I don’t typically critique decks for fundraises we didn’t cover on TechCrunch, but for Supliful, I had to make an exception because it’s a company that solves a spectacularly interesting problem.

Consumer packaged goods companies can churn out products all day long, but marketing is an expensive challenge. Creators produce content all day long but don’t always have an easy way of monetizing their traffic. Of course, creators have access to affiliate marketing and/or promoting goods on behalf of brands, but Supliful comes along with another option: the ability to use their brand to promote white-labeled supplements and health products.

Men’s Journal breaks down the simple genius of the business model, and TechRound has an interview with the founder that dissects the details of the company, its founder and its formation.

Supliful also claims it raised $1 million with a really interesting deck, which was the thing that got my little ears to perk up. Plus, it was remarkably frank with its numbers and slides, without any redactions. Let’s dive right in.

We’re looking for more unique pitch decks to tear down, so if you want to submit your own, here’s how you can do that.

Slides in this deck

On the first click-through of the deck, I couldn’t get past the fact that it is laden with typos and the design is god-awful. But after leafing through it more carefully, I reminded myself of my go-to golden rule: People are willing to suffer bad UX for good content, but they won’t suffer great design for bad content. This 22-slide deck ain’t perfect, but it’s a great example of how a company can use storytelling to make a point. It also uses a few slides I see very rarely in slide decks (financial levers and predicates, to mention a couple) that are used to great effect here.

- Cover slide

- Case study teaser slide

- Problem slide

- Solution slide

- Market size slide

- “Why now” slide

- “How it works” — product slide

- Financial levers slide

- Inside sales/market growth slide

- Case study slide

- Metrics slide

- Competition slide

- Predicates slide

- Team slide

- Investors slide

- Financial projections slide

- Use of funds slide

- Contact info slide

- Interstitial slide: Appendices

- Appendix: Suppliers

- Appendix: Adjacent market opportunities

- Appendix: Creator growth

Three things to love

This deck — design and typos notwithstanding — is extraordinary, and I’m unsurprised that Supliful raised money successfully. There’s a lot to love, but since there are a few opportunities to do so, I want to celebrate the more unusual slides that work really well.

Financial levers slide

High-quality founders understand what the financial drivers are in their company. I’m particularly passionate about this, and essentially, what it boils down to is “if we spend 5x more here, we get 15x more revenue over there,” or “if we spend 2x more on this aspect of product development, we cut time-to-market by a fifth.” Knowing how these things hang together is crucial. I explored that more a few years ago:

Supliful has a whole slide that shows that it has a deep understanding of what it needs to do to get where it wants to go:

This slide is deceptively simple, but it does a few things: It shows that in the next 18 months, the company wants to hit $4 million of gross merchandise value (GMV). That’s what the industry refers to as a BHAG — a big hairy audacious goal.

But it’s not just wishful thinking; Supliful explains that it knows how to get there — get average markup to a third. Ensure they get 5% commissions on storefronts. And roll out a subscription plan for creators. For people in the CPG space, those numbers will seem not just reasonable, but eminently achievable. The psychological effect of this slide is, “Well, I believe this company can pull this off.”

This slide clearly shows what drives the growth and evolution of Supliful, and that’s a lesson startup founders should note. If you can’t elucidate how you’re going to hit your goals, is that because you don’t fully understand or because there’s some complexity you haven’t cracked yet?

