What if hardware product managers had tools as good as those available for software PMs? Well, that’s the world Five Flute wants to live in. The company raised a $1.2 million round I covered earlier this week. Today, we’re taking a closer look at the pitch deck it used to raise its pre-seed round. Five Flute shared its excellent deck with us with only minimal edits, and I’m psyched to share it with you — along with my usual teardown shenanigans. Let’s dive in and figure out what works well and what comes across as a little bit wobbly.

We’re looking for more unique pitch decks to tear down, so if you want to submit your own, here’s how you can do that.

Slides in this deck

Five Flute raised its pre-seed round with a really interesting deck; it includes a number of slides that I rarely see in pitch decks, but the narrative flows well, and I can see why the company chose to include them.

The company has a few slides that were lightly redacted for publication: There are logos removed from slides 5 and 11, a small amount of text related to product plans removed from Slide 15, and some of the company’s targets and fundraising details removed from Slide 16.

Here’s an overview:

- Cover slide

- “We’ve shipped hardware and software products across industries and we deeply understand the problem space.” — team slide

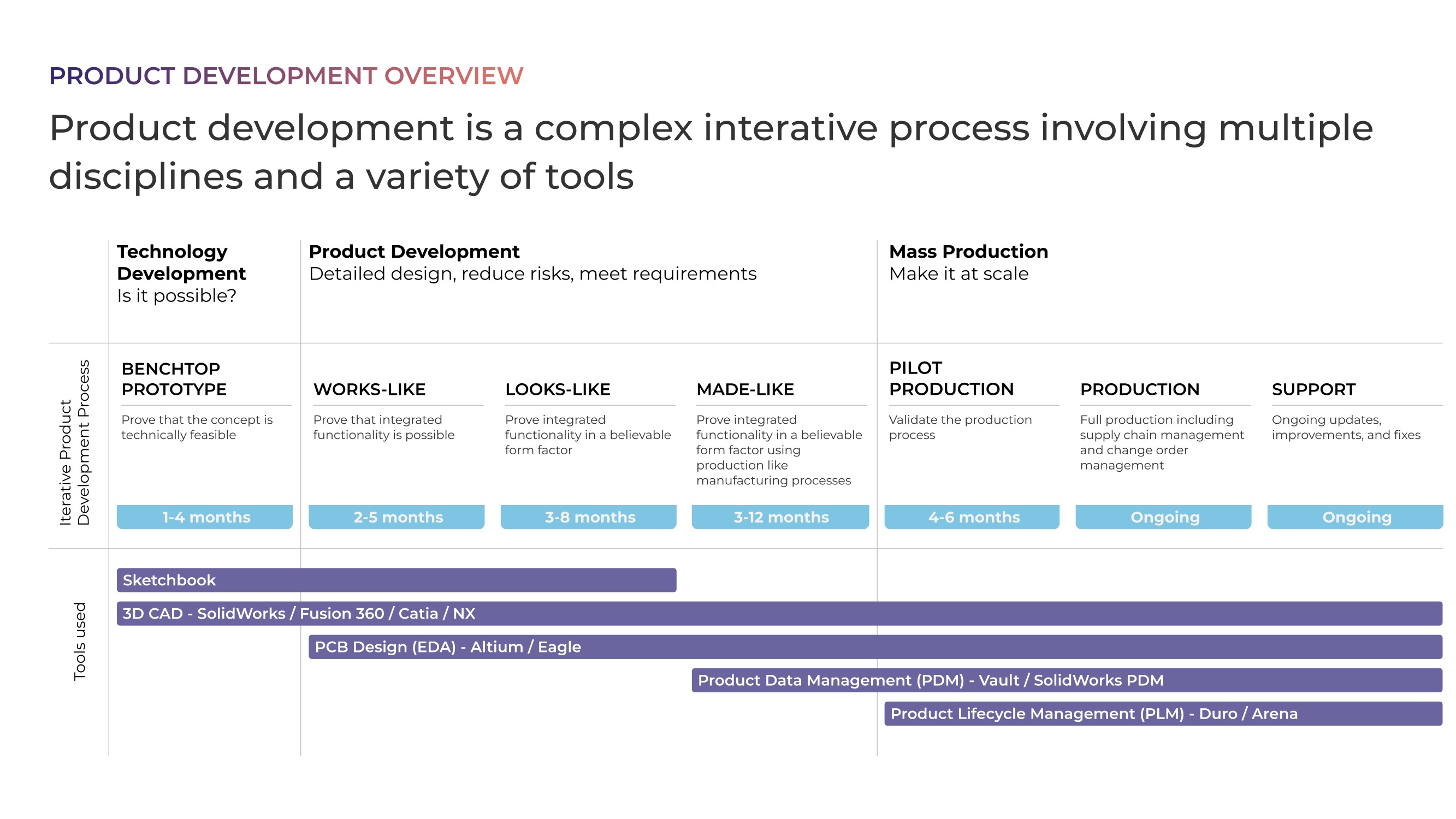

- “Product development is a complex interactive process involving multiple disciplines and a variety of tools.” — overview of how hardware products are made

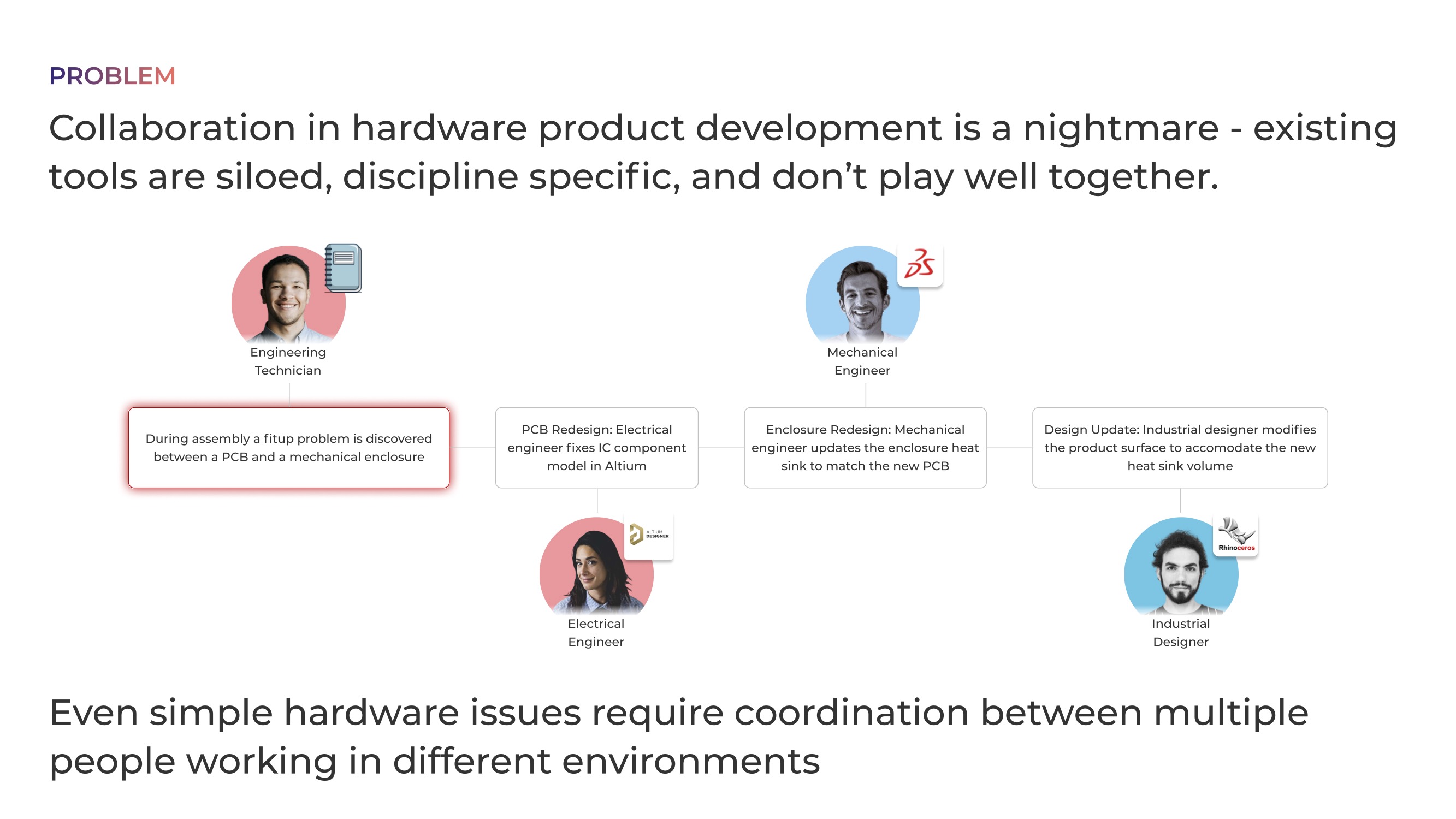

- “Collaboration in hardware product development is a nightmare — existing tools are siloed, discipline-specific and don’t play well together.” — problem slide

