Jake Jolis

Three years ago, we released the first edition of the Matrix Fintech Index. We believed then, as we do now, that fintech represents one of the most exciting major innovation cycles of this decade. In 2020, all the long-term trends forcing change in this sector continued and even accelerated.

The broad movement away from credit toward debit, particularly among younger consumers, represents one such macro shift. However, the pandemic also created new, unforeseen drivers. Among them, millennials decamped from their rentals in crowded cities to accelerate their first home purchases to the benefit of proptech companies and challenger mortgage players alike.

E-commerce saw an enormous acceleration in growth rates, furthering adoption of online payments platforms. Lastly, low interest rates and looming inflation helped pave the way for the price of Bitcoin to charge toward $30,000. In short, multiple tailwinds combined to produce a blockbuster year for the category.

In this year’s refresh of the Matrix Fintech Index, we’ll divide our attention into three parts. First, a look at the public stocks’ performance. Second, liquidity. Third, we highlight one major trend in the sector: Buy Now Pay Later, or BNPL.

Public fintech stocks rose 97% in 2020

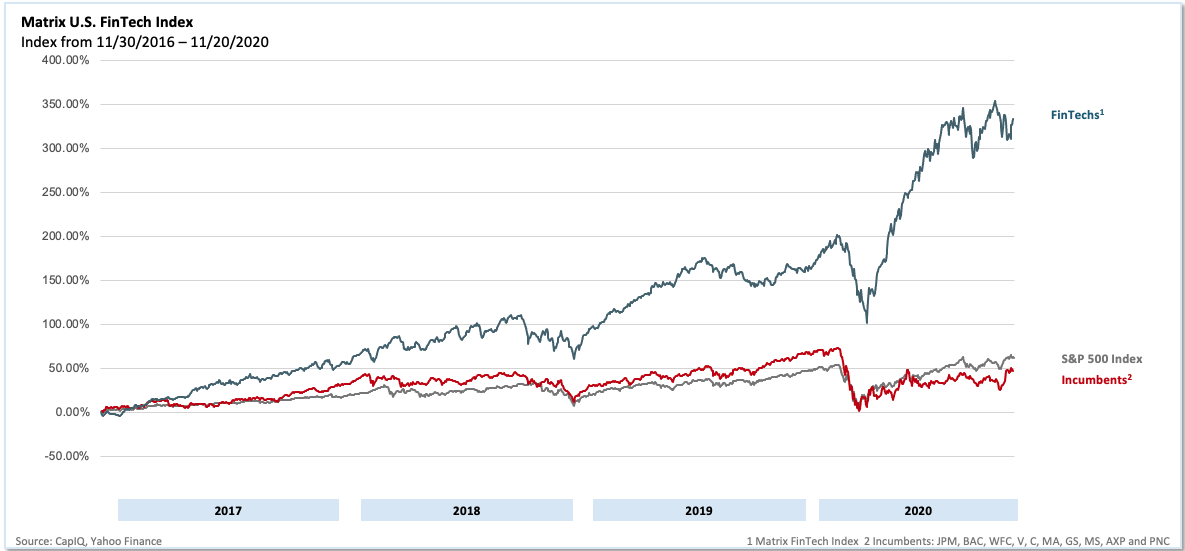

For the fourth straight year, the publicly traded fintechs massively outperformed the incumbent financial services providers as well as every mainstream stock index. While the underlying performance of these companies was strong, the pandemic further bolstered results as consumers avoided appearing in-person for both shopping and banking. Instead, they sought — and found — digital alternatives.

Our own representation of the public fintechs’ performance is the Matrix Fintech Index — a market cap-weighted index that tracks the progress of a portfolio of 25 leading public fintech companies. The Matrix fintech Index rose 97% in 2020, compared to a 14% rise in the S&P 500 and a 10% drop for the incumbent financial service companies over the same time period.

