Kittu Kolluri

More posts from Kittu Kolluri

Silicon Valley dreams of unicorns. Thinking big fuels the entire startup ecosystem, and overall, it’s a very good thing.

But product-market fit is hard to get right. When it’s not quite there, we all know what to do: pivot. Still, not every startup is destined to go all the way, especially right now.

So what if “going long” isn’t on the cards, no matter how much you pivot? Promising young companies that need financing but can’t command good market value are caught between the devil and the deep blue sea: On one hand, you can take a down round, which hurts everyone; on the other, you can protect your valuation, but you risk sinking with the ship.

Living through four major downturns has taught me that “winning” and “losing” are not the only possible outcomes. When you can’t quite make it to product-market fit, there’s a third choice that too many entrepreneurs, and their investors, overlook: selling out.

You can think of it as playing “the short game,” and it should always be an option.

How can founders decide whether to go long or short?

Founders often feel they have to become a unicorn to do right by their constituents. In reality, sometimes playing the short game delivers more value to founders, investors, employees and the acquiring company than the long game ever could.

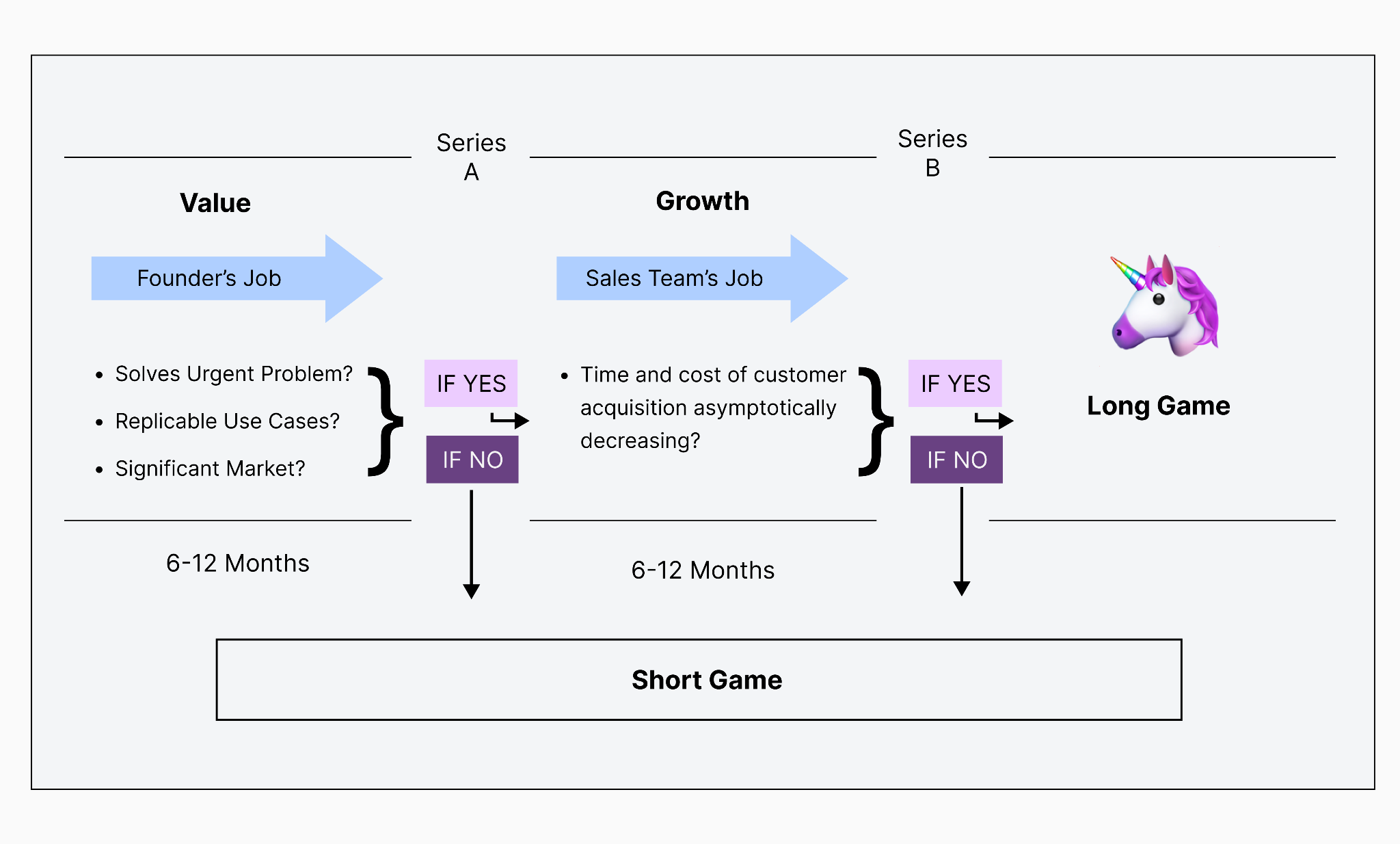

How can you choose? While it isn’t a trivial decision, it’s also not as hard as you might think. The answer has been hiding in plain sight ever since Steve Blank and Eric Ries first defined in “The Lean Startup” the concept that Andy Rachliff later canonized as “product-market fit.” There are only two gates: value and growth.