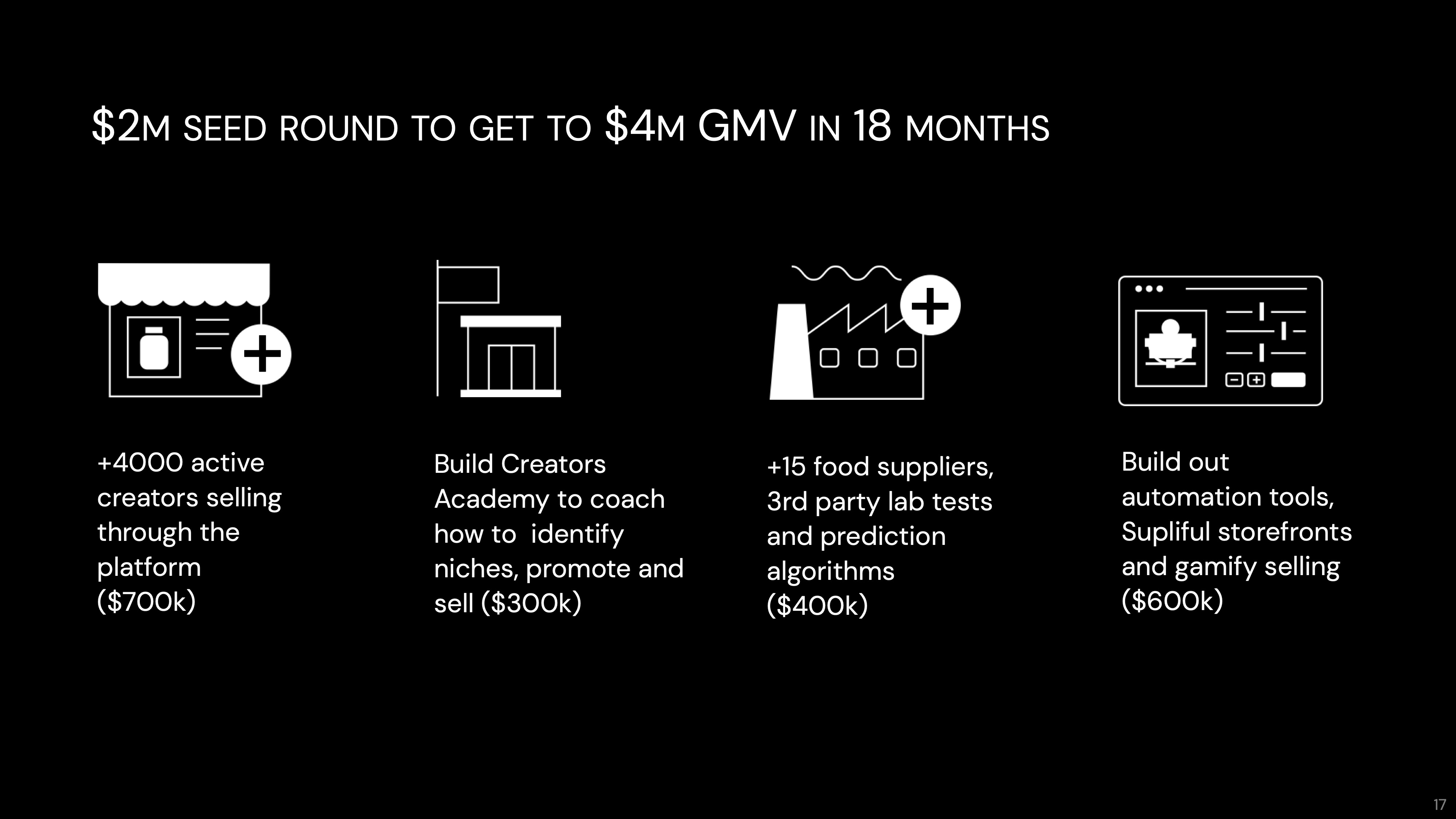

Super clear ask slide

Kinda similar to the above, but instead of talking about the specific goal, which is related to understanding the financials within the business, this slide discusses how much the company is raising and what it can accomplish when it does. It does two things beautifully — it breaks down how much Supliful is raising and shows what the money will be spent on. These are classic SMART goals: The company is promising 4,000 active creators, an education program, 15 suppliers and testing capabilities, and automation tools to make selling more efficient for creators, all for $2 million. It’s clear, and it’s easy to measure whether the company is on track.

For startup founders, the takeaway here is that clarity sells really well. There’s no doubt what the company is promising. My favorite is that the goals are distinctly defined. This isn’t “we will get some more creators,” it is “we will get 4,000.” This isn’t “we will engage with some food suppliers,” it is “we will find 15, and we’ll come up with a testing lab to ensure that what we’re selling is actually living up to its promises.

ChefsKiss.gif.

