Paris Heymann

Whether it’s the coffee shop down the street, a mobile app on your phone or software used at work, any long-term minded and customer-centric company is typically focused on:

- Acquisition: Attracting new customers.

- Retention: Maintaining existing customer relationships and preventing churn.

- Expansion: Deepening and broadening existing customer relationships through cross- and up-sell.

Companies aspire to have direct, long-term and recurring customer relationships with high retention and expansion because these characteristics lead to more predictable revenues and profits. Predictable businesses are more durable, easier to manage and typically rewarded with higher valuations than unpredictable ones.

Software companies tend to have relatively high customer retention and expansion compared to other business models. For software, two metrics are commonly used to measure retention and expansion:

- Gross dollar retention (GDR).

- Net dollar retention (NDR), sometimes referred to as net revenue retention, or dollar-based net revenue retention.

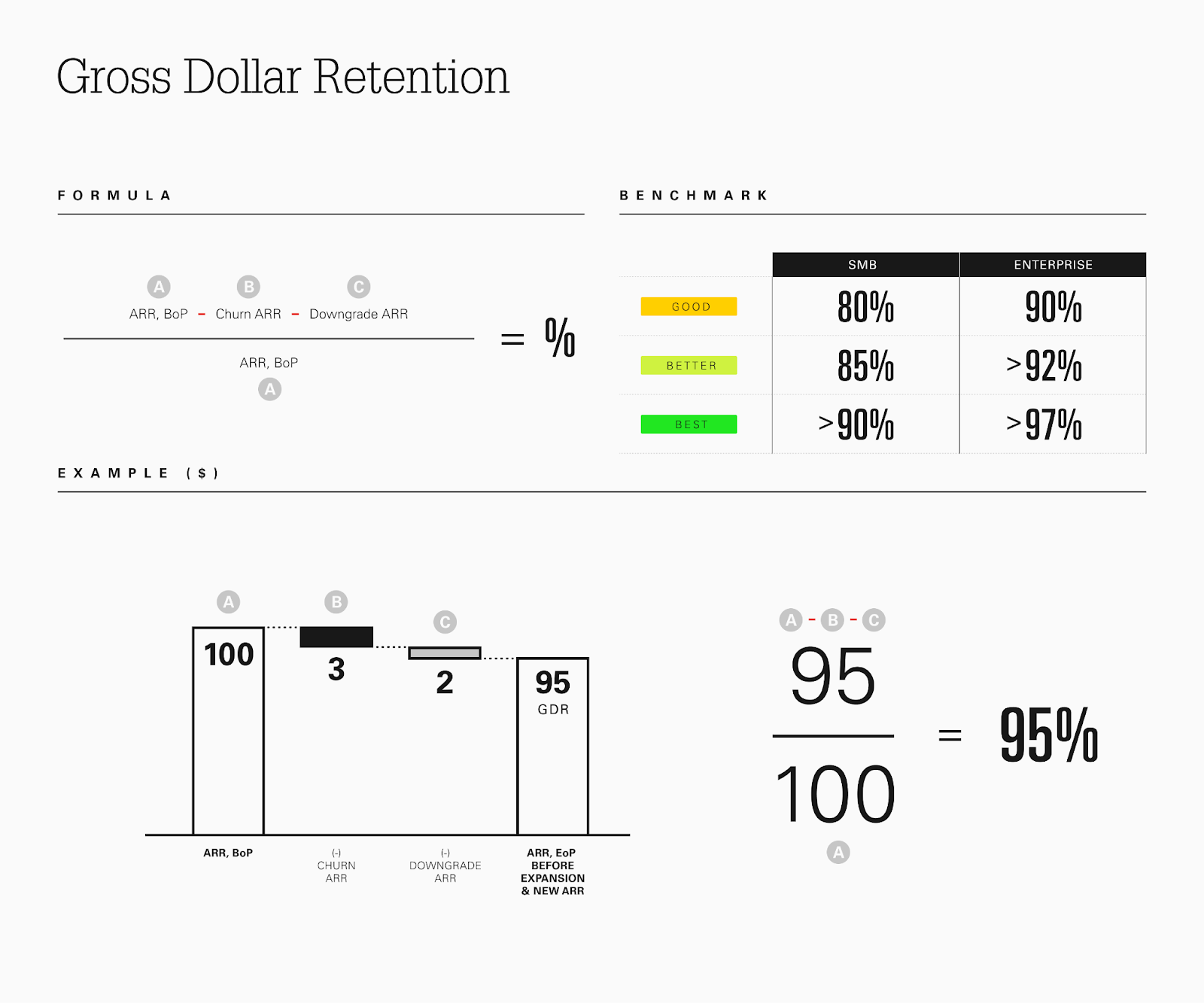

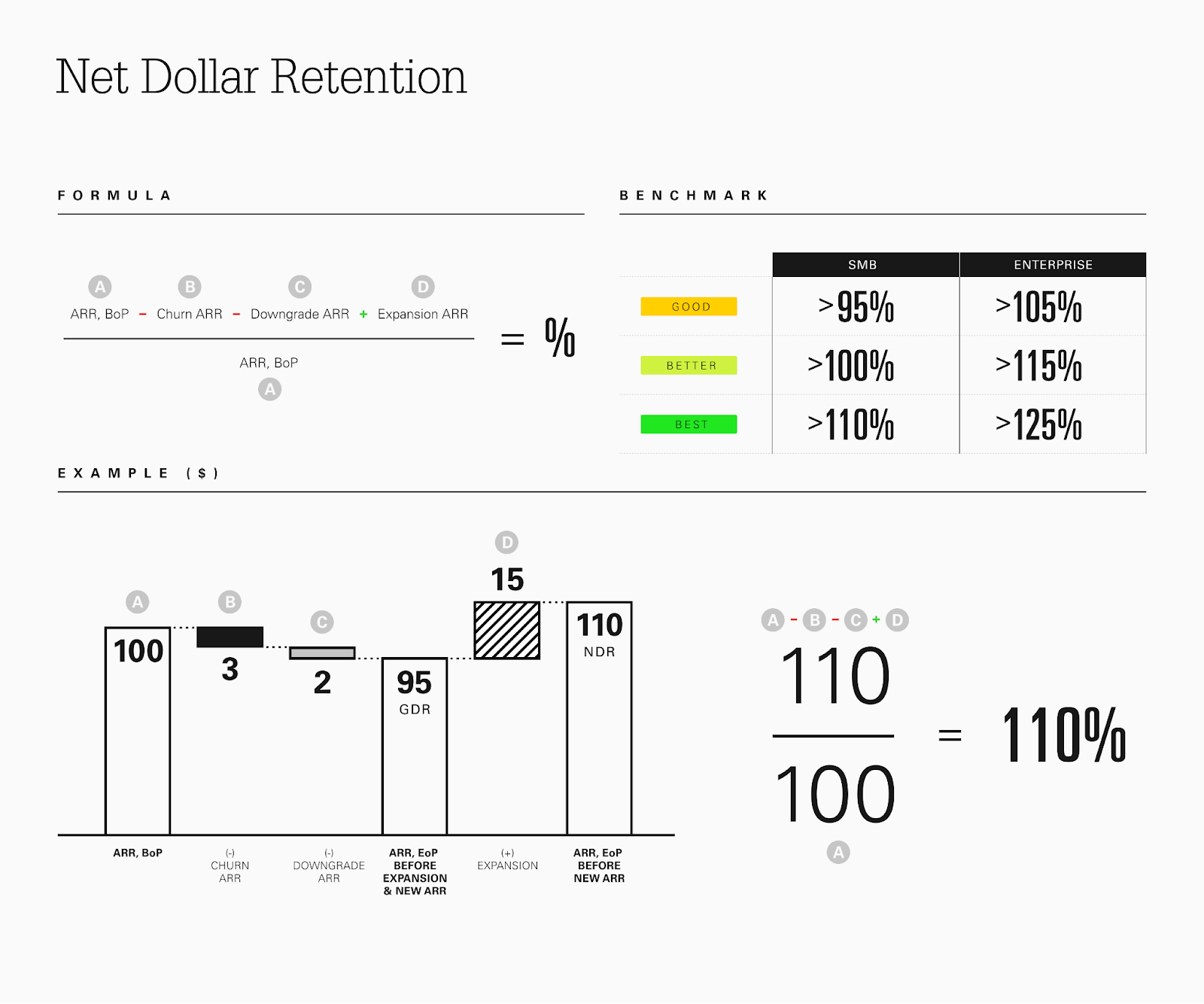

GDR measures retention of an existing book of revenue before expansion, whereas NDR incorporates expansion:

GDR and NDR are well-known and widely used metrics, often discussed in the context of growth. Software companies with NDR over 100% grow revenues organically each year just by expanding their existing book of business before adding any new customers.