Value

First, you need to validate your “proof of value.” Does your solution solve a “hair on fire” problem that customers can’t live without? Are there replicable use cases a significant number of customers have? To establish proof of value, founders need to be out there, confirming that their solution is something customers really need and will pay for.

If you don’t have clear, positive market feedback by the time you reach Series A, take it as a sign. Pivot big or start looking for the exit.

Growth

Next, address your growth hypothesis, the “proof of market”: Do you have a sales model that allows you to economically acquire customers at a pace and volume high enough to expand your business?

While proof of value is a job for the founders, sales teams should be trained to build proof of market effectively so that you can scale. If both the time and cost of acquiring your next customer is asymptotically decreasing by the time you are approaching your Series B round, it’s strong evidence that you have established proof of market.

If not, it could be time to go short.

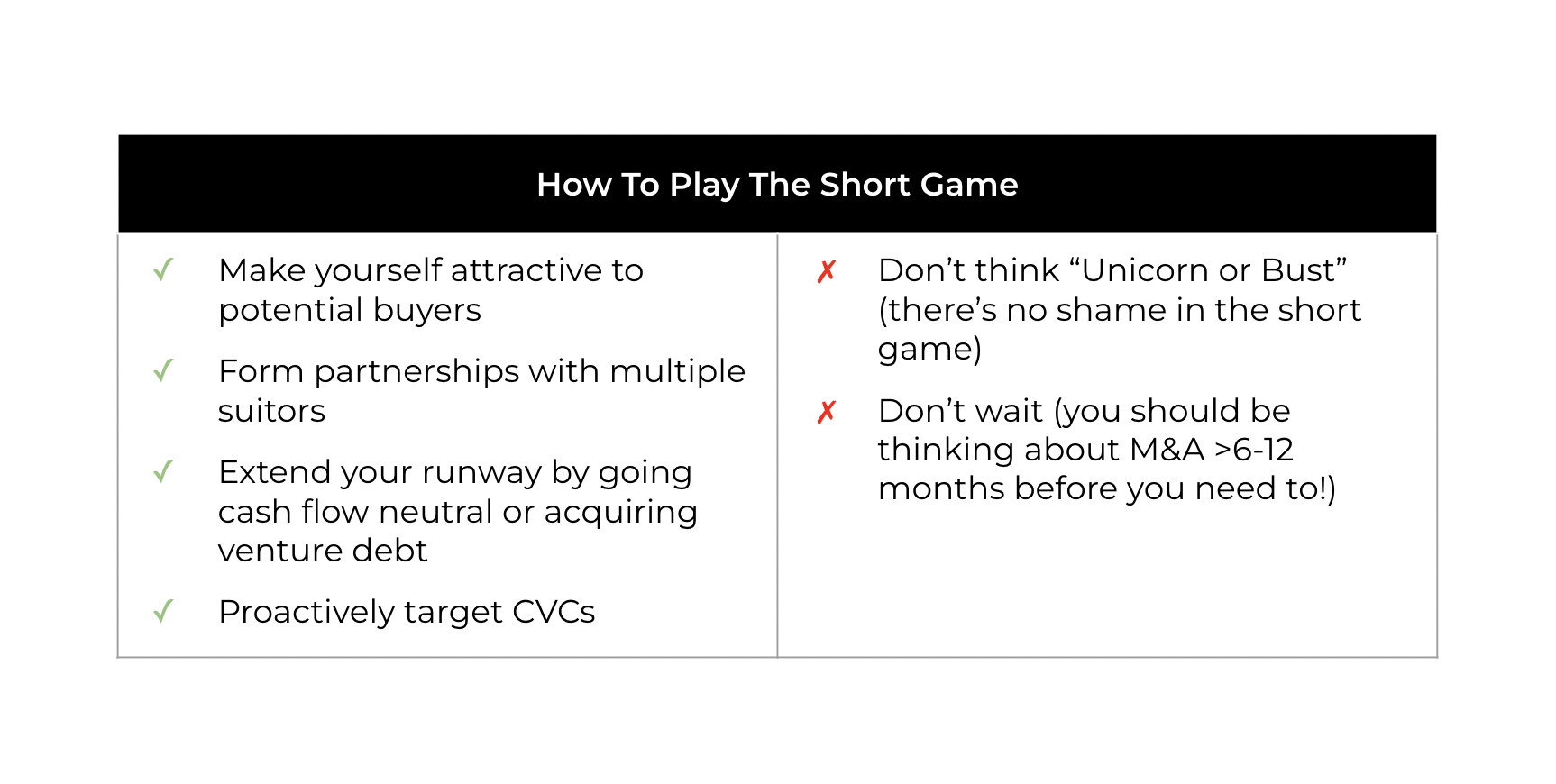

If the chart above helped you determine that going short makes sense, you’re probably asking yourself: Where do I start? How do I decide which buyers to go after? What can I do to attract their attention without scaring off customers and potential investors? How can I negotiate from a position of strength and get good value? What should I do if none of that works?