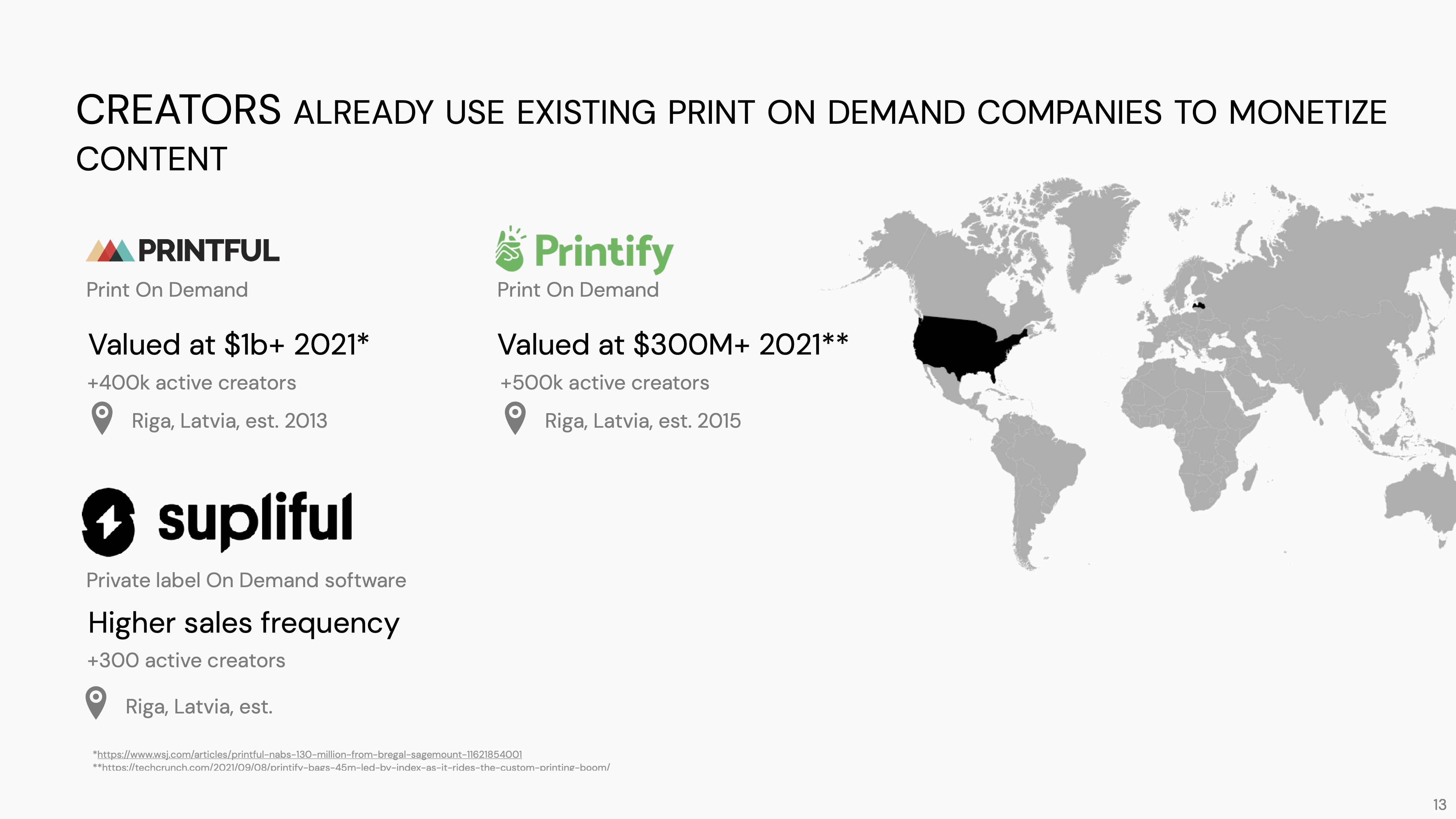

Predicates! Yaaaaas!

As a startup, you’re occasionally caught between a rock and a hard place; yes, you want to upend a market and change something significant, but when you do, how do you know that the customers want what you’re flogging? A great way of telling this part of the story is by using predicates — relatable examples in adjacent markets — that show that what you are doing might be possible in your market.

