Steve Sloane

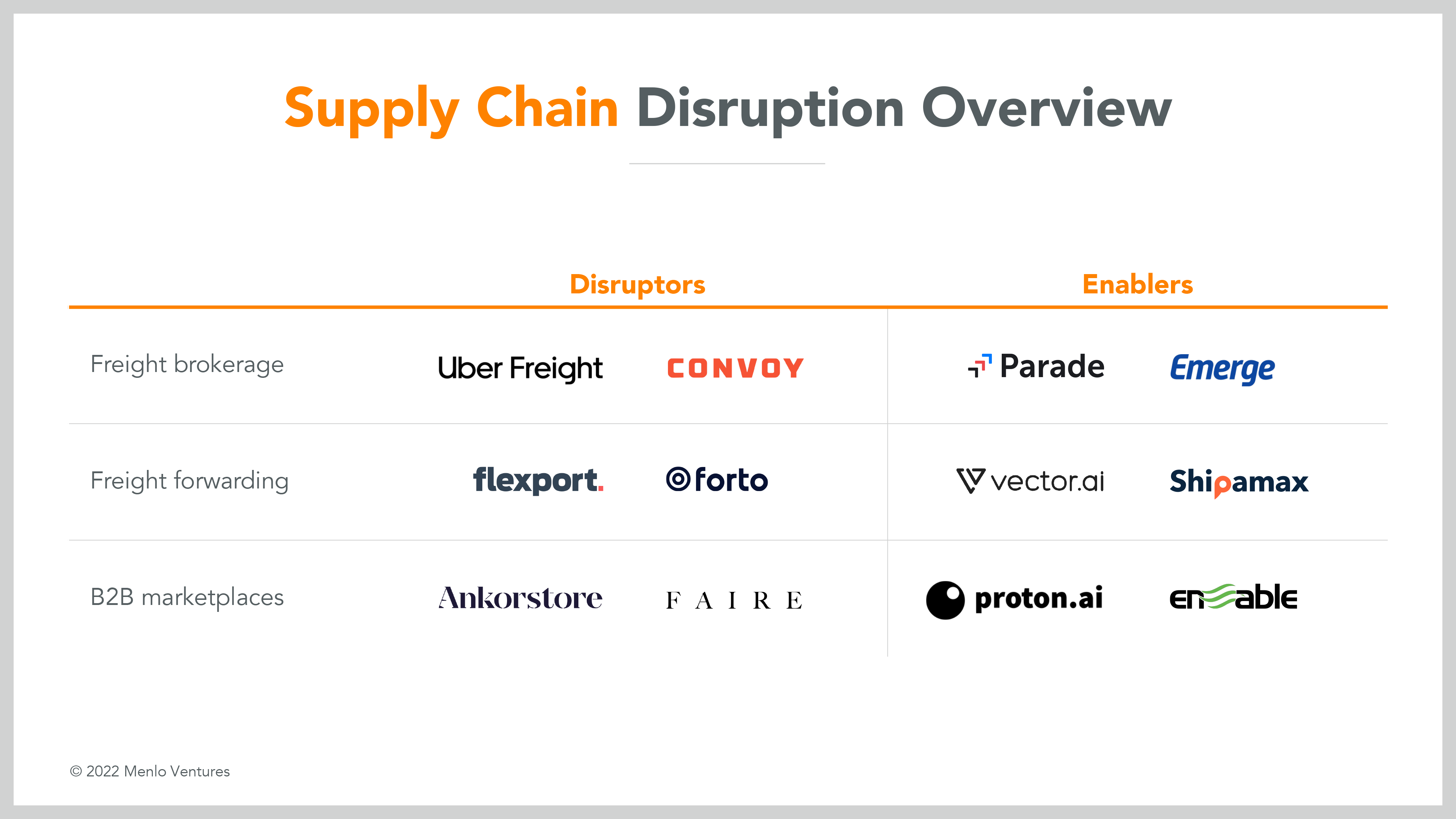

For years, the prevailing narrative for innovation in supply chain has focused on the disruptors: Upstarts that enter the industry with new technologies and business models to displace incumbents.

Less heralded has been the next wave these disruptors often catalyze: Digital enablers seeking to arm the incumbents against the incursions of their new digital rivals.

But in verticals ranging from freight brokerage to B2B marketplaces, these enablers have repeatedly emerged after an initial disruption. For these industries, digital enablers, rather than disruptors, constitute the next wave of supply chain innovation.

