Toni Eliasz

Singapore is home to fewer than six million people, making it one of the smallest ASEAN countries, in terms of population. It is a young country as well — having gained independence in 1963 — and resides in a neighborhood with far larger economies, including China, Indonesia, and Vietnam. When the country first became independent, its mandate was to simply survive rather than thrive.

So how does a country evolve from a position of relative uncertainty, with comparatively few resources, to one that leads the ASEAN region in venture capital investment and has been home to 10 unicorns?

Countries around the world examine Singapore’s ecosystem from a distance, hoping to learn from, and emulate, its story. The World Bank Group recently published a report, The Evolution and State of Singapore’s Start-up Ecosystem, documenting the country’s experience in building its startup ecosystem and the challenges facing it.

This article presents an overview of the report’s key findings and offers a few key recommendations on what other countries can learn from Singapore’s experience, as well as what Singapore itself can do to maintain progress.

A glimpse into Singapore’s current startup ecosystem

As of 2019, Singapore had over $19 billion in PE and VC assets under management, more than twice that of neighboring Indonesia, Philippines, Vietnam, Malaysia, and Thailand combined. In that same year, the country was home to an estimated 3,600 tech startups and nearly 200 different intermediary and supporting organizations (accelerators, co-working spaces, coding academies, etc.) – some which have a multinational presence, such as Blk71, whose Singapore headquarters has been referred to as “the world’s most tightly packed entrepreneurial ecosystem.”

While assessing the size and strength of startup ecosystems is an evolving method, Start-up Genome priced Singapore’s ecosystem at over $25 billion, five times the global median.

Arguably, the most eye-catching hallmark of this ecosystem is its population of current and former unicorns. Collectively, Singapore has been home to ten unicorns, three of which have offered an IPO (Nanofilm, Razer and Sea) and two of which have been acquired – one by giant Alibaba (Lazada) and one by Chinese streaming powerhouse YY (Bigo Live). The remaining five are Trax, Acronis, JustCo, PatSnap, and Grab – the ASEAN region’s largest unicorn to date.

The education sector is also prominent in Singapore’s ecosystem. Universities like the National University of Singapore (NUS) and Nanyang Technological University (NTU) are deeply embedded into this ecosystem, helping with R&D commercialization linkages, incubation, talent/knowledge transfer, and other areas.

So, how did Singapore’s startup ecosystem come to be?

Numerous factors have contributed to building Singapore’s startup ecosystem, with government intervention and leadership being the dominant driving forces. The government has spent more than USD60 billion over the past several decades to enhance the country’s R&D infrastructure, create VC funds, and launch accelerators and other support organizations.

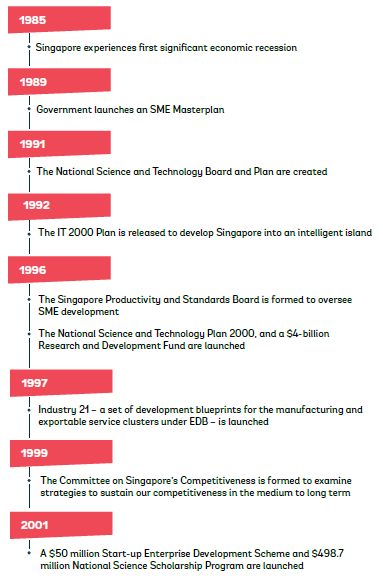

Long before the country had any VC funds, accelerators, or unicorns — before the word “unicorn” was ever used to discuss startup growth or the country had even a basic semblance of a startup ecosystem — Singapore’s government began laying the foundation for an increasingly competitive, global economy and has spent decades embedding the country into global value chains. In 1989, after suffering its first recession, the government began focusing on R&D and specializing in high-technology to help Singapore catch-up with more advanced economies over the next 20 years.

