For this week’s Pitch Deck Teardown, I’m (virtually) traveling to Sweden to take a look at the $3 million seed round raised by developer tool startup Encore.

The company is creating what it calls a software development platform for the cloud. It reportedly raised from Crane Venture Partners with Acequia Capital, Essence Venture Capital and Third Kind Venture Capital joining the round.

I wanted to take a look at this deck in more detail, in particular, because it tells a really elegant story in a market where it’s extraordinarily hard to differentiate yourself — both to your customers and to investors!

Pitching a dev tool in a way that tells the story well enough to understand but without dropping deep into a rabbit hole is a particularly hard challenge, and that’s the needle Encore threads ever so efficiently in this 24-slide pitch deck.

We’re looking for more unique pitch decks to tear down, so if you want to submit your own, here’s how you can do that.

Slides in this deck

- 1 — Cover slide

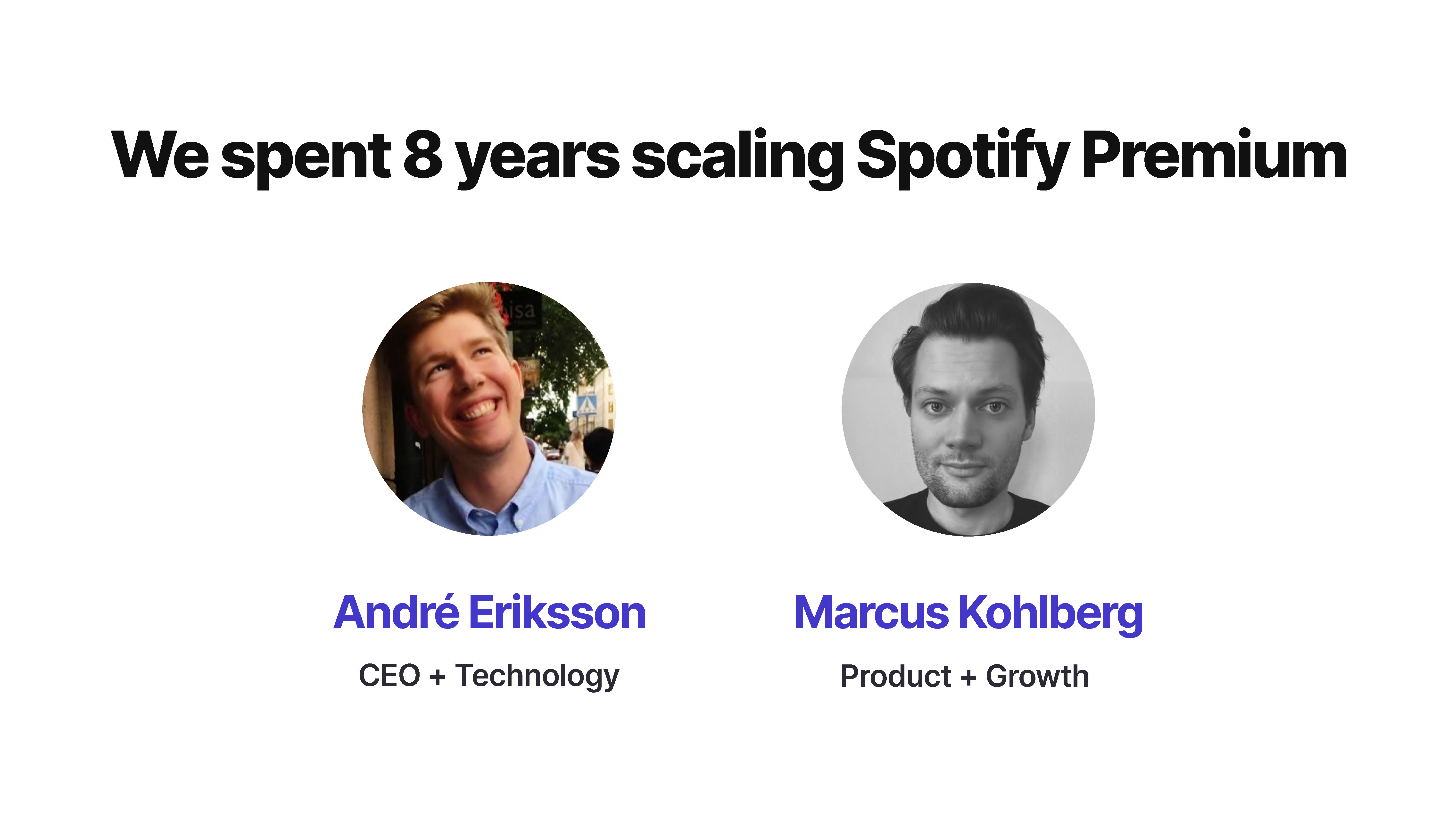

- 2 — “We spent 8 years scaling Spotify Premium” – team slide

- 3 — “Modern software is richer and more advanced than ever” – problem slide

- 4 — “Building modern software is slow” – problem slide

- 5 — “Building backends seems simple” – problem slide

- 6 — “But there’s lots more to it” – problem slide

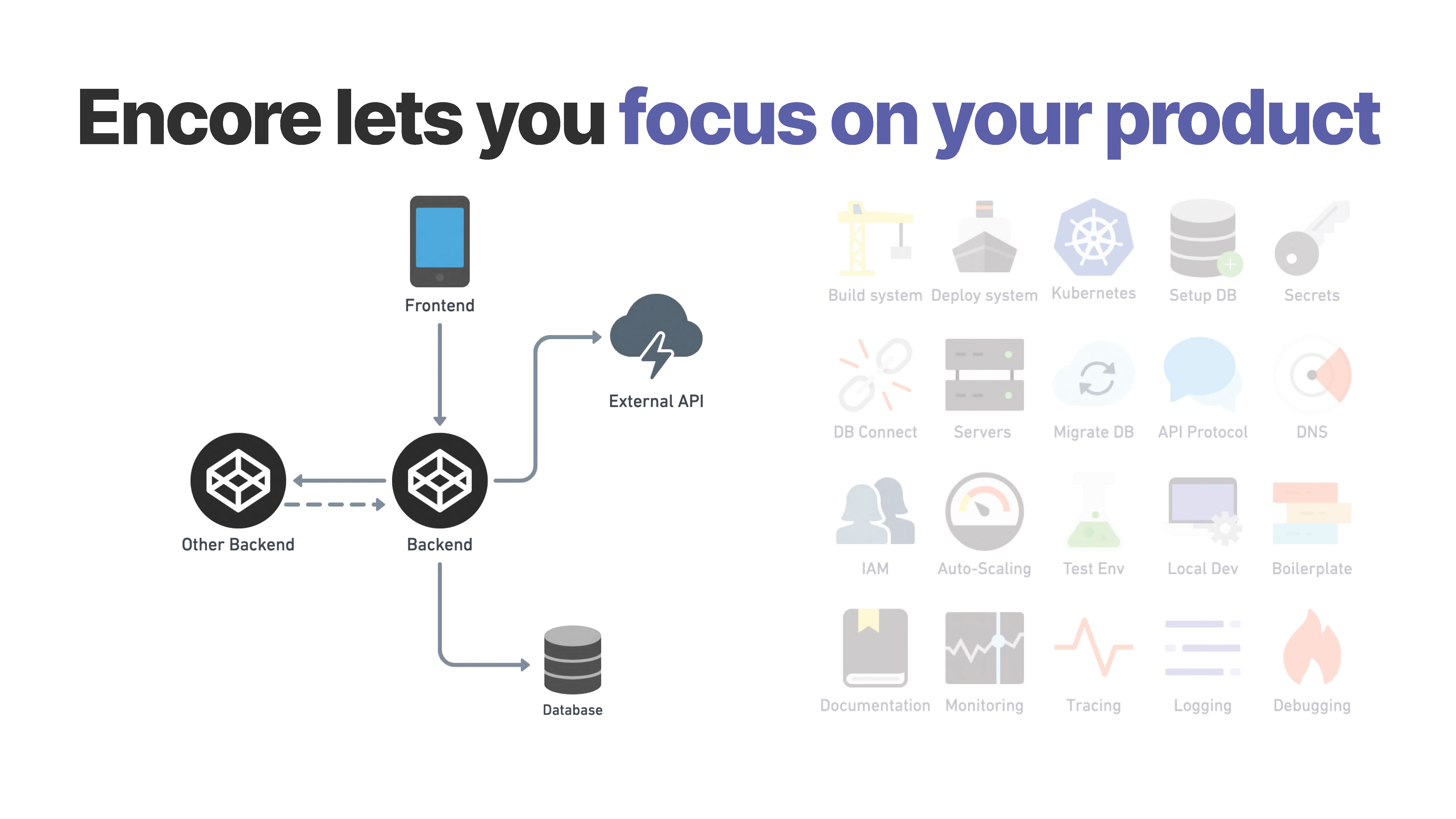

- 7 — “Encore lets you focus on your product” – solution slide

- 8 — “Unlike all other tools, Encore understands your application” – solution slide

