Happy August! Or, as many of my neighbors are fond of saying: Happy Fogust.

San Francisco sits on a peninsula surrounded by chilly water, so when warm summer air rushes in, thick fog obscures the landscape. Some days, the blanket is so thick, visibility is just a few hundred feet.

It’s an apt metaphor for the uncertainty plaguing tech companies as we hear about layoffs, reduced valuations and more discussion of dry powder than I’ve heard in many years.

One bright light amidst the gloom: Startups that generate enough revenue to drive steady growth will find many investors willing to take their calls.

“If you’re a bootstrapped company who is not yet on the treadmill, you have that kind of optionality or that ability to choose when to get on,” says Cavan Klinsky, co-founder of payments processor Healthie.

Full TechCrunch+ articles are only available to members.

Use discount code TCPLUSROUNDUP to save 20% off a one- or two-year subscription.

“Once you’ve already raised a bunch of ventures, you’re kind of building a business for venture scale, whereas if you are bootstrapped … you can be really really opportunistic about what that right time is,” he told Natasha Mascarenhas.

Even so, she interviewed founders at a handful of bootstrapped startups and found that “even if they don’t want to,” some “may choose to turn to venture capital to get to the next level of sales” or keep hiring on track.

Inflation and competition with crypto salaries are just two factors driving up costs, which is leading many self-sufficient founders to reconsider going it alone.

“For a lot of bootstrapped companies, they’re not out there fundraising,” said Sketchy CEO and co-founder Saud Siddiqui.

“A lot of times it is investors approaching them, so it kind of depends on the climate, and if folks aren’t investing, maybe they’re just gonna keep chugging along.”

Thanks very much for reading TC+ this week.

Walter Thompson

Editorial Manager, TechCrunch+

@yourprotagonist

Will once-bootstrapped startups turn to venture during a watershed moment?

5 tips for scaling your green startup during a funding drought

I’m not much of a gardener, so I chose houseplants that tolerate my forgetfulness with regard to water and fertilizer.

Startups that are trying to create scalable solutions to the slow-rolling climate disaster we’ve created for ourselves are not so resilient, however.

These companies often have lengthy, sizable fundraising rounds and years-long product development timelines, which means they’re particularly vulnerable to external market forces.

Priyanka Srinivas, co-founder and CEO of food tech startup Live Green Co., shared her advice for entrepreneurs who are focused on climate and sustainability:

“If your business activities have produced desired results and repeatable cycles — like developing a new product and distributing it through local markets — then you are ready to multiply.”

5 tips for scaling your green startup during a funding drought

US startups seeking funds shouldn’t overlook financing from the government

I know people who’ve worked with the U.S. Small Business Administration (SBA) to find funding for a food truck, a bakery and a clothing store, but I don’t know of any startup founders who’ve used this federal program to grow their companies.

Eligible startups can acquire government-guaranteed loans up to $5 million that are paid back over a decade, reports Rebecca Szkutak. That’s real money.

“The problem is that business owners oftentimes overlook pretty readily available debt capital,” said Fountainhead CEO and founder, Chris Hurn.

“They don’t have to give up any equity. [SBA loans] can oftentimes be the exact stepping stone they need to get to the next stage.”

