Rocio Wu

In the vast and varied lands between Patagonia and the Rio Grande, a region entrepreneurs and investors like to call “LatAm,” there are 38 different countries using 39 different currencies.

Only 19% of Latin American adults own a credit card, and 70% of credit cards in Brazil, Argentina and Chile can’t be used internationally. Local payment methods account for 68% of online sales, and, depending on the region and merchant networks, merchants must integrate dozens of payment service providers. Meanwhile, cash voucher systems like Brazil’s boleto bancário and Mexico’s Oxxo payment network account for a significant share of Latin American consumer transactions.

Fraud is also a major problem for online merchants in Latin America. Since the onset of the pandemic, Stripe observed that fraud rates at businesses in Latin America were 97% higher than in North America and 222% higher than businesses in the Asia Pacific.

In fewer words: The payments landscape in Latin America seems hopelessly fragmented and riddled with fraud.

Meanwhile, the failure of one-click checkout startup Fast and questions about Bolt’s revenue suggest payment orchestration in the U.S. will remain dominated by the likes of Shopify and Stripe. Bolt and Fast wanted to bring Amazon’s one-click experience to all online vendors. After all, 75% of shopping carts are abandoned before payment, thanks in part to lengthy checkout processes.

But incumbents like Stripe and Adyen already dominate distribution channels, and they can easily extend a one-click solution. Meanwhile, checkout-only startups’ thin margins suffer under payment incumbents’ vertically integrated solutions, as well as from the “incentive wars” that payments, BNPL and checkout players wage on price-sensitive merchants.

So if one-click checkout startups are struggling to make headway against incumbents in the single-currency, highly digitized and concentrated U.S. market, it might seem impossible for a payment orchestration startup to succeed in the fragmented markets of Latin America.

However, we believe that fragmentation (and the absence of a Stripe-like incumbent’s dominance over the entire region) actually offers a huge opportunity for vertically integrated payments orchestration startups to capture a lot of value.

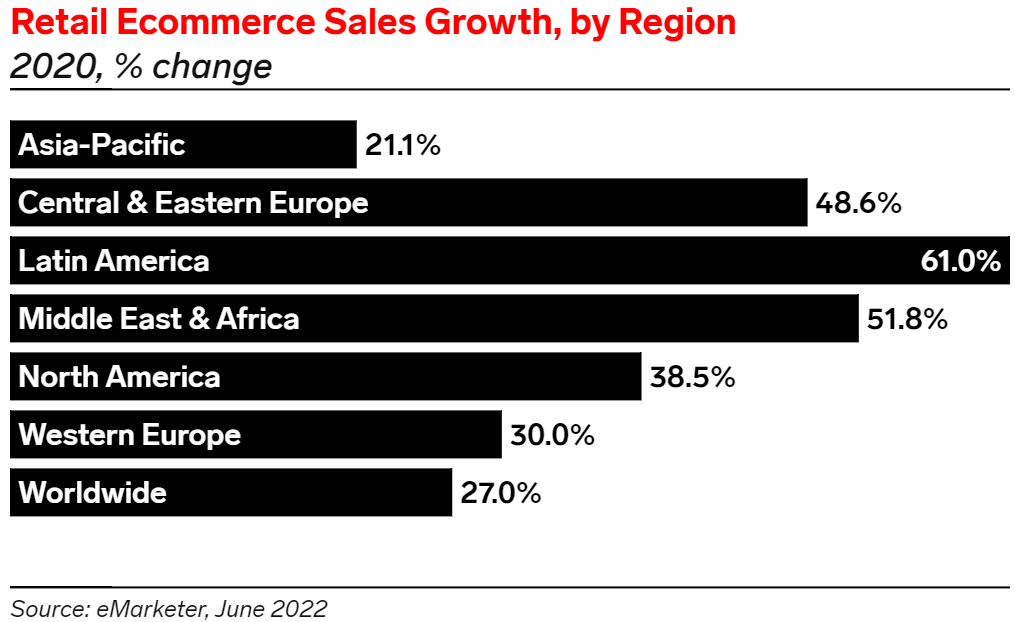

Macro tailwinds

In 2021, the number of new businesses opening Stripe accounts in Latin America rose by a whopping 518%. Even when you account for the post-COVID resurgence in business activity, that’s an unprecedented growth in opportunity for online payment providers.