- 9 — “Unique end-to-end insights to radically improve the dev experience” – value prop slide

- 10 — “Encore: The Software Development Platform for the Cloud” – product slide

- 11 — Diagram showing how current solutions perform – product slide

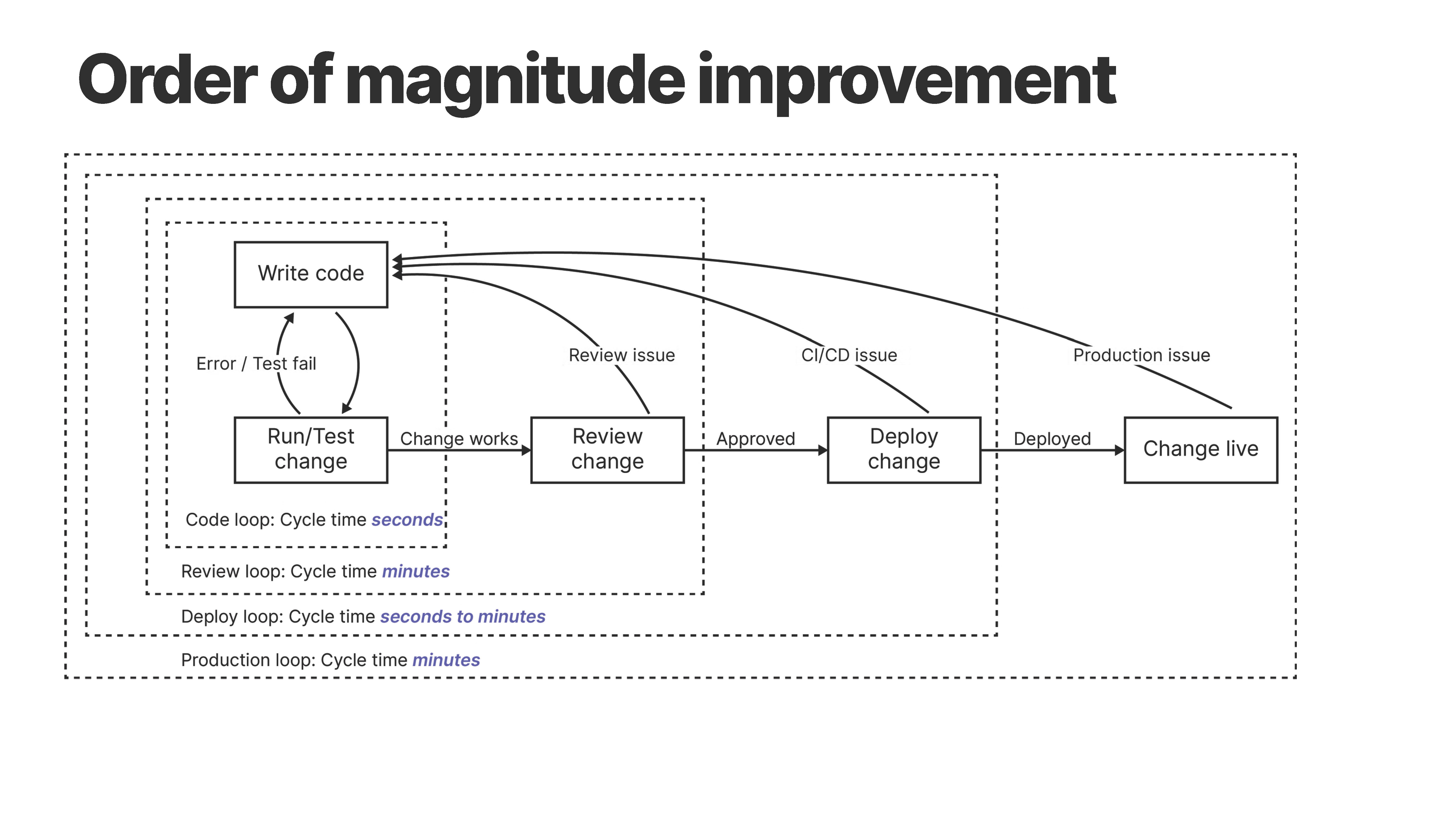

- 12 — “Order of magnitude improvement” – product slide

- 13 — “Flexible abstraction level” – product slide

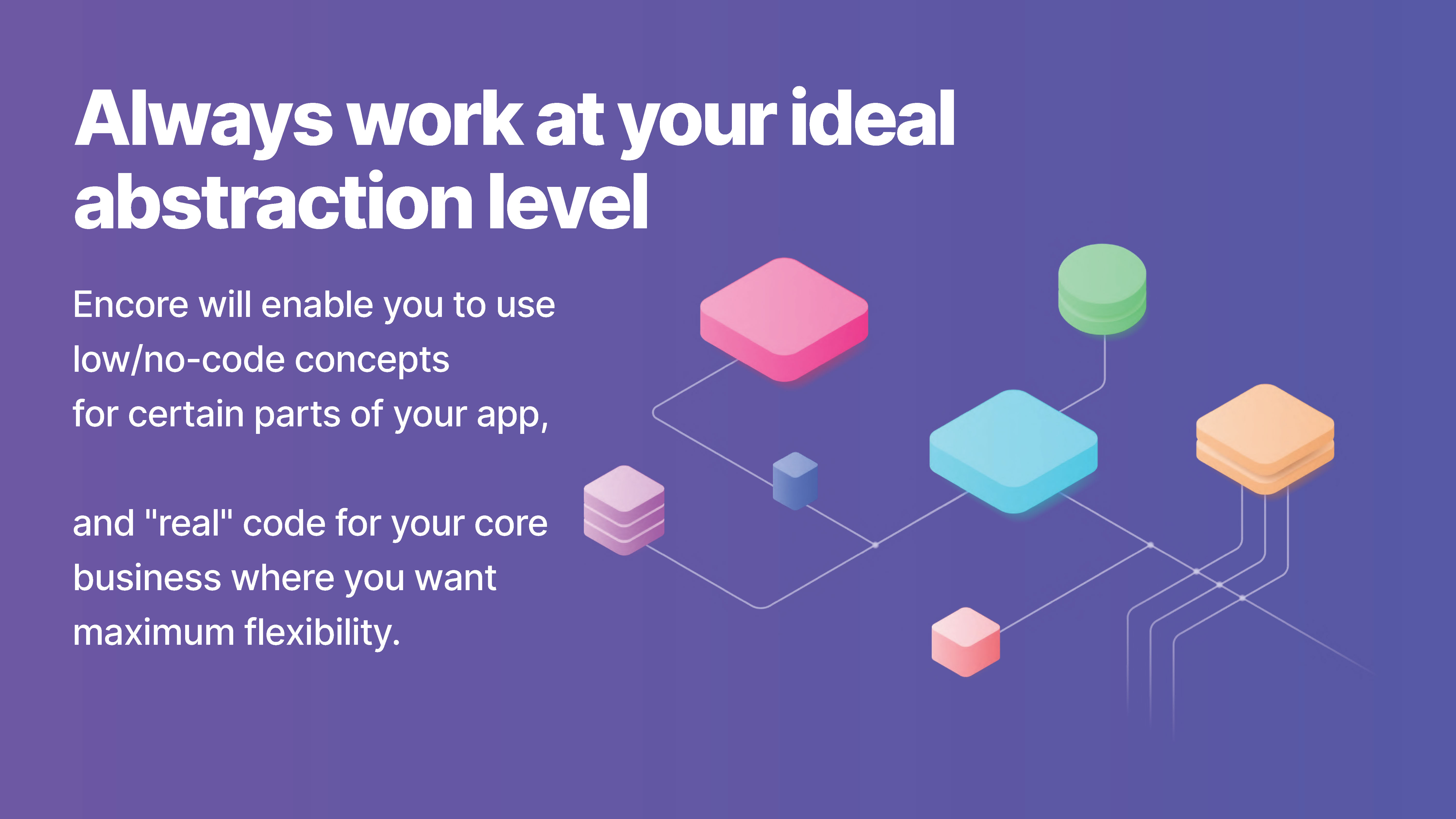

- 14 — “Always work at your ideal abstraction level” – product slide

- 15 — “What’s in the box” – product feature set slide

- 16 — “Road map” – product road map slide

- 17 — “Strong traction” – traction slide

- 18 — Diagram slide

- 19 — “User feedback incredibly positive” – market validation slide

- 20 — Early user personas – target audience slide

- 21 — “Grow through word of mouth by nurturing a community of builders” – go-to-market slide

- 22 — “Start by charging for productivity, add incredible tools for whole orgs” – business model slide

- 23 — “Sales through organic adoption and meeting bottom-up with direct sales” – sales strategy slide

- 24 — Company vision slide

Three things to love

This is a relatively small round, and Encore is still very early in its journey, and I can 100% understand how it could totally “get away with” some of the things I’ll bring up in this teardown. It also tells a really good story in an engaging manner — so let’s start with the good!

