Earlier this year, Brian wrote about ANYbotics’ $50 million Series B fundraise, which made me realize it’s been a hot minute since I’ve done a robotics teardown. That changes today, since ANYbotics was kind enough to share its pitch deck so we could take a closer look at the highs and lows of four-legged ‘bots.

Since the startup claims it has $150 million in preorders/reservations from gas, oil and chemical companies, and the fact that this is a growth round, I know this is going to be a traction-forward pitch. But there are many ways to weave that narrative. Let’s see how ANYbotics decided to carve that particular turkey.

We’re looking for more unique pitch decks to tear down, so if you want to submit your own, here’s how you can do that.

Slides in this deck

ANYbotics sent through a lightly redacted deck that only blurs customer logos and financials. Here are the slides:

- Cover slide

- Mission slide

- Problem slide

- Why now slide

- State of the industry slide

- Company history slide

- Product slide

- Solution slide

- Value proposition slide

- Traction slide [redacted]

- Market size and market projections slide

- Technology slide 1

- Technology slide 2

- Team slide

- Competitive landscape

- Go to market slide

- Financials slide [redacted]

- Testimonials slide [redacted]

- Thank you slide

Three things to love

ANYbotics is a pretty cool company, and I’m always curious how any robotics company tells its story vis-à-vis the Goliath in the room: Boston Dynamics. This is the name that usually springs to mind when it comes to four-legged robots. ANYbotics does a great job on some fronts, though.

Here are three things I loved about the pitch.