- “We’ve felt this pain personally.” — a “who experiences this problem?” slide

- “Five Flute is a connected issue-tracking platform for cross-discipline work.” — solution slide

- “Five Flute’s issue-tracking platform lives where real work is done.” — product slide

- Demo slide

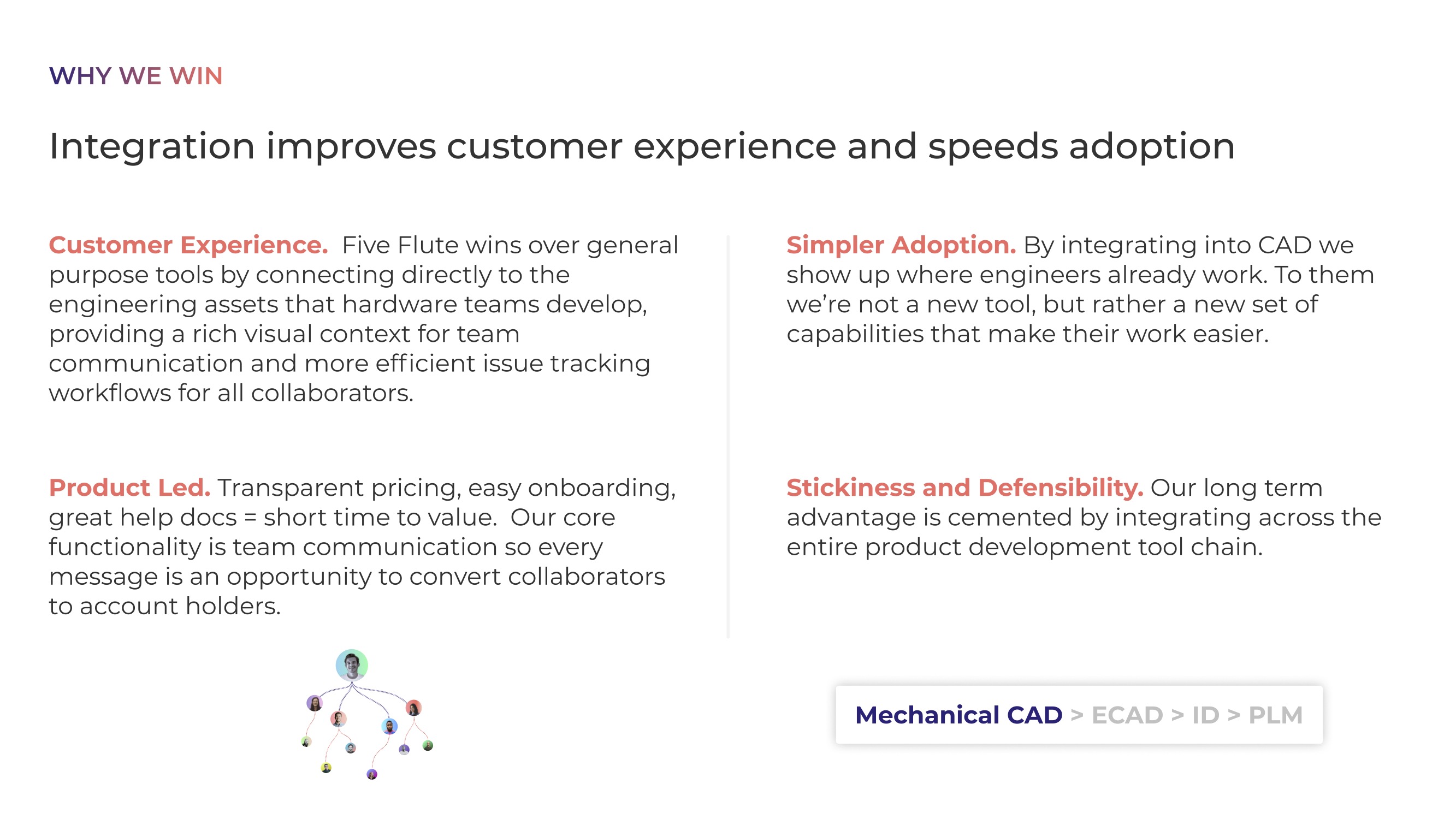

- “Integration improves customer experience and speeds adoption.” — moat slide

- “Integration is key.” — go-to-market strategy slide

- “Our competition is structurally unable to address this niche.” — competition slide

