Unicorn traffic jam meet unicorn glut.

Private-market tech companies worth $1 billion or more have long been an indicator of investor enthusiasm. The number of so-called unicorns minted in a particular period was a workable indicator of how hot the venture capital market was at the time.

For example, the pace at which new unicorns were born grew sharply in 2020, per CB Insights data, rising from 25 new $1 billion startups in the first quarter of that year to 47 by Q4. Then, the rate of unicorn births multiplied, reaching 115 in Q1 2021 and peaking at 146 in the second quarter of the same year. Since then the number has slowly fallen, reaching 113 in the first quarter of 2022. It could drop into the double digits in Q2.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

The raw number of new unicorns is only a part of the dataset that matters. Venture capitalist and SaaS influencer Jason Lemkin recently noted on Twitter that the “vast majority of [venture capital investment] went into unicorns and decacorns the past [two] years” and not earlier-stage companies. This means that the boom in venture capital totals was, to some degree, a unicorn bonanza.

The same CB Insights dataset makes clear just how much venture capital unicorns grazed last year. In 2020, for example, some $140.5 billion was raised in 633 nine-figure rounds — those of $100 million or more, a loose comp for venture deals that went to billion-dollar companies.

The same CB Insights dataset makes clear just how much venture capital unicorns grazed last year. In 2020, for example, some $140.5 billion was raised in 633 nine-figure rounds — those of $100 million or more, a loose comp for venture deals that went to billion-dollar companies.

In 2021, those numbers soared to $366.6 billion from 1,569 nine-figure deals. The portion of venture capital dollars invested globally that went to deals worth $100 million or more rose from a little under 50% in 2020 to nearly 60% in 2021.

(When we discuss 2021 mega-rounds, we cannot fail to mention the rapid-fire pace at which Tiger Global put funds to work in later-stage startups. That said, the firm was not alone in its temporary exuberance.)

While the unicorn venture market is slowing — CB Insights says that 51% of Q1 2022 venture capital went to nine-figure rounds, or $73.6 billion in 364 deals — the largest deals to the most valuable startups cleaned up in recent years, and even more so as the venture capital market reached a peak last year.

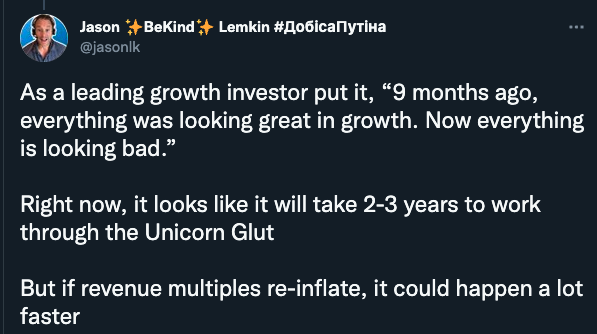

This helped form the unicorn glut. What’s that? Lemkin describes it as a “massive overhang of growth investments that will take startups years to grow into.” The problem, Lemkin continued in a thread, is that many of the largest 2021 deals will take another three years or more to “grow into their valuations,” which “may slow down growth investment for years to come.”

How so? Last year’s heady deal-making will require “waiting until perhaps 2024/2025 for those unicorns and decacorns to grow into their 2020 [and] 2021 valuations,” the investor said, which in turn will slow earlier funding rounds.

In his view, “as growth stage slows, each stage below it also has to slow, if not quite as much,” leading to a cascading effect in the earlier-stage venture market. The expected period in which unicorns are forced to re-earn their now-dated valuations, slowing the startup funding market, is what Lemkin calls the “unicorn glut.”

Lemkin is right, but for unicorns, the road ahead is actually a little bit more difficult than even the above argument makes plain. Unicorn glut, meet unicorn traffic jam.

What’s a glut to a jam?

Back in 2016, in the predecessor to The Exchange, this column asked about the growing number of unicorns compared to the pace at which billion-dollar startups were minted. The growing backlog, we felt, was indicative of a unicorn traffic jam.

The metaphorical cars idled up at an increasing pace from that point forward, though an IPO boom in late 2020 and 2021 did provide a short period when it seemed that accelerating liquidity might begin to beat back the gridlock. That IPO market did not last, has ended and the market for public debuts is not showing signs of coming back to life.

The unicorn traffic jam is therefore back in effect. Now, hybridize that historical and continuing issue with the Lemkin point that a great number of unicorns were minted last year at prices that will take years to sort out, and we can see that the traffic jam is not about to ease. In fact, it’s likely going to continue to worsen for the foreseeable future. Yowza.

Most of this we could have extrapolated on our own. What Lemkin adds to our late-stage analysis is a timeline:

More than 1,000 unicorns are piled up in the private markets with a frozen ceiling above them thanks to the closed IPO market. Even more, a great number of those unicorns, companies that hoovered up record sums last year, are mispriced compared to today’s market realities. That means that even if the IPO market opened suddenly, a large portion of unicorns would not be able to exit regardless.

The unicorn glut is compounding the unicorn traffic jam, and as far as the eyes can see, the great majority of private-market value is frozen. Not good, as they say. Not good at all.

Comment