A logical evolution

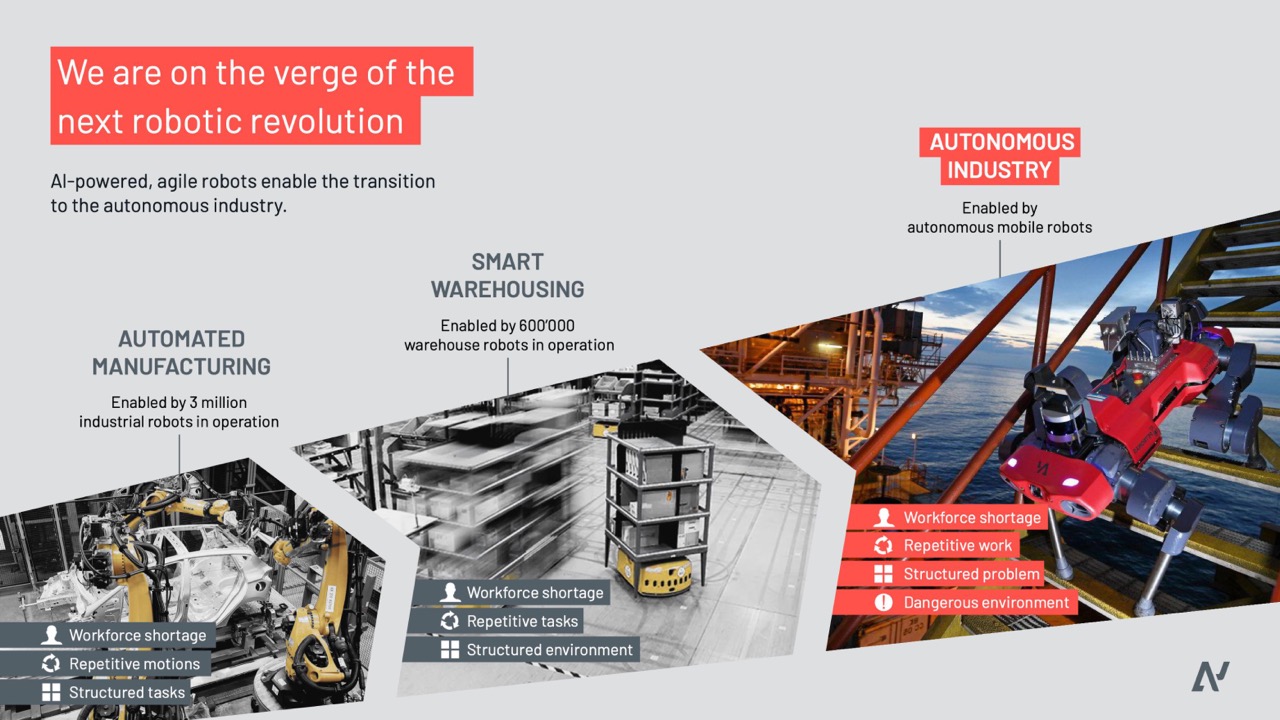

Experienced robotics investors won’t truly need this slide, but ANYbotics is shrewd to include it. Investment decisions are rarely made in a vacuum, and in a VC firm, a broader partnership usually must be convinced of the viability of an investment. Slides like this can do a lot of the heavy lifting when it comes to telling the story.

This slide tells investors something they already know: Manufacturing robots have been around for a long time, warehousing robots are just finding their stride, and the market is ready for the next step of the evolution. Framing the story of robotics as a journey from structured tasks to structured environments and then to structured problems was an elegant choice, and by outlining the history, the company is already hinting at the problem space and the benefits to customers. It’s a pretty subtle and masterful stroke of storytelling.

Startups should learn from this to contextualize their product in the market. Why are you doing what you do? What came before? How can you extrapolate existing markets and products to show how your company can be successful? Is there any way you can tell the story of your market like ANYbotics did here?

