Lower, an Ohio-based home finance platform, announced today it has raised $100 million in a Series A funding round led by Accel.

This round is notable for a number of reasons. First off, it’s a large Series A even by today’s standards. The financing also marks the previously bootstrapped Lower’s first external round of funding in its seven-year history. Lower is also something that is kind of rare these days in the startup world: profitable. Silicon Valley-based Accel has a history of backing profitable, bootstrapped companies, having also led large Series A rounds for the likes of 1Password, Atlassian, Qualtrics, Webflow, Tenable and Galileo (which went on to be acquired by SoFi).

In fact, Galileo founder Clay Wilkes introduced the VC firm to Dan Snyder, Lower’s founder and CEO. The two companies have a few things in common besides being profitable: they were both bootstrapped for years before taking institutional capital and both have headquarters outside of Silicon Valley.

“We were immediately intrigued because Ohio-based Lower echoes both of these themes,” said Accel partner John Locke, who led the firm’s investment in Lower and is taking a seat on the company’s board as part of the investment. “Like Galileo, Lower will be one of the most successful bootstrapped fintech companies globally. The combination of a company built in a nontraditional region across the globe and a bootstrapped company reminds us of [other] companies we have partnered with for a large Series A.”

There were other unnamed participants in the round, but Accel provided the “majority” of the investment, according to Lower.

Snyder co-founded Lower in 2014 with the goal of making the home-buying process simpler for consumers. The company launched with Homeside, its retail brand that Snyder describes as “a tech-leveraged retail mortgage bank” that works with realtors and builders, among others.