The recurring second wave of innovation

In freight brokerage, Convoy and Uber Freight digitized the traditional process of matching truckers with loads, enabling them to streamline hours of emails and phone calls with simple app-based workflows. Now, companies like Parade are equipping traditional freight brokers with many of the same tools.

Flexport and Forto made headlines in freight forwarding by promising greater transparency and control. They introduced digital business models that improved the customer experience but also hastened an onslaught of enablers — including Vector.ai and Shipamax — seeking to make legacy freight forwarders more digital, too.

And in the traditional world of B2B commerce, which is dominated by trade shows and sales reps, Faire and Ankorstore helped fuel the rise of enablers Proton.ai and Enable.

Again and again, we see these call-and-response patterns of disruptive innovation across supply chain categories. The story repeats as enablers follow disruptors across each category of supply chain business.

In each case, the threat of displacement has driven incumbents to increase investment in their own digital capabilities, allocating more budget for digital tools to match the capabilities of their new competition. The result? Nothing less than the next generation of innovation, this time led by enablers.

The quiet engines driving transformation

Enablers typically emerge or accelerate growth after their disruptive predecessors have introduced technology that reshapes verticals and customer expectations. They take on the unglamorous role of helping incumbents stay relevant. Perhaps because of this approach, enablers as a category have been surprisingly overlooked, especially considering their widespread proliferation across the supply chain landscape and the impressive outcomes they’ve achieved.