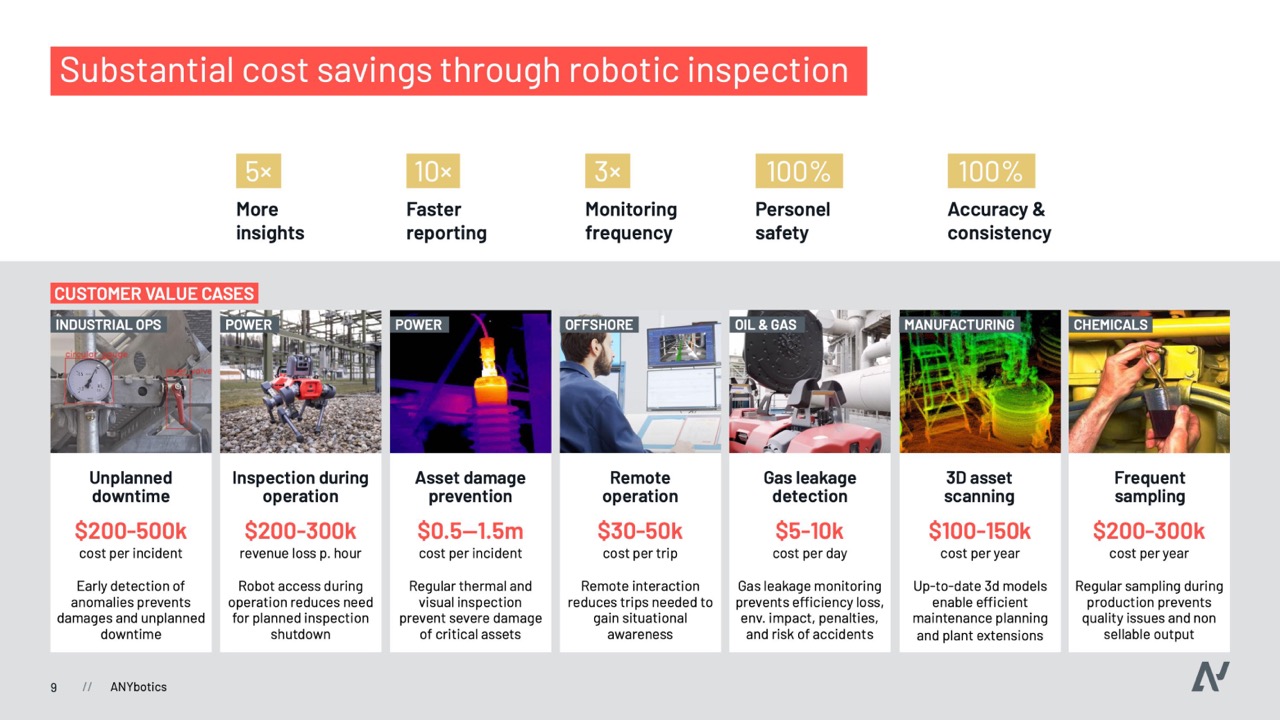

Showing the breadth of opportunities

If this slide had shown up in an early-stage deck, I’d have lambasted the company for a complete lack of focus. But this isn’t a pre-product company hand-waving and saying, “Eh, there’s tons of opportunities, I guess.” This is a company raising $50 million to spur growth. Assuming ANYbotics has a solid go-to-market strategy for each of these value propositions, this slide communicates the utility of autonomous, all-purpose robots that can be used in a ton of situations where not employing a robot can be costly, pose safety risks, or both.

Also: Including the value propositions in the slide helps bring the size of the market to life and illustrate some of the growth opportunities.

I’d have loved to see a slide about the pipeline for selling to these customers to go with this one, but it’s possible that some of that information is on the redacted slides. But as a startup, if you’re saying pretty much everyone could be your customer, you’d best be prepared to back it up and explain how you’re going to reach “everyone.”

IT’S OVER 9,000

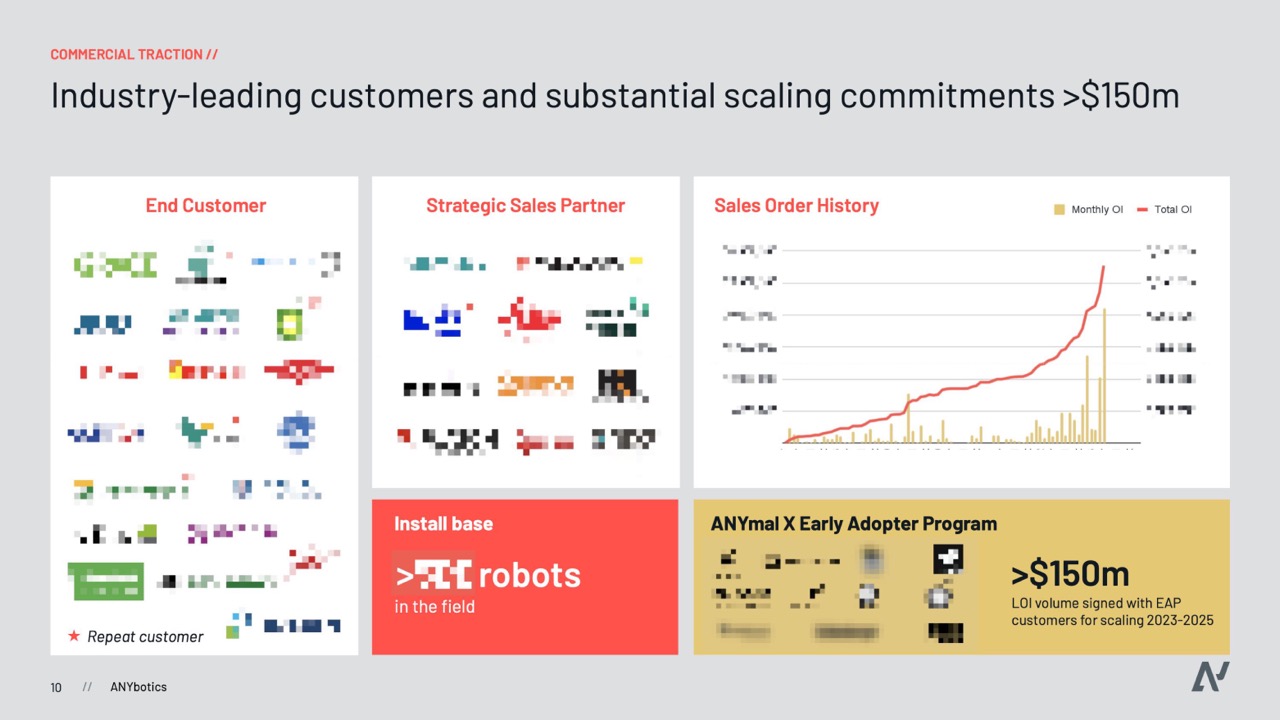

Forgive the meme, but I wanted to share this heavily redacted slide and what I noticed:

