Russ Heddleston

The road to a successful funding round can be a long and arduous one.

From your first meeting with a VC to money in the bank, a seed round takes on average 18.5 weeks. Within that time frame, you are pitching your heart out to multiple investors and ideally setting a number of meetings, either virtual or in-person.

You’re also busy building and constantly tweaking your narrative (and pitch deck) and managing each of those meetings and the necessary followup. Then, if things go well, you’re negotiating term sheets and final closing details. All the while running a startup with equal intensity.

So how do you prepare for this important stage in your company’s growth, navigate the challenges of a fundraise, and not let the process overwhelm the responsibility of still running your business? While not every fundraise is the same, founders can tap the experience of others who have been down this path to ensure their fundraising efforts are efficient and, most importantly, successful.

This can be done both qualitatively and quantitatively. Tap your network to learn from both peers that have been through the fundraising process recently as well as more seasoned experts that can impart useful wisdom and perspective. And quantitatively, there’s a ton of data out there on the fundraising process that can remove the mystery and uncertainty for you as a founder. Having very clear data on where VCs focus their time on pitch decks or in meetings will guide you to deliver a finely tuned pitch to the right investor.

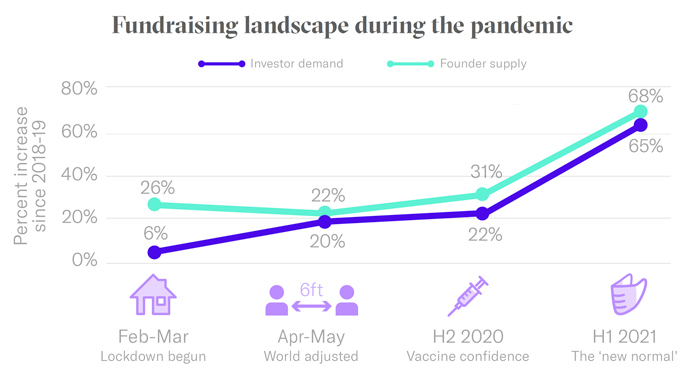

This year has shown growth in the fundraising landscape like we’ve never seen before. Records in deal dollars have been continuously broken, and VC demand and startup supply have increased consistently since April 2020. While the tides have seemingly turned in the favor of founders, there are different investor expectations for each stage of funding, from pre-seed to Series A and beyond.

As more founders pitch their startups, funding rounds are competitive, so you need to prepare accordingly. Below I’ll lay out a few essential steps every founder will take during their fundraising journey, with proven and data-driven strategies to approach them.

The right pitch deck

A good pitch deck is key to opening the door to funds. It’s the first impression you make on a VC, and with them breezing through decks at record speeds (2 minutes and 34 seconds per deck), yours has to count. It needs to clearly communicate purpose and value, demonstrating that your company is a solid investment and that your idea is worth their money and time.

By analyzing deck compilation and comparing it to metrics, DocSend has found that startups that have successfully fundraised have commonalities across their pitch decks. This can be broken down by different stages and help you understand the order of your slides, which sections to include more detail on, which sections will get the most attention and more.

For example, if you are raising for the seed round, our data shows that pitch decks used by startups that have successfully raised an average of $2.7 million in that round are 14 sections, 19.5 slides, and VCs spend 3 minutes and 20 seconds looking at the deck. The recommended first five slides in your deck should be, in order:

- Company purpose

- Problem

- Solution

- Market size

- Why now?

While a meeting with an investor is what stands between you and your funding, the story your pitch deck tells is the tool you have to make that happen. By compiling a strong one, you can make the most out of the short time VCs look at your pitch deck.

Contacting investors and landing meetings

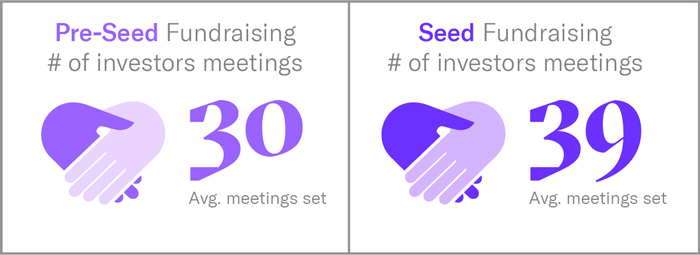

One of the hardest parts of fundraising is simply getting in front of investors. Even with the best idea, you are still one of many, so you want to make sure you have a high volume of meetings within a reasonably small time frame of about two weeks. Our data shows that seed-stage founders on average contact 99 investors and set 39 meetings.