While NDR is not a required disclosure, as it is a non-GAAP metric, public software companies often provide visibility to investors through a combination of shareholder presentations, public filings and earnings calls:

Beyond impacting revenue growth, retention and expansion can also greatly impact underlying profitability. Per Harvard Business Review, acquiring a new customer is 5x to 25x more expensive than retaining an existing customer, depending on the industry. Increasing customer retention can meaningfully impact profitability. It’s often much more profitable to drive growth from an existing, high-affinity customer than it is to go find a new customer and educate them on your product or service.

Consider your favorite quick-service restaurant: At the register, it’s likely they will ask if you’d like to add a soda or bottled water. Because you’re already in the store, and the fixed costs of running the location (rent, salaries, electricity, etc.) are paid for regardless of whether you purchase the soda, that additional beverage flows through the restaurant’s P&L statement at high margin.

This is significantly more advantageous for the restaurant than having to place a billboard on the side of the road or buy a costly television advertisement to acquire you as a beverage-consuming customer.

This concept also exists within software: An incremental dollar of revenue growth from existing customer expansion flows through a P&L statement at a higher margin than an incremental dollar of revenue growth from a newly acquired customer. This is especially true if the expansion comes from more consumption or seat purchases of an existing product that requires only modest ongoing investment in R&D.

Given today’s macroeconomic landscape, it’s becoming difficult for software companies to sign up new customers unless they can demonstrate high and measurable ROI with rapid time to value. Many software buyers are sitting on the sidelines, purchasing only what’s most critical.

Against a difficult backdrop for new logo growth, this is the moment to refocus on existing customers in order to develop long-term and mutually expansive relationships that yield higher utility, more value and more spend over time.

As a founder, it’s important during this time period to stay vigilant on each customer account while also keeping a long-term perspective. If you find that your retention or expansion metrics are dropping to levels that look low relative to benchmarks, it’s crucial to assess whether that’s a temporary phenomenon or structural.

If you feel that customers are only temporarily delaying buying more of your software, it could be a sign to stay patient. But if you observe structural churn it could be a much more worrying sign to look deeper at both product and customer success.

One of the best ways to monitor retention and expansion is to keep a close eye on the behavior of underlying customer cohorts (customers who signed up during the same time period as one another). Technology companies invest in sales and marketing to acquire a cohort of customers, which then evolve over time and ideally begin to develop predictable patterns of retention and expansion.

Achieving predictability of underlying cohort behavior is critical because that can lead to increased conviction around investing to fuel future growth.

Viewing retention and expansion on a cohort basis, and then comparing those cohorts to one another, is helpful because it enables you to very quickly determine whether metrics like lifetime value to customer acquisition cost (LTV:CAC) and CAC payback are evolving attractively.

Cohorts also help magnify idiosyncrasies — it’s possible that a group of customers acquired in one period exhibit better or worse retention and expansion characteristics than a group acquired in a different period. Getting at the heart of why that behavior is occurring helps to inform how you should work with those existing customers today and also what archetypes of customers are worth acquiring tomorrow.

Lastly, although gross dollar retention and net dollar retention are often thought of as B2B-focused software metrics, the same principles of acquisition, retention and expansion exist within both B2C-focused software companies and more broadly within other consumer-focused technology companies as well.

For instance, many publicly traded e-commerce companies disclose detail around retention of underlying cohorts on a GMV basis in addition to context around evolution of order frequency and average order value (AOV). This disclosure helps educate investors and entrepreneurs alike to make prudent and data-driven decisions during uncertain times.

Comment