Easy-to-understand problem space

Over a number of evolving slides (5, 6, 7), the founders do a really smooth job of carving out a space within a market that has spectacular competition right now. By spending a few slides telling the story of how the company is positioning itself in the space, it starts alluding to what the product challenge is. The message of letting the technical team focus on building its product, rather than worrying about what’s happening under the hood, is a compelling proposition for anyone who’s ever had DevOps ruin the product party.

One quibble here that isn’t really serious enough to warrant its own item in the “things that could be improved” section: These slides are formulated as if the company is talking to its customers. “Lets you focus” makes sense if you’re talking to a prospective sale. Remember, though, that you aren’t selling the product to the investors — you’re selling shares in your company. “Lets developers focus” would work better and is an opportunity to name who your target audience is as well.

Clear value proposition

Time is money, and if most startups’ P&Ls are anything to go by, developer time is right up there with some of the most expensive time there is.

In slides 11 and 12, Encore nails down why its product has such a powerful value proposition: Flicking to this slide, it tells the story of how getting a product feature or a bug fix to a production app suffers hours of avoidable delays. The subtext is clear: This is avoidable by using Encore’s tools.

If the company can put the money where its mouth is — i.e., if it really does reduce time to deployment from hours to minutes — and if it can prove a direct link to development efficiency, the value to software companies is immense. That’s it; that’s the story — it doesn’t really matter what Encore even does, exactly, if it can show that developers save significant amounts of time and it can find a route to market, this is a company that could get huge.

Telling the same story in a different way

This slide says, essentially, the same thing as slides 12 and 13 — but it says it in a way that is really easy to visualize.

As a company, one way to gain efficiency is to ensure that you focus your developers’ attention on the things that really matter, which is worth reiterating on multiple slides.

In the rest of this teardown, we’ll take a look at three things Encore could have improved or done differently. In particular, I’m curious about why it focuses so heavily on its product, when — in my experience — investors generally don’t care as much as you might think. A more curious part is how the business is working now (in the form of traction and finding a repeatable business model) and what it is hoping to accomplish with the money raised in this round. We’ll also share Encore’s full pitch deck so you can see the whole thing in context.

Three things that could be improved

There is a lot to love about Encore’s deck: It simplifies a complex product story into a few easy-to-digest slides and shows why there’s an opportunity in the market. But if I were to invest in this company, I would have a few questions right off the bat. Let’s take a closer look at what raises the red flags:

High-risk opening slide

I typically suggest opening with your strongest slide, so when I see founders who open the entire presentation with a team slide, I lean in for a much closer look. The slide had better represent an epic moat against the competitors or some fiercely unfair competitive advantage. A good example here might be if one of the founders has a Ph.D., patents, incredible history of founding companies and deep industry knowledge or some sort of unique access to its target industry.

When I first eyeballed this slide, I read that Eriksson was the CEO at Spotify and Kohlberg headed up Product and Growth. Then I paused for a moment. Wait a minute, I know the Spotify CEO. I looked up Eriksson and Kohlberg on LinkedIn and realized that they were a software engineer and group product manager at Spotify, respectively. The text referred to their roles within Encore.

Even as I’m typing all of this out, I feel stupid; would anyone really make that mistake? Perhaps not — but if there’s any room for doubt, make sure to spell things out. As an investor, if I somehow got a deck from the CEO of Spotify across my desk, I’d pay really close attention, and even if I later realized that it was my own dumb fault for misreading the slide, that’s not exactly the first impression you want to give an investor.

Now, I’m giving the team a hard time, but eight years each at Spotify is a lot more impressive than a lot of other slide decks I see, so that gets some bonus points. Looking at the founders’ LinkedIn profiles, though, I find myself wondering: Based just on a skim of the two founders’ experience, wouldn’t a group product manager be better positioned to lead up the company? And even if that wasn’t the case, why does one of the co-founders not have a C-suite title on the slide? (On LinkedIn, Marcus’ title is CPO.)

So the slide immediately sets off a number of alarm bells and raises a flurry of questions. In my opinion, if you are opening with a team slide, I’d love to have seen a reason or two that makes investors go, “Oh, yeah, that makes sense, I would totally fund this.” Unfortunately, scaling growth at the world’s largest streaming service, while impressive, does not in isolation scream “these are two guys who would be perfect at starting this company.” And that’s really the bar you’re aiming for.