Why pack so many meetings within such a short window? You want to create demand and a sense of urgency. If your pitch is good, a lot can happen in those two weeks and you want to be able to field multiple offers to weigh them against each other and negotiate for the best terms. So plan for the amount of time the outreach and meetings will take and pace that out with all of your other responsibilities as a founder.

Tap into your network for different experts and perspectives across the industry to sound out your idea. To expand your network of potential investors, don’t be afraid to ask for introductions. One way to do so is by looking at mutual connections on LinkedIn and providing a forwardable introductory email.

When entering the fundraising process for DocSend in our early days, I found that talking to others was a way for us to determine if there was a market for our idea. I even went to talk to those I thought were larger competitors, like Google, to find out why they weren’t building a product like mine to gain competitive intel and further validate my idea.

Embrace feedback from those in your network who understand the problems you’re facing, even your potential competitors. This helps you get closer to landing those investor meetings and empowers you to perfect your pitch.

Locking meetings with investors takes time and strategy, and the more people you talk to, the greater your opportunity is for success. If you don’t land a meeting right away, keep putting yourself in front of investors that are a mutually good fit for you and your company.

For example, we find that successfully funded founders at the pre-seed stage meet with 30 investors on average, out of the 58 they contacted. There is a sweet spot for how many meetings you will take, and you will want to remain productive before you reach a point of diminishing returns. Maintaining a healthy flow of potential meetings and staying motivated even when denied is key. But so is knowing when to stop.

Visibility into investor interest and engagement

The fundraising process has been very opaque until recently. Having transparency into how investors engage with your pitch deck — including how many people opened it, how long they viewed it and which sections of the deck they are most focused on — gives you an advantage.

Rather than being left in the dark after emailing a pitch deck and wondering if the investor has looked at it or spent any time with it, now you can have visibility into what, when, why and how. Investors spend a lot of their time looking at pitch decks and have it down to a science, while most founders have one chance with one deck. Giving founders more visibility into the process helps level out the playing field, and in the end creates a more open, efficient process.

Christian Kletzl, CEO and founder of UserGems, used DocSend to share his pitch deck with investors and found a level of visibility he wasn’t anticipating.

“I noticed that an investor who wasn’t interested in funding our round go back to our deck repeatedly. The only reason someone goes back to a deck after they turned you down is that they are probably funding someone else with a similar idea,” said Kletzl. “That level of transparency has changed the way I approach fundraising.”

In any business engagement between two parties, each party has “currency.” In the case of fundraising, VCs have the actual currency — dollars to invest. Founders need to keep in mind that their currency is their business idea and how they’re communicating it through their pitch deck. So analyzing investor interactions using your currency, which is your pitch deck, can give you more control over the fundraising process.

Narrowing your funnel for a successful fundraise

Your pitch deck is often the entree to a first meeting with an investor. And brace yourself for contacting far more investors than you’ll actually meet with. But once you get the meeting, be prepared and make the most of it.

“Luckily there are a lot of tools to help you actually land a meeting with investors. There are plenty of pitch night virtual events that help you get in front of investors and practice your pitch,” said Nyasha-Harmony Gutsa, co-founder of Billy.

In today’s fast-paced funding environment, that first official meeting with an investor may be more Q&A than a formal presentation of your deck. VCs will have already seen your deck and should have a good idea of your idea, business model and other fundamentals. They’ll already have a number of questions for you before you even walk in the door (or log onto Zoom).

You’ll end up going through a number of meetings, which may feel arduous, but every meeting either leads to another meeting or is at least a learning experience for next time. You may want to even consider asking a peer for hard questions to prepare you for that first meeting. Or perhaps the first meeting when you start fundraising isn’t the most critical one. Use it as a practice round to see what sorts of questions you get.

Position your meetings so that each one prepares you for the next, and that your ideal investor is toward the end of your set of meetings, allowing you to make an airtight case for your business and put yourself in a strong negotiating position.

The fundraising stage of your business may have twists and turns, but the good news is that you can help alleviate known stresses by being prepared. Although every individual’s story is different, others have been down this path before. There are stories of success and stories of failure. Then there’s hard data that removes the mystery and focuses on the facts and even services that provide pitch deck evaluation to help perfect your pitch.

Use any and all of these insights and tools to better control your fundraising experience.

Comment