As expected, ANYbotics raised this growth round based on beefy traction. Look at the monthly and total operating income graph on the top right: Over the course of its history, the company has seen fits and bursts of sales and income, but things went a little silly in the last 20% of the graph.

I would have told this story differently. Instead of cramming this slide with logos and sales partners, I’d have featured the sales order history upfront and backed it up with some way of showing that the exponential growth isn’t a fluke, but the result of a repeatable sales approach.

When you tell the story that way, it almost doesn’t matter what the rest of the deck says. You have strong traction and a way to continue that traction. I expect that ANYbotics goes into more detail on this front on slide 16, and if I were a potential investor, I’d find myself asking a very important question: Where do I send my investment check?

In the rest of this teardown, we’ll take a look at three things ANYbotics could have improved or done differently, along with the company’s full pitch deck!

Three things that could be improved

An important part of raising growth funding is showing how you’re going to achieve that growth. Unfortunately, and perhaps understandably, the company redacted some of the slides that help us get the full picture of that growth (slide 17, in particular). Still, reading between and around the lines, I can spot some things that might benefit from a tuneup.

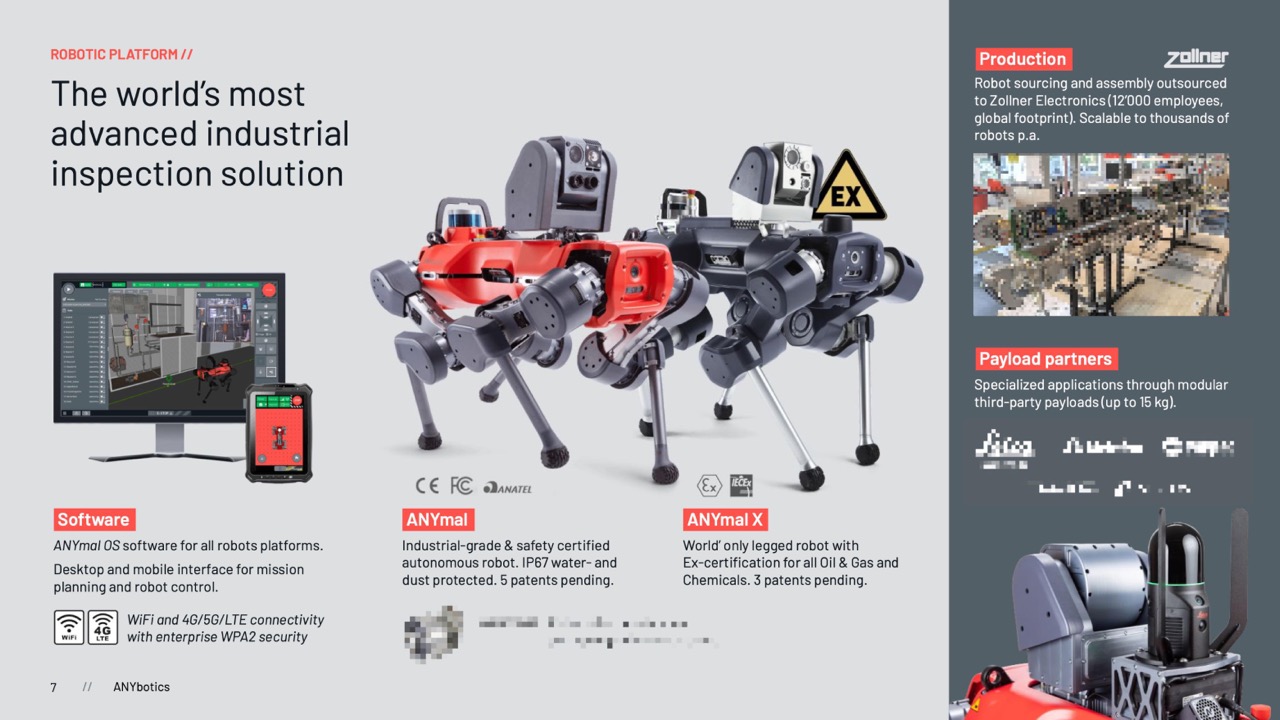

Go into more detail about the part that you “own”

Robotics is complex, and ANYbotics shows that it works with many different partners to deliver value. On some of the slides, however, the company gets too vague about where ANYbotics ends and the development partners begin. I found this slide particularly confusing, for example:

Here, we’re talking about different levels of automation for measuring and taking action based on measurements. From the pictures, it looks like the company offers autonomous inspection and maintenance, but it’s unclear which parts of the value stack ANYbotics owns and which it partners with third-party providers for. For example, Does ANYbotics deliver full inspection out of the box, or does that need to be customized to each customer and use case?

The digital twin at the top seems, both visually and from a storytelling perspective, to be the glue that holds it all together. But is digital twins part of the service that ANYbotics offers? If not, I am worried how replaceable these robots are. If third-party providers are building much of this stack and the robots are commodities, what is to stop a competitor from swooping in?

