Ximena Aleman

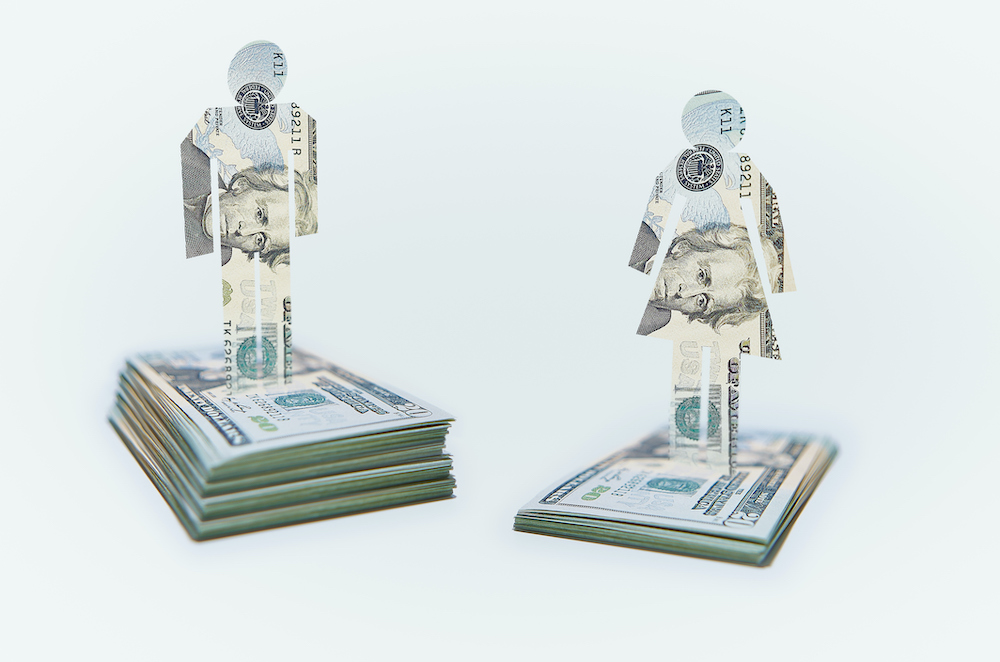

Year-in, year-out, the gender gap in venture capital investment continues to be a problem women founders face. While the gender gap in other areas (such as the number of women entering tech in general) may be on the right path, this disparity in funding seems to be stagnant. There has been little movement in the amount of VC dollars going to women-founded companies since 2012.

In fintech, the problem is especially prominent: Women-founded fintechs have raised a meager 1% of total fintech investment in the last 10 years. This should come as no surprise, given that fintech combines two sectors traditionally dominated by men: finance and technology. Though by no means does this mean that women aren’t doing incredible work in the field and it’s only right that women founders receive their fair share of VC investment.

In the short term, women founders can take action to boost their chances at VC success in the current investment climate, including leveraging their community and support network and building the necessary self-belief to thrive. In the long term, there needs to be foundational change to level the playing field for women entrepreneurs. VC funds must look at ways they can bring in more women decision-makers, all the way up to the top.

Let’s dive into the state of gender bias in VC investing as it stands, and what founders, stakeholders and funds themselves can do to close the gap.

Venture capital is far from a level playing field

In 2019, less than 3% of all VC investment went to women-led companies, and only one-fifth of U.S. VC went to startups with at least one woman on the founder team. The average deal size for female-founded or female co-founded companies is less than half that of only male-founded startups. This is especially concerning when you consider that women make up a much bigger portion of the founder community than proportionately receive investment (around 28% of founders are women). Add in the intersection of race and ethnicity, and the figures become bleaker: Black women founders received 0.6% of the funding raised since 2009, while Latinx female founders saw only 0.4% of total investment dollars.

The statistics paint a stark picture, but it’s a disparity that I’ve faced on a personal level too. I have been faced with VC investors who ask my co-founder — in front of me — why I was doing the talking instead of him. On another occasion, a potential investor asked my co-founder who he was getting into business with, because “he needed to know who he’d be going to the bar with when the day was up.”

This demonstrates a clear expectation on the part of VC investors to have a male counterpart within the founding team of their portfolio companies, and that they often — whether subconsciously or consciously — value men’s input over that of the women on the leadership team.

So, if you’re a female founder faced with the prospect of pitching to VCs — what steps can you take to set yourself up for success?

Latin America takes the global lead in VC directed to female co-founders

Get funded, as a woman

Women founders looking to receive VC investment can take a number of steps to increase their chances in this seemingly hostile environment. My first piece of advice is to leverage your own community and support network, especially any mentors and role models you may have, to introduce you to potential investors. Contacts that know and trust your business may be willing to help — any potential VC is much more likely to pay you attention if you come as a personal recommendation.

If you feel like you’re lacking in a strong support network, you can seek out female-founder and startup groups and start to build your community. For example, The Next Women is a global network of women leaders from progress-driven companies, while Women Tech Founders is a grassroots organization on a mission to connect and support women in technology.

Confidence is key when it comes to fundraising. It’s essential to make sure your sales, pitch and negotiation skills are on point. If you feel like you need some extra training in this area, seek out workshops or mentorship opportunities to make sure you have these skills down before you pitch for funding.

When talking with top male VCs and executives, there may be moments where you feel like they’re responding to you differently because of your gender. In these moments, channeling your self-belief and inner strength is vital: The only way that they’re going to see you as a promising, credible founder is if you believe you are one too.

At the end of the day, women founders must also realize that we are the first generation of our gender playing the VC game — and there’s something exciting about that, no matter how challenging it may be. Even when faced with unconscious bias, it’s vital to remember that the process is a learning curve, and those that come after us won’t succeed if we simply hand the task over to our male co-founder(s).

More women in VC means more funding for female founders

While there are actions that women can take on an individual level, barriers cannot be overcome without change within the VC firms themselves. One of the biggest reasons why women receive less VC investment than men is that so few of them make up decision-makers in VC funds.

A study by Harvard Business Review concluded that investors often make investment decisions based on gender and ask women founders different questions than their male counterparts. There are countless stories of women not being taken seriously by male investors, and subsequently not being seen as a worthwhile investment opportunity. As a result of this disparity in VC leadership teams, women-focused funds are emerging as a way to bridge the funding gender gap. It’s also worth noting that women VCs are not only more likely to invest in women-founded companies, but also those founded by Black entrepreneurs. In addition to embracing women and minority-focused investors, the VC community as a whole should ensure they’re bringing in more women leaders into top positions.

Gender equality in VC makes more business sense

From day one, the Prometeo team has made concerted efforts to have both men and women in decision-maker roles. Having women in the founding team and in leadership positions has been crucial in not only helping to fight the unconscious bias that might take place, but also in creating a more dynamic work environment, where diversity of thought powers better business decisions.

Striving for gender equality, both within the walls of VC funds and in the founder community, is also better for businesses’ bottom line. In fact, a study by Boston Consulting Group found that women-founded startups generate 78% for every dollar invested, compared to 31% from men-founded companies.

Here in Latin America, women founders receive a higher proportion of VC investment than anywhere else in the world, so it’s no surprise that women are leading the region’s fintech revolution. Having more women in leadership positions is ultimately a better bet for business.

Closing the gender gap in VC funding is no simple task, but it’s one that must be undertaken. With the help of internal VC reform and external initiatives like community building, training opportunities and women-focused support networks, we can work toward finally making the VC game more equitable for all.

Pandemic’s impact disproportionately reduced VC funding for female founders

Comment