Supliful picked print-on-demand services. Creators, and especially cartoonists and visual artists, have long sold their designs on T-shirts, mugs, posters, etc. The print-on-demand market for these audiences is well developed, and you can point to a string of successful companies that use this model to help creators make money. It stands to reason that print-on-demand works for cartoonists, but what about wellness and fitness creators? Tah-daaaaah, that’s where Supliful comes in. I love this as a storytelling technique because you can say, “Hey, it worked over there, why wouldn’t it work for us?”

If you can find a comparable market with solid players that you can point to as a related market for what you’re doing, it can help make the story seem less scary.

In the rest of this teardown, we’ll take a look at three things Supliful could have improved or done differently, along with its full pitch deck!

Three things that could be improved

I know I’ve mentioned this several times already, and that’s because as a writer, this pisses me off to no end. Typos are unnecessary: Run a spell check and double-check the names of your own investors (I know Marvin on Slide 15 from his 500 Startups days — hi, Marvin! — but that’s not how you spell his last name).

But honestly, I’m nitpicking on typos because there’s not much else to whine about. This is one of the best decks I’ve ever seen, despite being butt-ugly and riddled with mistakes. I suspect what happened here is that the company raised its money so quickly that it never bothered to revisit the deck, which is a mic drop all in itself.

Explain the TAM/SAM/SOM more

I don’t love this market-sizing slide, because I’m not sure how the number of creators is tied to the money. Somehow, 200,000 creators translate into $1.2 billion of serviceable obtainable market? I feel compelled to point to this post:

But even then, I’m not sure. There’s just not enough info to fully understand the data the company used to underpin these figures. And maybe it doesn’t matter; once you have enough traction behind you (and Supliful certainly has a fair chunk of that), perhaps investors are willing to squint and go, “Sure, there’s space for growth here.” But I’d love to see a bit more detail and consideration.