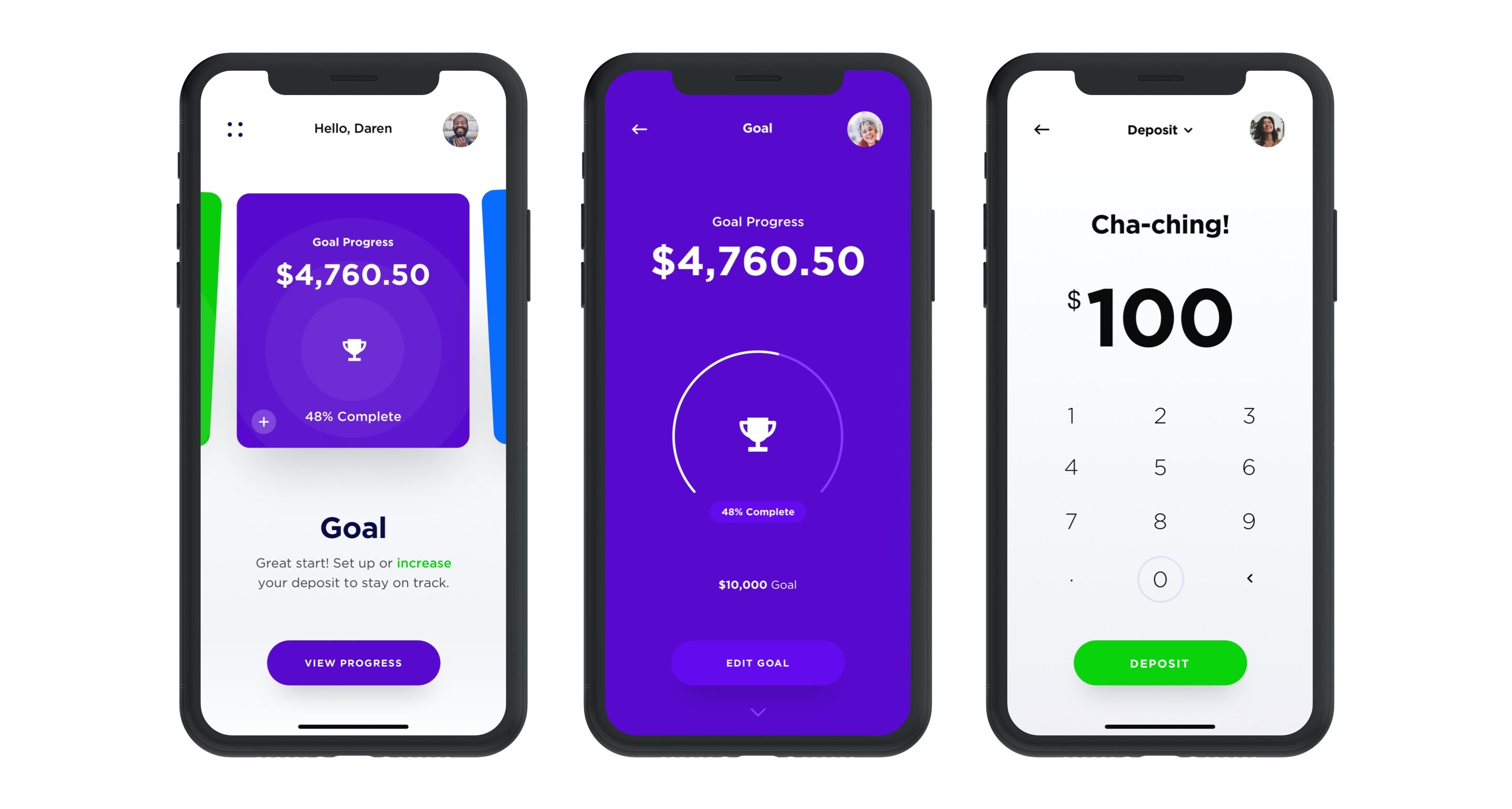

In 2018, the company launched the website for Lower, its direct-to-consumer digital lending brand with the mission of making its platform a one-stop shop where consumers can go online to save for a home, obtain or refinance a mortgage and get insurance through its marketplace. This year, it launched the Lower mobile app with a savings account.

Standing (L to R): Co-founders Mike Baynes, Chris Miller

Not pictured: Robert Tyson; Image credit: Lower

Over the years, Lower has funded billions of dollars in loans and notched an impressive $300 million in revenue in 2020 after doubling revenue every year, according to Snyder.

“Our history is maybe a little atypical of fintech companies today,” he told TechCrunch. “We’ve had a view going back to the start of the company that we wanted to run it profitably. That’s been one of our pillars, so that’s what we’ve done. Also, we all grew up in the mortgage industry, so we saw firsthand the size of the market, but also how broken it was, so we wanted to change it.”

In launching the direct-to-consumer digital lending brand, the company was working to make the homebuying process more “digital, transparent and easier for consumers to access,” Snyder said.

At the same time, the company didn’t want to lose the human touch.

“We tried to design the app flow in a way where you can get as far along as you can in the application but if you want, at any point in time, to talk or chat with someone, we’re available,” Snyder added.

Lower’s typical customer is the millennial and now Gen Z who’s aspiring to own their first home, according to Snyder.

“They might be thinking, ‘OK, I might be living in an apartment now, but in the next few years I’m going to meet someone and/or have a child and I want to unlock the investment that is a home,’” he told TechCrunch. “And we’ll help them on that journey.”

Lower’s recently launched new app offers a deposit account it’s dubbed “HomeFund.” The interest-bearing, FDIC-insured deposit account offers a 0.75% Annual Percentage Yield and is designed to help consumers save for a home with a “dollar-for-dollar match in rewards” up to the first $1,000 saved, Snyder said.

Lower works with more than 35 major insurance carriers nationally, including Nationwide, Liberty Mutual and Allstate. It has more than 1,600 employees, about half of which are based in Lower’s home state. That’s up from about 650 employees in June of 2020.

Looking ahead, the company plans to add more services and has an “aggressive roadmap” for adding new features to its platform. Today, for example, Lower sells primarily to Fannie Mae and Freddie Mac. And while it services the majority of its loans, like many large lenders, it uses a subservicer. That will change, however, in early 2022, when Lower intends to launch its own native servicing platform.

And while the company intends to continue to run profitably, Snyder said he and his co-founders “think the time is now to gain share.”

“We want to become a global brand, raise money and gain market share,” he added. “We’re going to continue to double down on product and build out our capabilities. We are the best-kept secret in fintech and plan to change that with smart branding, advertising and sponsorships.”

And last but not least, Lower is eyeing the public markets as part of its longer-term roadmap.

“Ultimately, we know we can build a great public company,” Snyder told TechCrunch. “We’re of the scale to be a public company right now, but we’re going to keep our heads down and we’re going to keep building for the next few years and then I think we can be in a spot to be a strong public business.”

Accel’s Locke points out that in the U.S., mortgage and home finance are among the largest financial service markets, and they have primarily been handled by large banks.

“For most consumers, getting a mortgage through these banks continues to be an overly complex, slow-moving process,” Locke told TechCrunch. “We believe by providing consumers a great mobile experience, Lower will gain share from incumbent banks, in the same way that companies like Monzo have in banking or Venmo in payments or Trade Republic and Robinhood in stock trading.”

Comment