Here are my thoughts:

Make yourself attractive to buyers

First, make a list of competitors and partners that could be potential suitors. Consider if your company is a stand-alone product or if it might work better as a feature within an existing product suite.

As you do this, it is essential to have empathy for your potential buyer. They have to consider whether it is better to build or buy the solutions their customers need. Examine their weaknesses and learn how customers perceive their solution versus yours. Could your strengths somehow make up for the potential buyer’s weaknesses? Once you understand this, make the changes necessary to establish yourself as an attractive acquisition target.

We did this with an early-stage portfolio company that was trying to compete in the cloud sector with a larger, stronger player. Instead of continuing to burn fuel against strong headwinds, we found a way to develop a competitive personalization offering that would greatly enhance the potential buyer’s offering. They ended up buying the company for around $50 million.

As you work on this, remember that you can likely offer an ascending hierarchy of value. It begins with your star engineers and product developers and their skill sets. Next comes your product and the advantages it has to offer, then come your customers and revenue. If you do get into M&A talks, how much you walk away with will reflect this hierarchy in one way or another.

Date around before getting married

The secret to pulling off M&A is to come off as “eager but not desperate.” Instead of waiting until you’re out of cash to consider selling, think about how you can develop sympathetic relationships with your competitors or partners in advance.

For example, you could approach potential suitors and offer to explore go-to-market partnerships that integrate your features with their offerings. A potential buyer who understands their Achilles’ heel and recognizes the value of your solution might propose an acquisition on their own. There may still be a bit of bluffing involved, though, and you might need to elect a “bad cop” to remind your buyer that acquisition was really their idea.

I’ve seen this scenario play out before. A portfolio company had raised Series A and B rounds but didn’t have enough to go the distance on its own. Fortunately, it already had a relationship with a major industry player that knew the target’s value. The buyer offered a lowball offer but didn’t understand how eager they were to exit. As a result, the startup managed to walk up hundreds of millions of dollars in the final deal.

Extend your runway as much as possible

Careful readers will already be thinking about due diligence. If you are running out of oxygen and badly need a lifeline, your balance sheet will show your situation when the potential buyer starts sniffing around. If they are smart, they will drag out the negotiations as long as possible and bleed you dry until you are forced to sell for pennies on the dollar.

The first thing to do in such a scenario is to get to neutral cash flow. Whether you raise another round or sell out, slowing your burn will put you in a much better negotiating position and communicate that you are no longer a soft target for predatory buyers. If needed, reorganize and downsize so that you can negotiate from a position of relative strength. That said, don’t throw the baby out with the bath water; you must retain enough key talent to remain attractive to buyers and investors.

You might also consider taking on a small amount of venture debt. That’s what another portfolio company in the cloud sector did. The business was doing relatively well, but customer acquisition had slowed considerably and it was difficult to raise more capital. One of the market leaders was eager to buy the company but offered only a fraction of the startup’s total investment value. The startup therefore secured a small loan from a leading investment bank, extending its runway.

The deal later went through at more than four times the buyer’s original offer.

Proactively target corporate venture capital

Almost all leading Fortune 500 companies have corporate venture capital (CVC) divisions. Whether you are open to acquisition or not, those investors should be on your call list. They invest in young companies to lay the groundwork for potential acquisition.

If there are real synergies between your market proposition and their overall business model, they may be the ones to table the idea. If you do find yourself needing a fast exit, having them on the cap table already is far better than approaching them cold.

That reminds me of another startup that was early on the idea of the smartphone app store. They had good traction and were about ready to raise their next round when Apple and Google launched their app store platforms. The writing was on the wall, very suddenly and clearly.

We approached the CVC guys from a large telecommunications company and said, “We’re about to raise our next round. If you are interested in buying us out, speak now, because the post-money valuation will be out of your price range.”

We eked out a 5x return on investment and everyone went home declaring victory.

There’s no shame in the short game

Here’s a final tip: You can’t wait until you need to raise money to start thinking about getting acquired. M&A deals do not “just happen”; they have to be engineered.

You should be thinking about this at least six months and possibly as much as one year before you need to raise your next round. To paraphrase Alec Baldwin from “Glengarry Glen Ross”: “Always be selling.”

Entrepreneurs are driven, optimistic people with the stamina to make tough dreams come true. That’s why VCs invest in you. We appreciate that you want to win and don’t want to let us down.

Trust me, you’re not! Investors are in the business of risk management. Our future opportunity cost is more important than our sunk cost. And your time and talent is worth more than our money. Walking away with $25 million, $50 million or $100 million is (almost) never a “failure.”

Fight the good fight; go for the long game. But remember: The technology business is first a business. We should celebrate cheap losses as much as we do huge gains. Sometimes, playing the short game is really the best way to win.

Comment