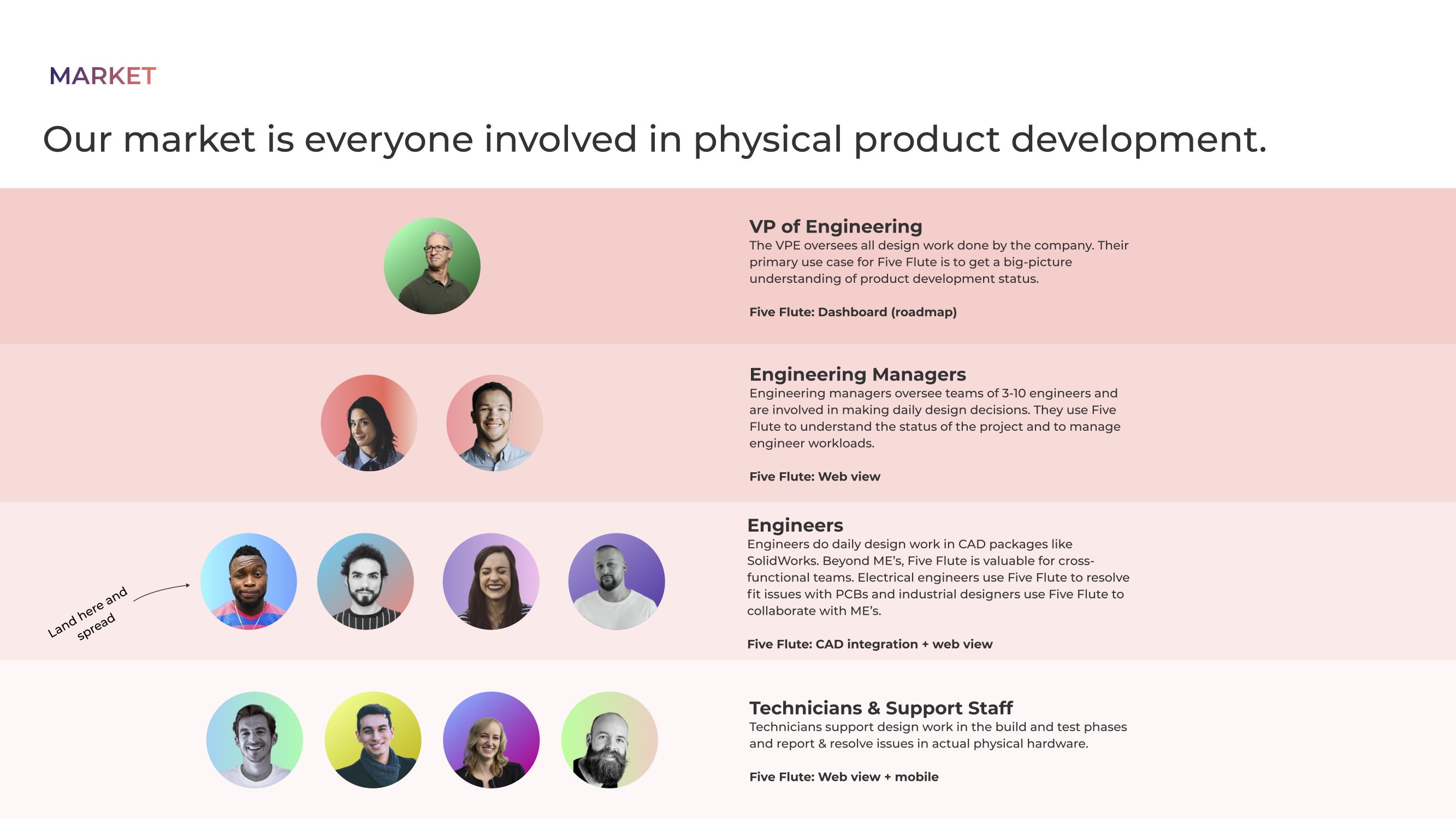

- Target audience slide

- Market size slide

- Go-to-market slide

- Product road map slide

- “The Ask” slide

- Closing/contact us slide

Three things to love

One incredible thing about this deck is that, in seeing its construction, I can imagine the frustration of Five Flute’s founder. There’s a “how hardware products are made” slide, a “who experiences this problem?” slide and a few others that you rarely see in slide decks.