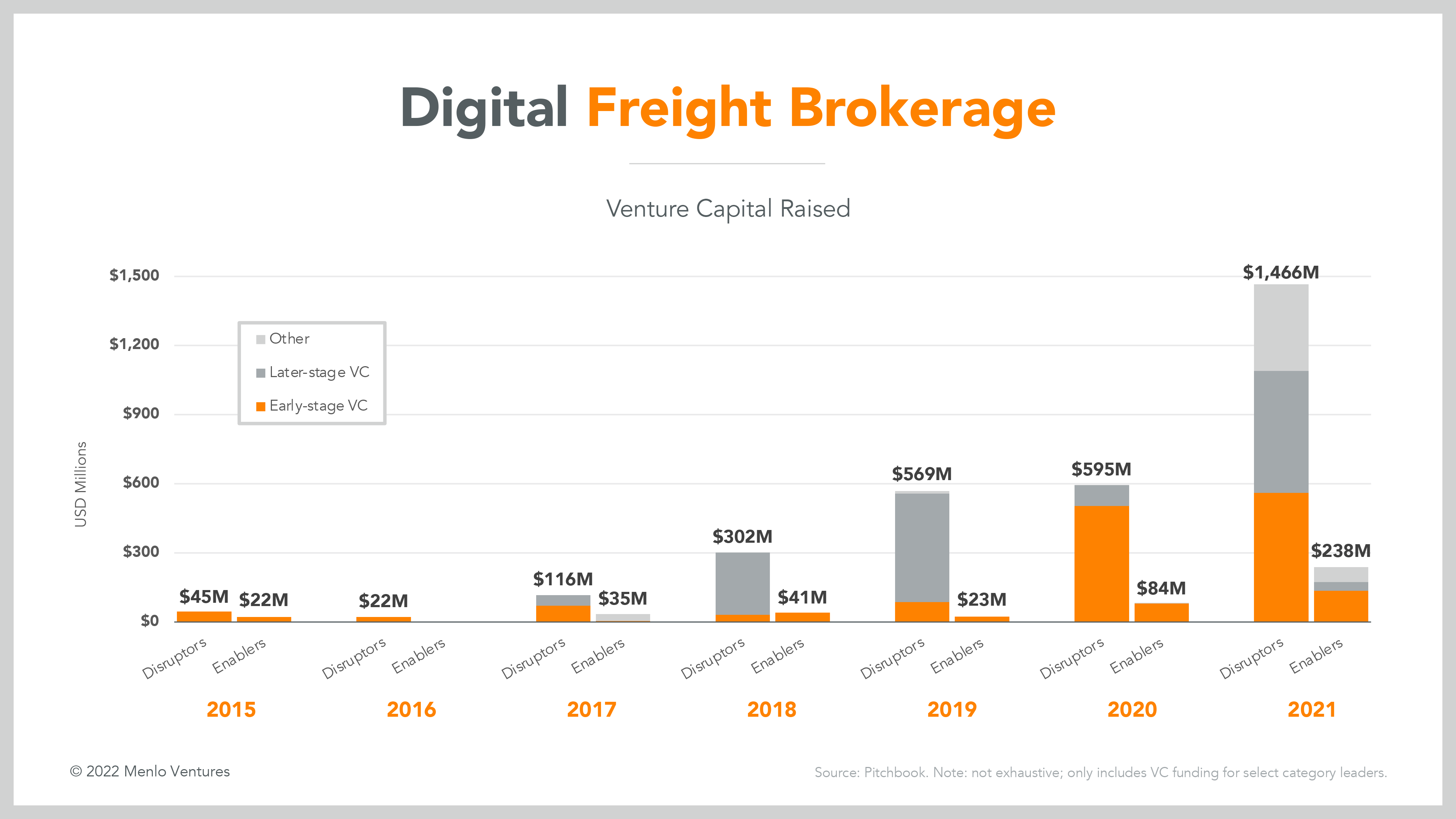

Freight brokerage provides one example. Convoy and Uber Freight grabbed headlines and mindshare across the industry when they led a surge in startups seeking to digitize the industry around 2015. Investors poured $1 billion into Uber Freight, on top of all the internal investments Uber Freight’s parent company made. Convoy raised another $930 million. Both were incredible sums even in the relatively hot venture market of the mid-2010s.

But a few years following the attention and funding, a less-heralded second wave of venture capital started flowing towards a new group of players in freight brokerage: The companies providing technologies that enabled traditional brokers to match their new competitors’ digital capabilities.

In 2021, venture dollars in these leading enablers totaled $238 million, up more than 180% over the previous year (again, surprising given the lack of fanfare) and outpacing the 140% growth in funding for disruptors. Recent investments include EmergeTech’s $130 million Series B, led by Tiger Global Management and Parade’s $13 million Series A, led by Menlo Ventures.