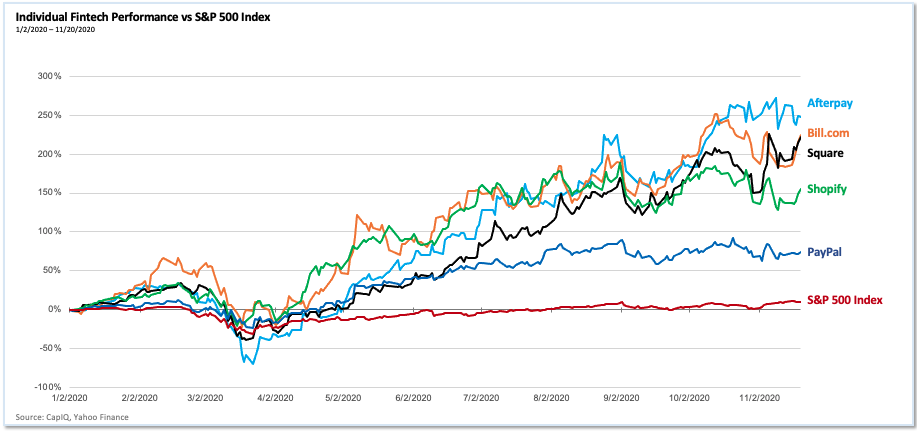

E-commerce undoubtedly stood out as a major driver. As a category, retail e-commerce grew 35% YoY as of Q3, propelling PayPal and Shopify to add over $160 billion of market capitalization over the year. For its part, PayPal in the third quarter signed up 15 million net new active accounts (its highest ever).

In the early months of the pandemic, Square also quickly capitalized on consumers’ movement away from cash. At the start of March, cashless businesses made up 8% of US Square merchants. By the end of April: 35%. By August, cash transactions at Square merchants overall had decreased by 7.4 percentage points (40% to 32.6%) YoY, a change that would have taken roughly three years at the pre-pandemic rate. Its stock rallied 288% over the year.

In 2021, we predict the Matrix Fintech Index will outperform both the incumbents and the S&P 500 by 2x.