No market, competition or operating plan slides

There are no hard and fast rules for what slides need to be part of a slide deck or what order they go in. There are plenty of templates out there that suggest a 10- or 12-slide deck, while others have a few more or less. I have my own template that I developed alongside my book, “Pitch Perfect,” if you’re curious about how I would solve the “what slides do you need?” conundrum.

For early-stage startups like Encore, you can perhaps skip a few slides. If you have no revenue, a revenue/ARR slide is redundant. If you don’t have any traction worth speaking of, omit that. And if you are in biotech and you are many rounds of funding and many years of research away from marketing a product, you forgo a go-to-market slide.

In the case of this deck, though, there are some big things missing. There’s no market size or market trajectory slide. This is the TAM/SAM/SOM, or a macroeconomic overview of the market you are planning to take on and how you fit into it. You may as well not pitch the story; the investors are going to have a lot of questions, and they want to know how you think about the market. Without the slide, you’ll be on your back foot, and that’s not a good place to be — it makes more sense to do a top-down or bottom-up analysis of the market and include that in your deck.

Similarly, your deck is going to need a competition slide. This slide will help explain how you see the competitive landscape and what the differentiators are. All startups have competitors — and any startup that claims they do not still needs a competition slide: Your customer will be solving this problem one way or the other, and we need to talk about how. If they aren’t solving the problem, you’re screwed: Without a problem worth solving, there’s no product to sell, and no customer to pay you.

Finally, I really believe that all companies need a “the ask/use of proceeds” slide. What are you raising, and what milestones will you need to reach in order to raise the next round of funding? To be fair to Encore, this is the one slide most founders get wrong, and obviously, they were successful in raising funding anyway.

The final missing slide is related to the “use of proceeds” — an operating plan. Operating plans typically include major milestones, along with cash flowing into and out of the business. In an ideal world, the operating plan should take you through to your next round of funding. It doesn’t have to be complicated (something like this works great) but having a solid operating plan helps investors understand that you comprehend the full business from a finance and numbers point of view. Ultimately, that’s why investors are willing to invest; they want to have faith in the fact that you’re a solid operator and you know how to shepherd your company through the milestones of growth.

Iffy traction metrics

I always say that if you have incredible traction, that’s realistically all that matters in a pitch. Inexperienced team but great revenue? You’ll raise. Weird market but high ARR? You’ll raise. Wonky product but a K factor of 1.9 with no customer acquisition spend? They’ll throw as much money at you as you’ll take.

When Encore lists its traction metrics as stars on GitHub, I wonder why that’s the company’s top metric. That’s interesting, and possibly even impressive, but stars aren’t dollars. Developers trying out the product is admirable, but no mention of whether they are paying customers sets off an alarm bell.

The rest of the “traction” isn’t meaningful, either. As an investor, when I look at traction, I’m looking for leading indicators that tell me that the company is about to explode — the numbers I care about are revenue (and, for a SaaS company, ARR), active users, spend per user, churn rates, cost of acquisition, lifetime value and other numbers that have a measurable impact on the business. Seeing numbers that are vanity metrics at best — or an attempt to hide something at worst — makes me nervous.

I would rather have seen a product feature set (which the company does have, as slide 15) and a road map (slide 16) combined with some user validation (slide 19) than metrics that don’t matter. I worry that the founding team doesn’t know what is important, and that is going to require some conversation in the Q&A section after the pitch — or worse, a fast “no” because the founder doesn’t come across as believable.

But none of this matters

Rereading my teardown of Encore makes me a little jittery. There are a lot of points to improve in there, and I am curious about how the deck and pitch were received by the investors. The truth is this: Pitch decks, pitching and fundraising isn’t a precise science, and even though the deck is different than what I would have put together, that doesn’t make it a bad deck. It tells a coherent story and brings together a lot of narrative strands that are important to an early-stage company. And, ultimately, Encore was successful in closing a $3 million round, which is literally the only thing that matters.

This is a deck that unlocked the next phase of a startup company and is backed up by $3 million of fresh capital to help build and grow Encore’s future. The founders were extremely generous in submitting the deck for review — without any redactions or edits — which is a wonderful gift for the whole startup ecosystem.

The full pitch deck

Without further ado, here’s Encore’s full 24-slide pitch deck!

If you want your own pitch deck teardown featured on TC+, here’s more information. Also, check out all our Pitch Deck Teardowns and other pitching advice.

Comment