Three ways to respond to disruption

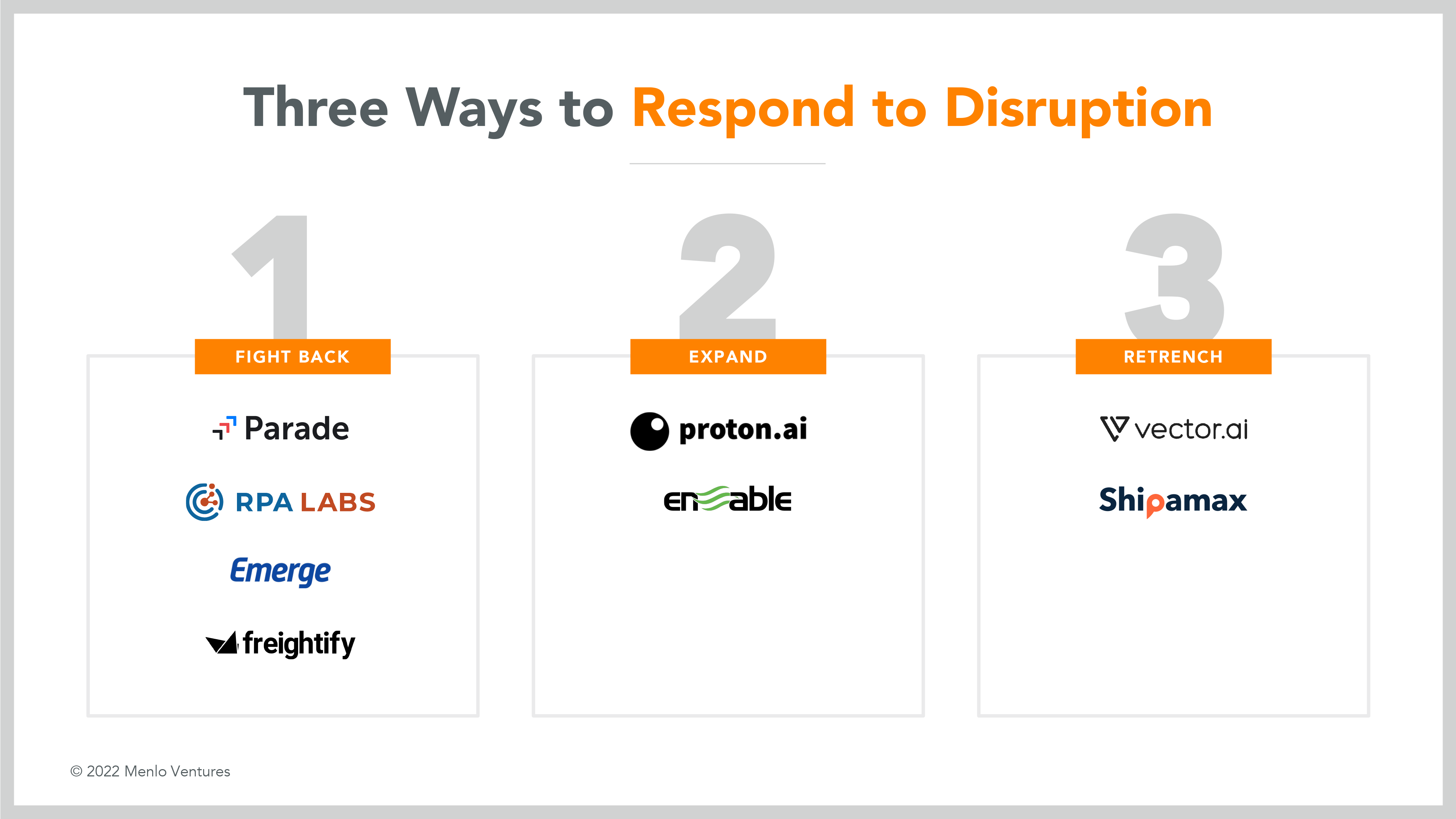

It is worth noting that the enabler landscape features an incredible diversity of offerings. Parade’s approach significantly differs from Proton’s, as Shipamax does from Enable.

This is because incumbents respond to disruption in different ways depending on the structure of the market and the nature of the disruption. The natural first response may be to simply bet to fight back via replication, matching tech with more tech. But this is not the only response available.

Pushing back against disruption may entail either offensive or defensive strategies. Sometimes incumbents will want to focus on existing customers, channels and products; in other cases, they will target new ones. Incumbent responses typically fall into three categories: Fight back, expand or retrench. Enablers, too, can be categorized in this way, each aligned with a particular response.

Fight back

Incumbents’ default reaction to digital disruption is often to go head-to-head against disruptors at their own game, responding directly to new entrants by competing for existing customers. This strategy works best in industries where disruption accelerates previous trends rather than creating a radical break from traditional business models.

“Disruptors,” in this sense, are more first-movers in the race to digitize than anything else.

Freight forwarding provides an instructive case study. Flexport and other digital forwarders raised massive amounts of capital on the belief that technology-enabled freight forwarding would win out and capture significant market share. The disruptors capitalized on the lack of visibility and control afforded by traditional players and offered a user-friendly alternative.

But questions remain about whether digital forwarders are really that transformative. Immediately after they entered the market, a second wave of enablers rushed in to help traditional forwarders replicate Flexport’s functionalities, piece by piece.

Online quoting? You have RPA Labs. Rate management and online booking? That’s Freightify. Track and trace? Turn to GoFreight. Enablers here have equipped incumbents with the tools to fight Flexport with the very tools the company pioneered.

Expand

Sometimes, it’s simply not feasible to replicate a disruptor’s playbook. In B2B commerce, Faire and Ankorstore have built online wholesale marketplaces for brands to connect directly with independent retailers — bypassing traditional distributors that have long occupied the position of scale intermediaries coordinating procurement. The disruptors offer retailers improved product discovery and attractive terms, like flexible financing and free returns.

Many aspects of these B2B marketplaces’ disruptive approach (e.g., Faire’s promise of net 60-day terms with all brands) cannot be replicated by traditional wholesalers for a number of operational and logistical reasons. Failing this, incumbents seeking to go on the offensive have been forced to think bigger and expand. They must find new ways to win customers through novel value propositions.

Proton.ai offers one approach: bringing sales intelligence to traditional distributors. Instead of competing on efficiency and payment terms, incumbents can now use Proton to personalize product pitches and offer a more curated experience to customers.

Enable provides wholesalers with another value proposition: Managing rebates is a trillion-dollar market that only traditional distributors offer to incentivize retailers via promotions and pricing. The company provides an upfront deal collaboration platform for distributors and their retail partners. It’s effectively a back end to manage payments coupled with a recommendation engine that surfaces optimization opportunities to optimize these incentives.

Retrench

The final defensive move for incumbents is to dig in and retrench, fighting competitive pressures by increasing operational efficiency and lowering costs.

In freight forwarding, Vector leverages machine learning models to automate the identification and extraction of key data across systems that traditional freight forwarders use. Vector saves these incumbents significant time and effort they otherwise would have spent copying and pasting data from PDFs and emails into transportation management systems and enterprise resource planning systems.

The enabler’s opportunity

Digital disruption is here, and the onus is on incumbents to adapt and stay relevant. Fortunately for these traditional businesses, disruptors beget enablers.

Whether these incumbents choose to respond to their new digital rivals through direct replication, market expansion or retrenchment, a new generation of startups has emerged to help build them the tools they need to succeed.

Disclaimer: Menlo Ventures has invested in Parade and Enable.

Comment