Unicorns and deep-pocketed buyers to drive record liquidity this year

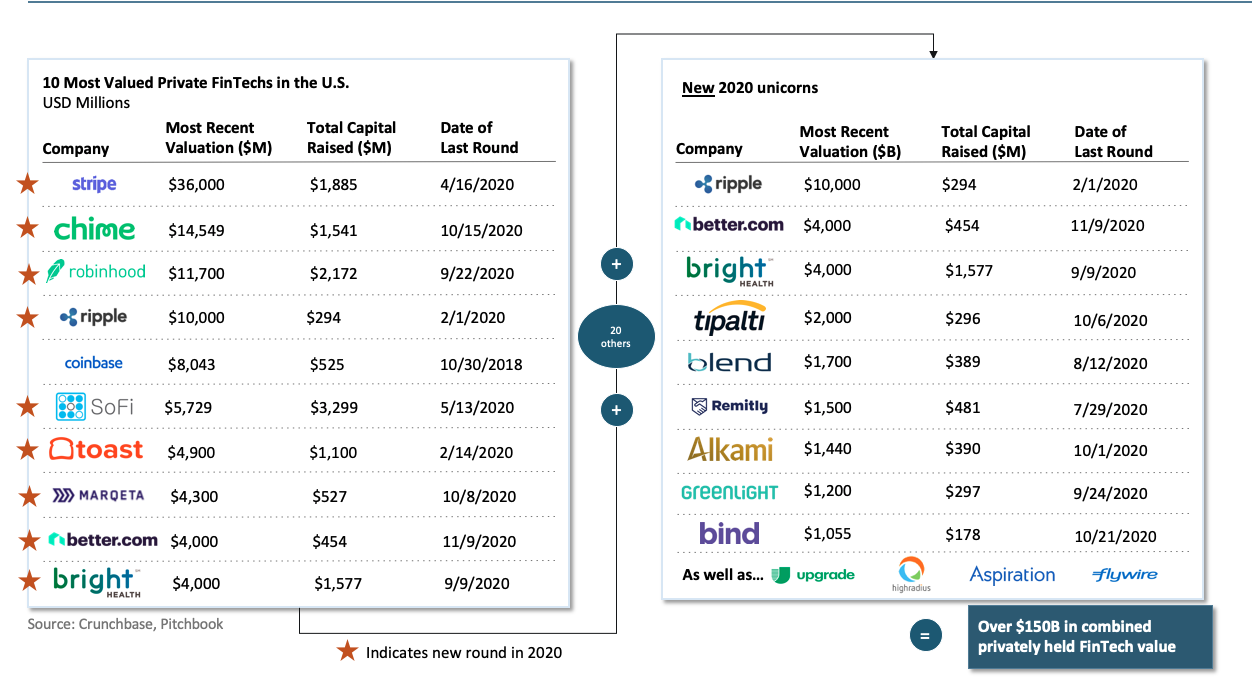

In 2020, 13 fintechs became unicorns. In aggregate, the fintech unicorns now represent $158 billion of market capitalization. Notably nine of the 10 most highly valued such companies raised new rounds during the pandemic year.

We also recognize 63 fintechs on our “Brink List,” which consists of companies that have raised $100 million of equity but are not yet publicly valued over $1 billion. Challenger banks such as Current and Varo raised large rounds at near-unicorn valuations. Earnin, in turn, continued to expand earned wage access as an alternative to the (often predatory) traditional payday lenders and as a safe haven from high overdraft bank fees.

Venture capital investments in the sector this past year totaled $19 billion, a 15% increase over 2019 and 134% compared to three years ago. Interestingly, the number of deals decreased for the first time in four years, pointing to a concentration of investments in the winners in their respective categories, highlighted by Stripe and Robinhood’s most recent large rounds.