Finally, I don’t like how this slide looks as if it has to be read from the bottom up. You’re talking about basic automation (connected and motorized machines), assisted operation (examination and interaction), and autonomous industry (inspection and maintenance), but as humans, we want to read from the top down. I suspect this slide works well with a voice-over, but unlike what we saw with slide 4 earlier, this narrative is much fuzzier.

As a startup, you can learn from this slide, so start by asking yourself what you’re trying to convey and see if the story matches up. While this slide looks good, the flow of information is a bit muddy, and I’m wondering about the company’s competition and risks instead of how this is a compelling reason to invest. I suspect this slide could be designed much better to avoid this issue.

Benefits > features

When it comes to value propositions, I often guide startups I’m working with toward statements that are driven by benefits. Sometimes, such statements can read like, “Unlike [current solution], by [feature], our product enables [customer persona] to [intermediary benefit] so that they can [direct benefit].”

In ANYbotics’ case, that might read like, “Instead of using human workers, by being waterproof and disposable, our product enables oil rigs to inspect their machinery from every angle to predict and avoid expensive failures in a production environment where it would be too dangerous to send human inspectors and too flexible to use fixed-mounted cameras.”

I’ve been involved in hardware design processes, so I understand that getting a robot rated IP67 is a feat of technology. And adding the ability to withstand the chemicals, heat and working conditions on oil and gas rigs on top of that is extraordinary.

But nothing in this slide really explains the why, and as a result, it falls a little flat. Sure, your robot is waterproof and can withstand chemicals, and you have a piece of software. But what I really want to know as an investor is why your customers care, and why these features give you an unfair competitive advantage over other suppliers of robot puppies. Without that, this slide is dull at best.

Truthfully, it seems as if ANYbotics actually talks about the value propositions and benefits elsewhere in the deck, which leads me to wonder whether this slide was even included in the actual pitch.

A caveat: Parts of the slides are blurred and it’s possible that this slide comes to life when it’s not redacted. Still, I feel like this slide could have been stronger if they’d just explained why customers are so excited about the software and the robots’ various ingress protection ratings.