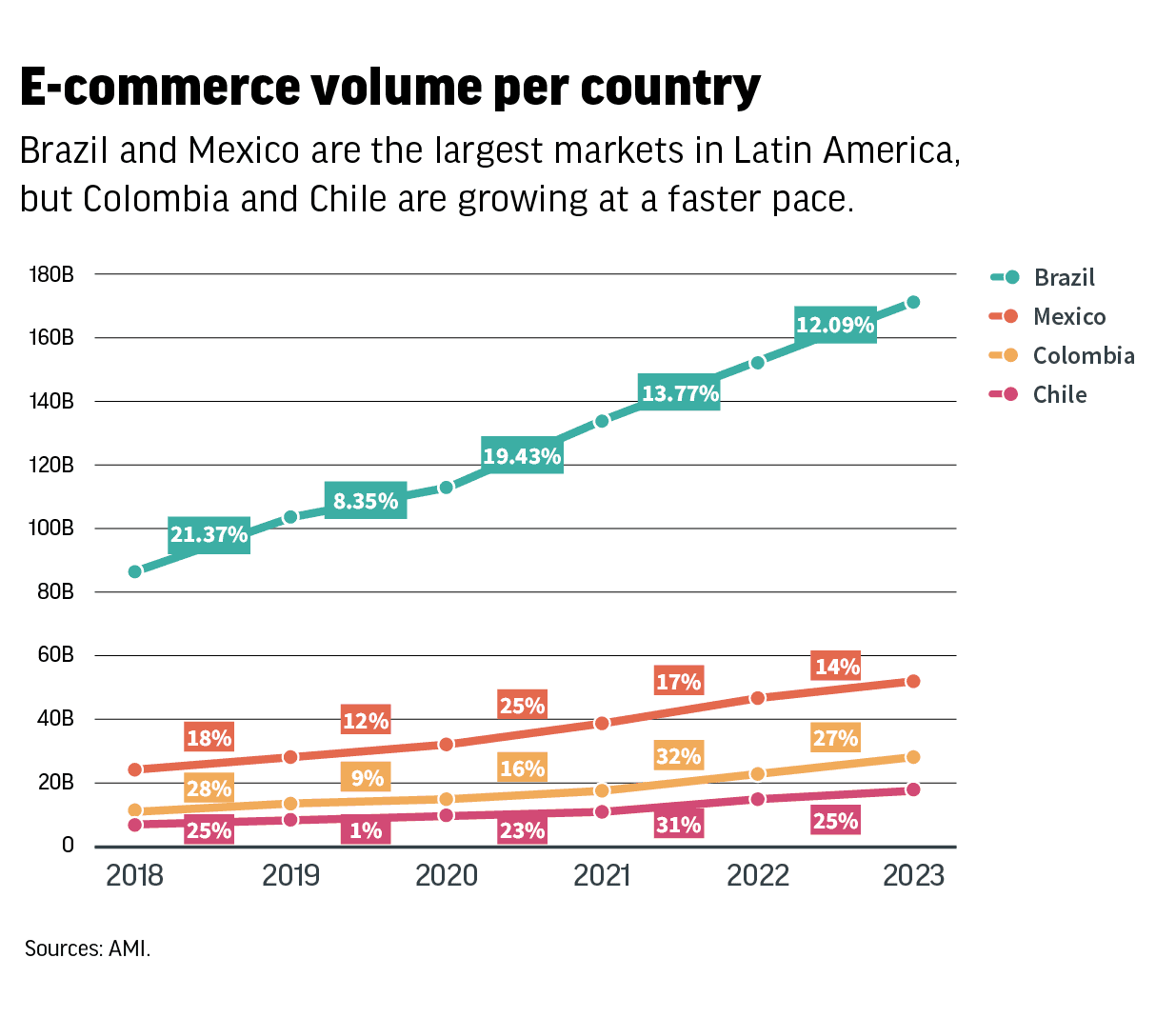

At the same time, the region’s e-commerce market is expected to reach $379 billion in 2022, representing 32% growth over 2021 and a CAGR of 25% through 2025, according to Americas Market Intelligence. That study suggests that the market will be worth $580 billion by 2024.

Together, Brazil and Mexico contribute about 60% of total e-commerce volume in Latin America, while Colombia and Chile are growing at a faster pace. And there’s still room for growth: Today, e-commerce only accounts for about 5% of total retail sales in LatAm.

Prerequisites for success

To be successful in Latin America, payment orchestrators must provide a robust value proposition that meets the unique conditions of the region. To help prevent payment fraud, a solution should aggregate multiple providers and data sources into a single decision engine. Balancing increasing payment acceptance rated with lowered fraud rates isn’t easy — a Stripe analysis found that the more fraud a business tries to prevent, the more likely they are to block legitimate charges in the process.

Payment orchestrators will also have to provide a single integration point for merchants, replacing the current labyrinth of local payment integrations. Smart routing technology will make switching volumes and PSPs easier and reduce costs that come with legacy acquirers and payments collectors. It would enable transaction abstraction to deliver split payments and settlement, as well as partial payments where one transaction is split across multiple sources, like vouchers and cards.

A single payment orchestrator would provide unparalleled opportunities for reporting, allowing merchants to visualize trends in payments, customers, orders and risk; understand where they can optimize; and compare their performance to peers and competitors. Third-party integrations with everything from point-of-sale and CRM platforms to rewards and loyalty programs would offer further use cases for merchants.

The current state of play

We count roughly 10 local payment orchestration players in Latin America right now and all of them are in the early stages. All approach the problem of fragmentation from a different angle, reflecting the fragmented nature of the payments landscape in the region.

For example, U.S.-based Spreedly has integrations with more than 100 payment gateway providers and third-party API endpoints worldwide. At last count, roughly 10% of its customers were based in Latin America. Meanwhile, local payments orchestrators like Plug, Tuna, Yuno, DeUna and Retry currently provide between 20 and 30 integrations.

We also have Compra Rapida and Trinio, one-click checkout startups similar to Bolt and Fast; Protego is a chargeback protection provider; Rebill has recurring billing services; and Destaxa is an offline payment orchestrator.

The technical work of building the tech and integrations in the space isn’t exactly rocket science, but working with so many merchants, acquirers, alternative payment methods, platforms and countries can feel like navigating a complex asteroid field. As a result, early exits are attractive for super payment gateway players: ZooZ sold itself to PayU in 2018; Payoneer acquired Optile in 2019; Paypal acquired GoPay in the same year; and Checkout.com took over a tiny 14-person startup called ProcessOut in 2020.

However, we believe there is an opportunity to build large, independent players in the payment orchestration space. To break out of the crowd and win the category, a successful venture would have to balance a high payment acceptance rate against low fraud and low costs and figure out the right incentives to onboard merchants with ease of product integration and configurability.

Fragmented markets like Asia, Europe and especially Latin America are more attractive than the U.S. precisely because of the heterogeneity of payment methods and currencies. While companies like Spreedly and Primer have already raised significant warchests to chase opportunities in the U.S. and Europe, the race in Latin America has just begun.

Comment