing on the Nasdaq via a SPAC at a valuation of $2.5 billion.

Business-to-business (B2B) fintech — particularly payment gateways enabling online and cross-border commerce — has also become a growing opportunity. Xendit, a payments infrastructure provider, saw a year-on-year increase in total payments volume (TPV) of over 200%, and currently, has a TPV of $9 billion processed per annum. 2C2P, a full-suite payments platform, offers a suite of services such as payment gateways, corporate cards, digital wallets and remittance services. The startup brought in revenue of over $100 million in 2020 and has been expanding rapidly in the region.

Digitization of the SME workforce

Small and medium-sized enterprises (SMEs) are the backbone of Southeast Asia’s growing economy, accounting for over 90% of total establishments and contributing more than 40% of ASEAN’s $3 trillion GDP. In the wake of COVID-19, over 65% of SMEs now intend to digitize their operations for better business efficiency and continuity. Companies that can provide solutions to bridge the gap have significant growth opportunities, and people are taking note.

India’s Moglix, a B2B procurement platform that serves over 500,000 SMEs in Asia, raised $120 million in a Series E round this year. And KiotViet, which offers affordable, full-suite software solutions to over 110,000 micro, small and medium enterprises in Vietnam, raised a $45 million Series B this September. GudangAda, a marketplace platform for wholesalers, also raised a $100 million Series B fundraise of over $100 million this July.

Third-party logistics and supply chain tech

Southeast Asia’s fragmented geography creates scalability issues for the e-commerce model of running logistics and delivery in-house. This has fueled the rise of tech-enabled third-party logistics providers who can handle distribution, warehousing and last-mile delivery across countries and jurisdictions.

According to Insight Partners, this opportunity represents a revenue pie that will be worth over $55 billion by 2025. Sector funding is at an all-time high — over 30 deals were announced in 2020 with a total deal value of almost $750 million. Some prominent companies in this space include Indonesia’s Waresix and J&T Express, Singapore’s Ninja Van and Thailand’s first tech unicorn, Flash Express.

The region is just getting started

Despite the impressive growth and stellar companies grabbing headlines and tons of capital, Southeast Asia is only just entering the next phase of development. This represents a broadening of the region’s tech industry that will further catalyze growth. With new deals and intentions to list in the U.S. being announced more frequently, the region shows no sign of slowing down and the birth of many more unicorns is on the horizon.

Disclosure: The following are Jungle Ventures portfolio companies — Livspace, Pomelo, Sociolla, Kredivo, Moglix, KiotViet, Waresix

Comment