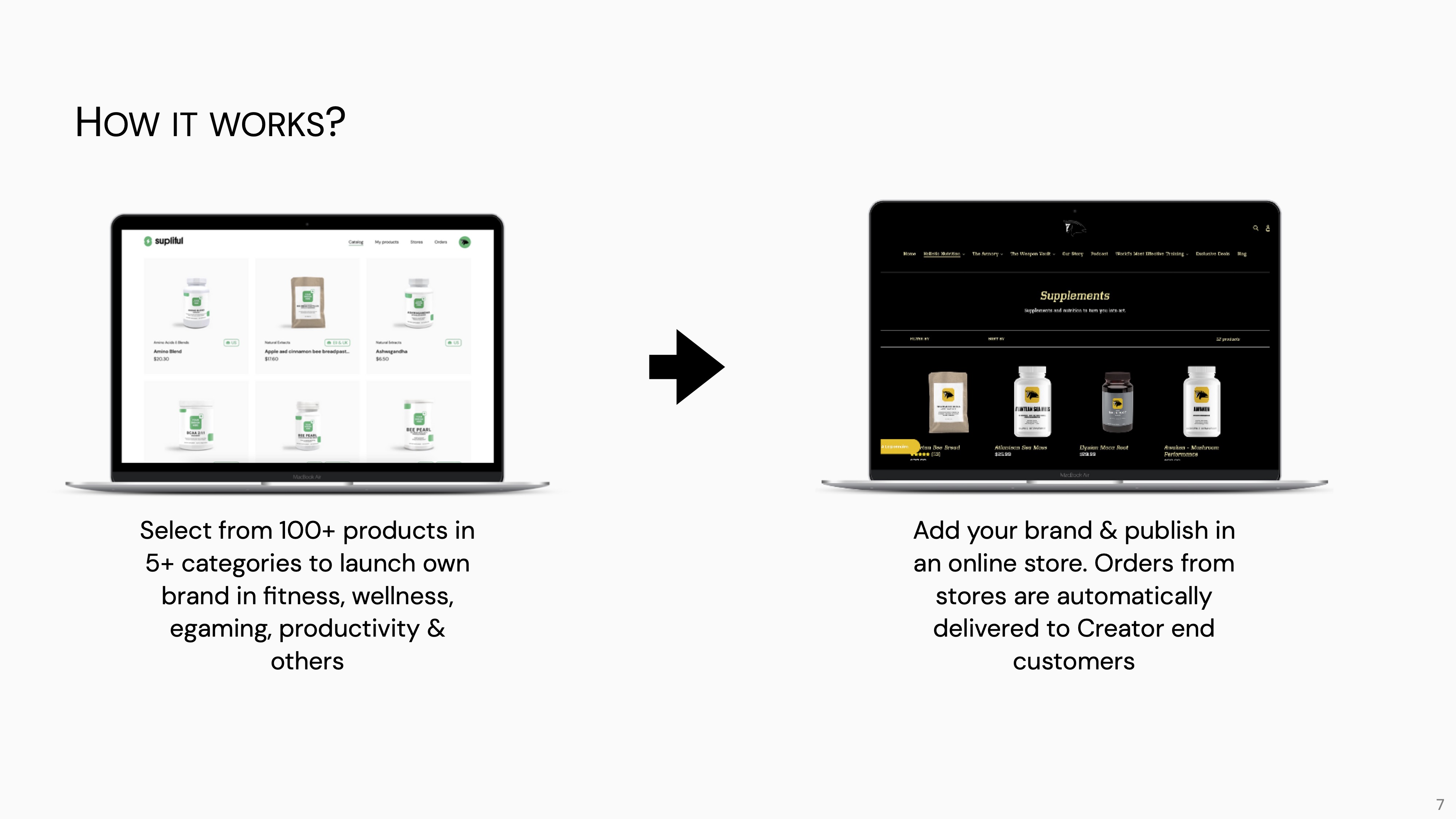

Oh, come on, we need a bit more than that

This slide might work fantastically well if you’re explaining to a creator how they can make a store. But as far as solving hard problems, this ain’t it; a team of semi-sentient developers can stamp out the functionality listed above easily enough.

The problem is, Supliful is, in fact, a supply-chain company. It has a wall of suppliers creating more than 50 different dietary supplements and health products that can be white-labeled for creators that fall inside reasonable guidelines for markings, product safety, shelf stability and everything that goes into creating a CPG. That is non-trivial, and the company sort of glosses over that.

If I were considering an investment, the “how it works” isn’t really about how creators can set up their own stores. Shopify has normalized how easy that is. I want to know where the products come from. How are the labels applied? How can you ensure that the products are safe and labeled according to local regulations? How do you handle the complex logistics from warehouse to customers, with the creator’s branding, in a time frame that’s reasonable? How do you deal with returns? How do you deal with customer support?

Don’t be fooled; this is a complex business, and the company only speaks about a tiny slice of that complexity here.

The lesson here for other startups? Think about what the long pole in the tent is for your startup. Perhaps a more detailed supply-chain slide could live in the appendix.