The late 1990s saw the introduction of targeted strategies and policies focusing on entrepreneurs and startups themselves. These actions helped spur the country’s evolution from one focusing on building a business-friendly environment that is globally integrated into one concentrating heavily on supporting innovation and startups directly.

In addition to direct government support to Singapore’s startup ecosystem, there have been other attributes that have helped shape it (many of which have also been government-driven). And while it is hard to separate the role of the government from Singapore’s startup ecosystem, the government has indicated that it understands the limitations of ecosystem development driven largely by the public sector and has increased its efforts to entice the private sector into taking a more active role in developing this ecosystem by encouraging the establishment of corporate venture funds and corporate startup programs.

Furthermore, the government has taken steps to utilize universities in their pursuit to build linkages between researchers, students, startups, and industry, as well as stimulate entrepreneurship.

What should the ecosystem focus on moving forward?

While Singapore has a number of impressive milestones in terms of its startup, VC, and accelerator communities, it must nonetheless address a series of lingering challenges. Our report suggests that, in addition to addressing an over-reliance on government, there are several priority areas to focus on in order to advance Singapore’s startup ecosystem, including:

- Access to data – As part of our research we obtained data on various macro-level trends (e.g. overall VC flows in Singapore and the estimated size of the country’s startup population). However, many opaque areas remain. Although the government has spent tens of billions of dollars building-out its startup ecosystem, it is still unclear what this spending has legitimately yielded. Understanding the ecosystem’s contribution to the country’s labor market, GDP, gender equity, and other dimensions is critical.

- Funding gaps – To date, while the supply of early-stage funding remains relatively consistent and sufficient, larger ticket sizes and the capitalization of niche sectors are relatively less common. While indeed, Singapore is putting a growing amount of capital and resources to work in the deep-tech space, these types of interventions typically require longer timelines for validating concepts and exiting them, and in parallel other sectors remain undercapitalized.

- Retaining talent – Just as financial capital needs to move easily throughout an ecosystem, so, too, does human capital in functional markets. Arguably, entrepreneurs and employees are the lifeblood of a startup ecosystem. A relative dearth of local and foreign talent available to Singapore hinders this dimension.Singapore struggles with keeping its cost of living low enough to retain talent over the long-term, which affects employees across sectors. Processes enabling foreign talent to move to the country can also be difficult to navigate for young startups – an issue compounded by the fact that larger corporations can offer higher paying jobs, resulting in talent leaving the ecosystem.

- Regional competition – Singapore leads all ASEAN countries in terms of overall VC funding and generally leads this regional startup pack by a wide margin. But while the gap in investment, the existence of unicorns, government spending, and overall startup activity between Singapore and its neighbors is significant, countries like Indonesia and Vietnam are continuing to build-out their ecosystems and divert talent and capital away from Singapore. In order to remain a regional hub, Singapore must ensure it stays relevant vis-a-vis its nearby ecosystems.

So what happens next?

Singapore’s startup ecosystem, much like the country itself, often captures the attention of countries around the world seeking to spur technology and startup-led growth. Rightfully so. There is a growing number of countries worldwide who aspire to create thriving, dynamic startup ecosystems – all of whom would be wise to contemplate lessons offered by Singapore’s experience.

Government leadership, the building of a business-friendly environment, and the development of talent (as well as specializing in industries that capitalize on this talent) are all trademarks that Singapore can showcase to other countries. However, Singapore’s development was not without growing pains either. For starters, while governments are needed to help jump-start ecosystems, they cannot always be the dominant player. Similarly, data gaps obscuring the true impact of an ecosystem can impede progress. In addition, even though Singapore has a relatively robust funding community, the country must still address gaps at later stages.

Finally, no ecosystem is an island and must collaborate with hubs in other countries. Singapore has strong economic ties throughout ASEAN, which has aided in solidifying its regional positioning. Yet those same countries are also competitors for talent and funding. Navigating such relationships is crucial for any country seeking to become a more relevant player in global startup and VC activity.

Comment