Let’s talk market size

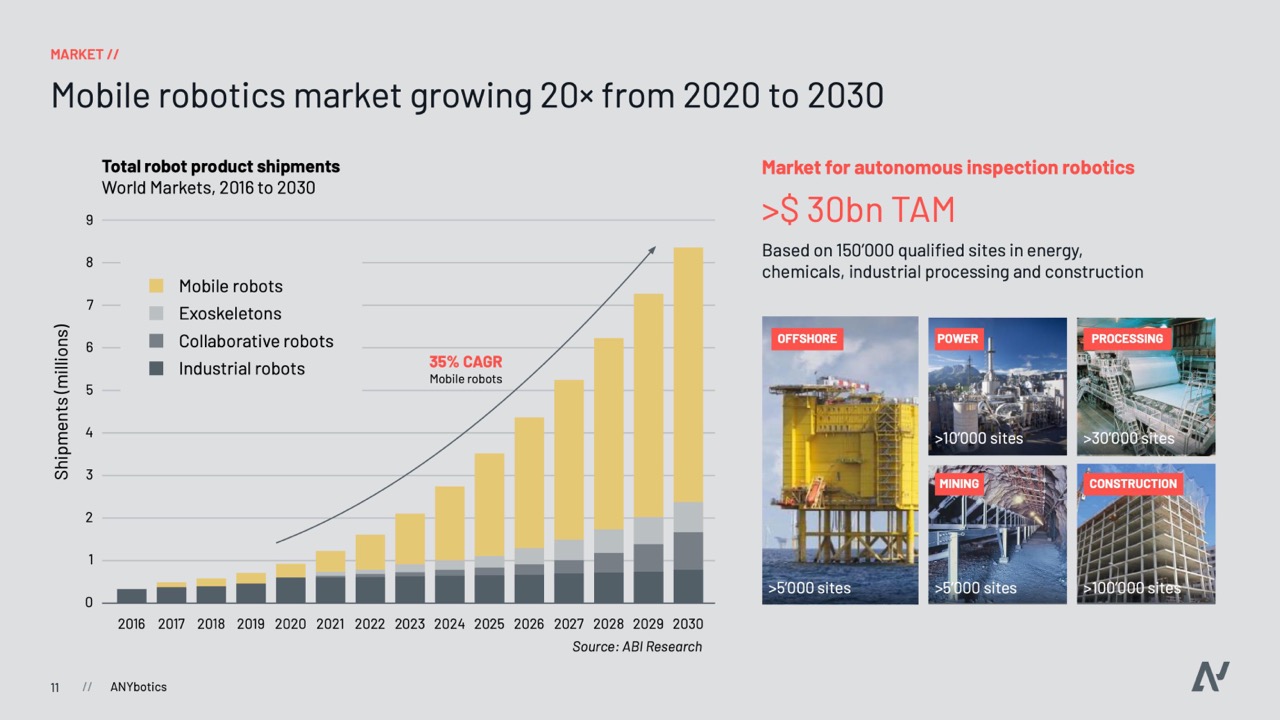

ANYbotics knows it is in a fast-growing market, but I have a lot of questions about the assumptions the company makes around the market size. Now, bear in mind that I’m just a random writer and don’t have a lot of robotics experience, but here’s what I see when I look at this slide.

The first thing to catch my eye is the company’s claim of a $30 billion total addressable market for autonomous inspection robots, based on 150,000 sites. That means ANYbotics is assuming the average spending on autonomous inspection robotics is $200,000. That’s a pretty extraordinary amount of money to spend on each site, and I’d love to learn more about how the company arrived at this number. I suspect there is a point where sending in an expensive robot to do the job is safer than sending in a person.

Still, I’m wondering if there is a point where disposable robots — maybe consumer-grade quadcopters — could do much of the same. If this market is going to grow at a 35% compound annual growth rate, there will be room for players that take alternative approaches and do things cheaper, especially in sectors such as construction, where the environment is less hostile.

Again, I don’t know this market very well, but if I were to consider investing in this company, I’d want to spend more time on this slide to get a much better understanding of where the market is, where it is going, and how ANYbotics plans to maintain or grow its market share.

The full pitch deck

If you want your own pitch deck teardown featured on TC+, here’s more information. Also, check out all our Pitch Deck Teardowns and other pitching advice, all collected in one handy place for you!

Comment