US startups seeking funds shouldn’t overlook financing from the government

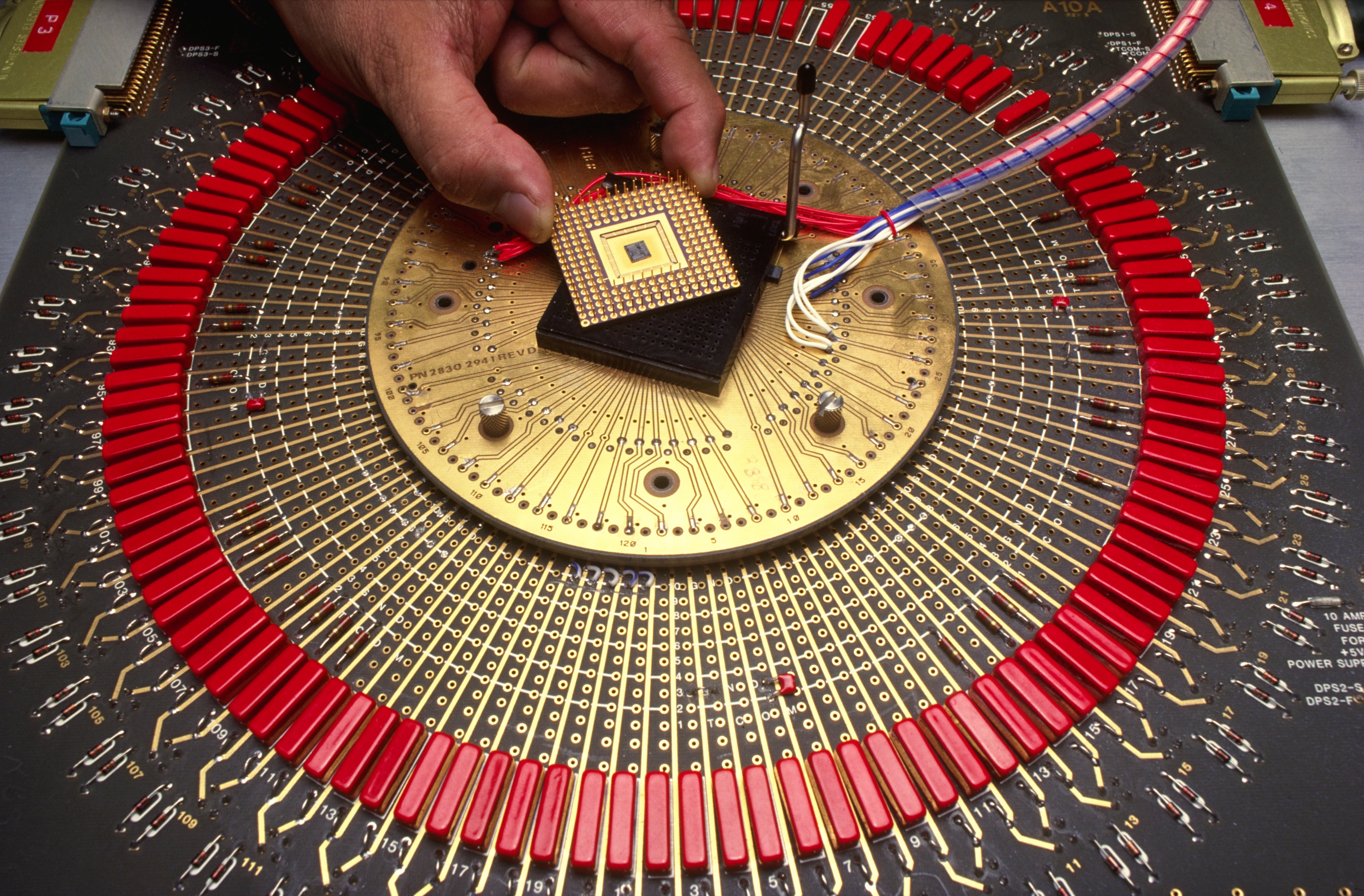

Beyond volatility: How semiconductor companies can thrive with a focused sector strategy

Despite chip shortages that are slowing down production for everything from televisions to farm tractors, semiconductor sales shot up to $600 billion in 2021.

To keep their heads above the water in the coming years, semiconductor makers should back technologies that power other industries, such as AI/ML, digital services and micromobility, according to McKinsey partners Ondrej Burkacky and Nikolaus Lehmann.

“From a demand perspective, we expect 70% of growth up to 2030 will be driven by just three industries: automotive, computation and data storage, and wireless […] Through deep analysis of their resources and capabilities, the task for decision-makers as they ramp up capacity is to tailor their capabilities to the most promising segments.”

Beyond volatility: How semiconductor companies can thrive with a focused sector strategy

Build a solid deck for your quarterly board meetings

Board meetings are crucial for getting feedback on your progress to date and your plans for the future, but what’s the best way to give board members the full picture?

According to Ridge Ventures partner Yousuf Khan, founders should “just ask” investors about what kind of details and metrics will make quarterly decks optimally valuable.

“Reaching out to your board not only helps provide a sense of direction, it also gives you the opportunity to build your relationship,” he says. “People appreciate the opportunity to weigh in.”

In this TC+ post, he shares seven tips for building a presentation that updates board members on progress, plans, product pipeline and financials.

Comment