It makes sense; at a moment in which software has eaten most of the world, there aren’t actually that many people in VC who fully and deeply grok what it takes to build a hardware product. That’s good, in a way — it means that when someone chooses to build a company in this space, they are likely up against a much smaller competitive set. It’s also a source of raging frustration: When your potential investors don’t have a frame of reference, it’s easy to assume that hardware development is as straightforward as writing and deploying software.

It’s fun to see some of these struggles and challenges come to life in this deck — and I’ve gotta say, the team did an extraordinary job.

Before we start going through the three great slides, can we just pause with the cover slide from this deck:

This cover slide … :chefs-kiss:

It summarizes what the company is doing succinctly, setting the stage for the rest of the pitch. The only thing I’d add here is that this is a pre-seed round, just to really anchor the deck, but it’s still a solid start.

Let’s peek at some of the other highlights.

How products are made

I’ll admit that before I did a lot of hardware development myself, I wouldn’t know any of this stuff either. The flow from prototype (“Is this possible?”) to final product rolling off the manufacturing assembly line is fantastically complex. It takes a product from a works-like prototype (the product works, but looks hideous) to a looks-like prototype (the product works and looks better but can’t be mass manufactured) to a made-like prototype (the product has gone through a “design for manufacturing” product, and the prototype is as close as possible to the way it would be mass-produced). That’s followed by a whole bunch of processes to validate the engineering, production and manufacturing workflows, and finally the product lifecycle management process, which is usually value engineering (making the same product more cheaply, with higher manufacturing yields, etc.).

It’s complex stuff, often referred to as EVT/DVT/PVT, and each step often results in oodles of design and product iterations. Now, if the founders were talking to investors who understood this process, this slide would be entirely superfluous. I can imagine the exasperation I would feel if I had to put a slide like this into my pitch deck; but on the other hand, as a founder, it’s your job, in the pitch process, to drag your investors along for the ride and to help them understand the size of the opportunity at play.

Including this slide is a very, very smart idea. Flick to the slide and see if the investor gives a grunt along the lines of, “I’ve been doing this since prehistoric times, and you can skip it.” If they lean in and are curious to learn more, you’ll “waste” some of your pitch time talking through this process. Frustrating, yes, but you have to — without understanding this piece of the puzzle, an investor cannot invest.

Bonus kudos to the Five Flute team for making one of the best, most concise overviews of this process I’ve ever seen; usually, the whole process takes a handful of slides. What I really like about this slide is that it makes it really easy to ask a question: “Do you understand all of this, or shall I give a quick recap of how hardware products go from idea to the shopping aisles at Target?”

For your startup, if you’re doing something particularly niche or obscure, don’t be shy about including a primer on your industry/market/problem space.

A great predicate

(opens in a new window)

I’m a little bit surprised that this slide doesn’t come up until well past halfway through the pitch deck. I would have advised putting this as the second or third slide. There’s a method to the genius, though — I’ll get to that in just a moment.

This slide is just great storytelling. It shows that there are predicates for what the company is trying to do in another industry. Even if the investor isn’t intimately familiar with the world of video production, it’s pretty easy to use TV as a way to tell the story.

“Hey, you know how a TV show starts with a script, then gets shot, and then they do editing, post-production, special effects and everything else? To keep the production crew on track and to make it easy to capture feedback along the process, Frame.io exists. We do the same, but for creating physical products.”

The other important point Five Flute makes on this slide is that going integration-first is a go-to-market strategy that has worked in other industries before, so they do not have to invent a new strategy to ingratiate themselves with their customers.

Now, if you flick over to Slide 11, you’ll see why this slide makes so much sense. That’s Five Flute’s competition slide, and the company argues that none of the incumbents or competitors are positioned to tackle this segment. The perfect solution in this space is product-agnostic, which means that if Autodesk were to develop it, it would need to create software that works seamlessly with its competitors’ and be deeply integrated up and down the product development cycle. All companies in this space do that to a certain degree, but few are independent enough to pull it off. Slide 10, then, sets up Slide 11 by reminding investors that the integration-first workflow is both a go-to-market strategy and a defendable moat of sorts.

Beautifully done.