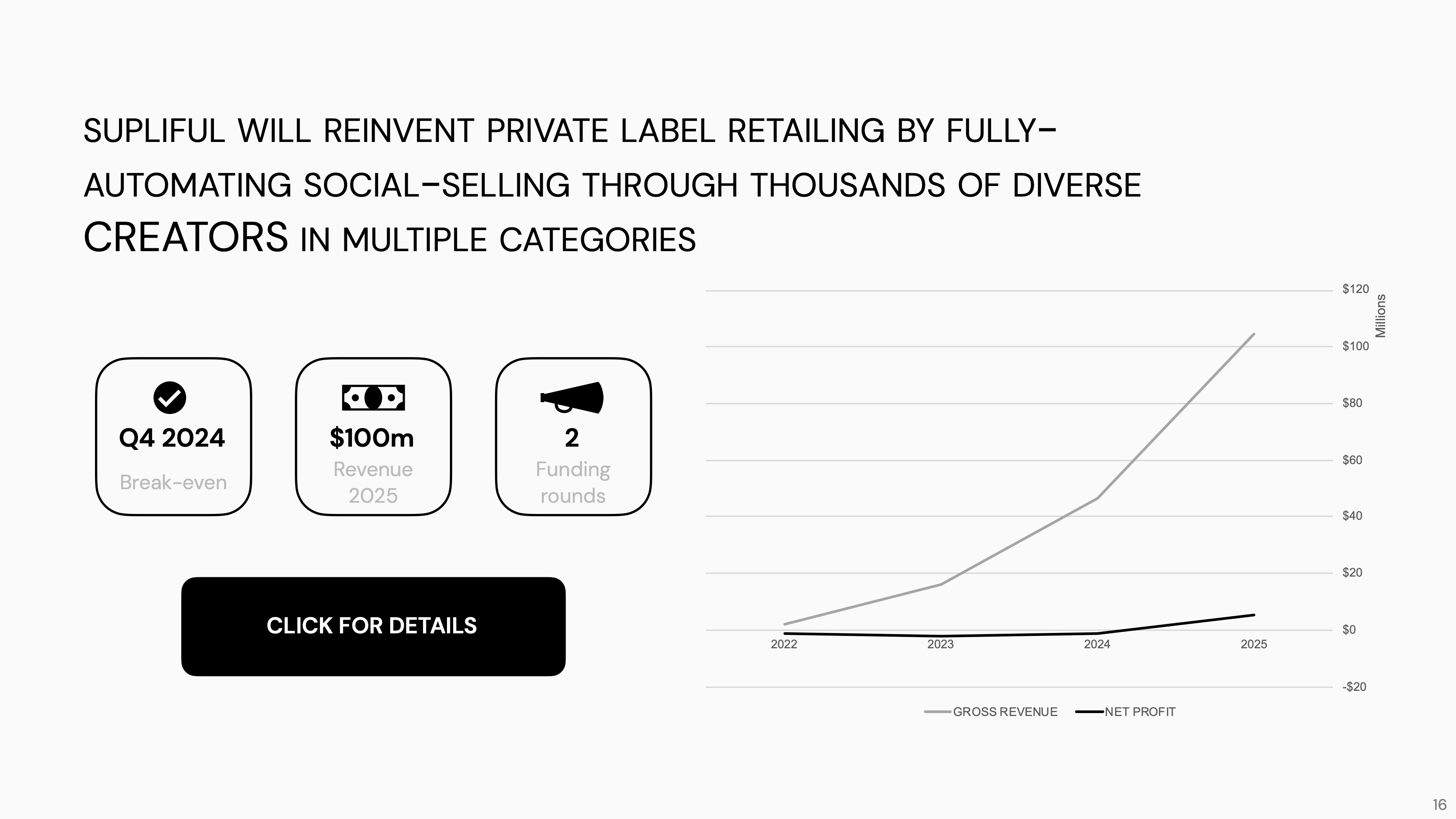

Yeah, but … oh wow

When I saw this slide, I realized that I was getting bored with Supliful’s hand-wavy future projection. Anyone can put together this sort of thing, and I just don’t believe it. For a company so good at showing the financial levers early on, this just doesn’t cut it. So I wrote a pretty substantial rant about how this wasn’t good enough, and then I finally spotted the big black button that said “click for details,” and what I found when I clicked it, dear readers, brought a tear to my eye. It was a full set of financials in a Google Sheet:

The sheet shows full, up-to-the-minute details of, well, everything. What the team is paid, what they’re spending on marketing, how they think about returns. It’s an extraordinary trove of data that you’d expect from a serious, late-stage company’s due diligence. It’s a powerful set of figures to add to a pitch deck, and it invites the investors to look at both what the company has done in the past and what it’s planning to do next.

Personally, I’d have preferred a summary slide (perhaps organized as an operating plan), but this is a hell of a solution, and given that the company raised its money without even fixing the basic typos in the deck shows that perhaps sometimes I tend to sweat the small stuff too much; if you’ve got traction and you can show it off, lead with that, and all the other pieces will fall into place.

The full pitch deck

If you want your own pitch deck teardown featured on TC+, here’s more information. Also, check out all our Pitch Deck Teardowns and other pitching advice, all collected in one handy place for you!

Comment