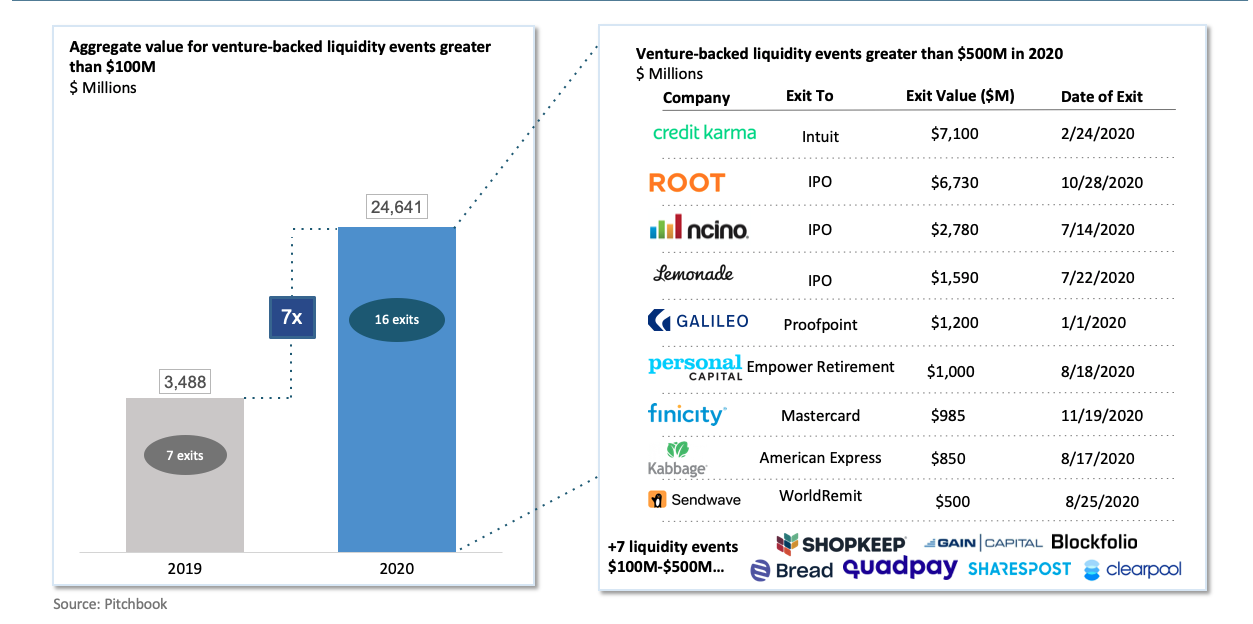

As for liquidity, 2020 saw $25 billion in aggregate exits, a 7x jump over the prior year. Even so, we expect to see a deluge of upcoming liquidity near term, caused by strong public company performance, excess cash reserves and robust capital markets.

With Robinhood, Coinbase, SoFi and Stripe all likely candidates for IPOs this year, we predict a record $100 billion of liquidity for fintech in 2021.

Buy now, pay later is going mainstream

We believe one of the most important trends to gain traction in the last three years to be point-of-sale financing, now referred to as Buy Now Pay Later (BNPL). Through companies like Affirm, Afterpay and Klarna, e-commerce shoppers can avoid accruing interest on a credit card (that often itself carries additional annual fees) and have access to a form of credit that is free to consume and merchant-sponsored on even the smallest purchases. No fees, no APR, enabling customers to get more use out of their dollar without the drawbacks of a credit line.

Other players are taking vertical approaches, and they too are gaining traction. For example, renters can now pay rent on installments thanks to companies like Flex and Till.

BNPL has seen traction fastest among millennial and Gen Z buyers. Coming of age during the ‘08 financial crisis, they saw their parents struggle with troubled mortgages, record-level student loan debt and high credit card debt. In time, people in this segment witnessed the system collapse and cause the Second Great Recession. Banks and free-flowing credit bore the brunt of the blame. Trust in the incumbent financial institutions eroded.

Many formed difficult memories from the crisis; many saw their parents lose their jobs or homes or both. The experience contributed to the acceleration of a macro trend: Younger consumers’ shunning traditional credit options, and in particular decreasing their reliance on credit cards in favor of debit. BNPL emerged to fill the credit void with a more convenient, and in many eyes fairer, option.

Point-of-sale and installment financing as a concept has existed for decades. Early entrant Bill Me Later, founded in 2000 and acquired by PayPal in 2008, belonged to the prior generation. The underlying conditions in 2021, however, are different.

E-commerce now accounts for 14.5% of total retail sales compared to less than 2% in 2000. Enabling bank APIs such as Plaid now allow BNPL providers to authenticate, underwrite and pull funds from users’ bank accounts in a seamless way. In our view, generational experiences that influence behavior, growth in the underlying addressable market, and, finally, a specific technology unlock have formed the perfect storm for BNPL’s advance, altering the way Americans pay for just about anything.

In 2021, we believe BNPL — both horizontal and vertical solutions — will cross the chasm to become a mainstream consumer choice, eventually replacing the role of credit card debt.

“Every company will be a fintech company”

Going forward our collective definition of what constitutes a fintech company will likely expand. Else we will need to find ways of taking stock of the embedded financial services being built inside companies that on the surface look nothing like financial service providers. Already Uber and Apple have overturned the long-time assumption that only banks could accumulate deposits, and Tesla’s becoming its own insurance carrier has certainly challenged the automobile insurance model.

While fintechs chip away at long-standing incumbent profit pools, we don’t believe they constitute an existential threat to the incumbent financial services industry, who would rather cede the user experience and user interface to new entrants and opt to provide their scale as a service, taking, for example, balance sheet risk off of products like Stripe Treasury.

We think what existential risk does exist for incumbents will come far more from the likes of Apple and Tesla, who have not only the direct relationship with the customer, but also the scale to afford them many of the advantages incumbents hold over even the largest startups.

Please visit our blog Viewpoints to access the data package for this year’s index and learn more about Matrix.

2019 looks to continue another lights-out year for fintech startups

Comment