Shiny happy people holding hands

(opens in a new window)

Chaos. Complete, unmitigated, frustrating, devastating chaos. That’s what you’re often looking at in product development; in the existing universe of physical product development, it usually takes a particularly steadfast project manager to keep it all pointed in the same direction. The matter is further complicated by the fact that different parts of the product development cycle have different priorities, areas of expertise and visibility into the issues and challenges a particular product faces.

This slide, more than any of the slides in this deck, brings to life how Five Flute could pull the whole process together. By starting on the engineering layer, and then making additional tools and views available, it’s easy to see how the company’s strategy is as lean as these things can be: Create a value proposition that works really well for one subset of the target customer, then expand by adding feature sets that the other user personas care about.

The needs of technical, repair and support staff (who often do the testing and customer-facing operations), engineering manager teams (who have a less detailed but more strategic view), and other aspects of the business are all different. On this slide, Five Flute is effectively mapping out how it is planning to make itself indispensable across the whole product org. The slide helps position the company in the org chart in a way that is easy to explain and shows its ultimate ambition really well, too.

As an early-stage company, there will always be a temptation to solve the whole problem you can see but that traps you: You literally cannot solve it all with the resources you have available. Reducing scope — in this case, by reducing the target audience — is a very smart move indeed.

In the rest of this teardown, we’ll take a look at three things Five Flute could have improved or done differently, along with its full pitch deck!

Three things that could be improved

I’ve already mentioned a couple of little things that I think I’d have done differently above, but let’s chomp down on some of the particularly juicy opportunities for improvement.

Why so words?

Across the board, Five Flute does a great job at telling its story in pitch form, but the company isn’t doing a great job at keeping things easy to process. A great number of the slides are absolutely chockablock with words. That’s a problem for a few reasons, but most importantly, when you pitch, there’s a huge difference between a presentation deck and the kind of deck that can stand fully on its own. You may need more than one.

This deck is great at telling the Five Flute story in a standalone way, but personally, I would find it frustrating to use it to pitch with. There are a fair number of slides that are incredibly information-dense (and, honestly, I have no idea how I’d simplify them enough to be good presentation deck slides) with a lot of text. In fact, almost every slide has way, way too much text content to serve well during a presentation. Simplify if you can, and add more slides if you have to. I’d rather have a 30-slide deck that works better to keep the takeaways bite-sized than a 10-slide deck that’s full of 12-point text.

The general rule of thumb is that your audience will remember one thing, maybe two, if you’re very lucky, per slide. When there’s too much happening on a slide, that number drops to zero.

A picture tells a thousand words

(opens in a new window)

It’s a testament to how good this deck is that I have to sort of make the same point twice, but bear with me. In this case, Slide 4 again has too many words on it, but these words are actually being used to describe something physical and potentially visually interesting. That’s a double whammy of “why?” — I can imagine this slide as a four-panel cartoon with rendered illustrations of what actually happens throughout the process here. Someone discovers a problem with a component on a PCB and the enclosure. A picture would be awesome. Someone fixes the component, replacing it with another? Awesome — show that visually. Someone redesigns the enclosure to make space for the updated PCBA? Excellent — show me the pictures!

As a general rule, the more visually interesting you make your slides, the better. You win in two dimensions: More graphics typically means fewer words, but also, it means that there’s a reason for the slides to exist. With graphs, graphics and images, you can tell parts of the story that words alone cannot achieve.

Where are your numbers?!

I already mentioned that this deck has a few slides that I’m less familiar with but was happy to see. Unfortunately, there are some things missing, too. There’s no operating plan nor any reference to how many customers there are currently.

The company does add some goals (runway, target MRR, target ARR and a customer acquisition cost (CAC) goal) on Slide 16, but I’d have much preferred to see a more in-depth plan shown as numbers. I know Five Flute is a young company, and perhaps there isn’t much to show in terms of historical data, but I do know that forward-looking plans are a crucial part of running an early-stage company.

As an aside, I know that the investor (Axel Bichara) who ended up leading the deal is particularly fired up about operating plans. He was a GP at the venture fund I used to work at before he co-founded Baukunst. In this instance, more than in most other times I’ve ranted and raved about operating plans in this column, I feel pretty secure in my recommendation:

The full pitch deck

If you want your own pitch deck teardown featured on TC+, here’s more information. Also, check out all our Pitch Deck Teardowns and other pitching advice.

Comment