I get a lot of pitch deck submissions for this TechCrunch Pitch Deck Teardown series from people who are raising friend and family rounds, and I mostly pass on them. Often, these decks aren’t very good, but it’s important to remember that they don’t have to be.

For a small round (say $200,000 or below), most well-connected entrepreneurs will be able to find a group of people who believe in them and are willing to invest in them. It’s not about the product (there typically isn’t one), and it’s not about the solution (the company is still iterating).

Such investors are usually betting on two things:

- Is this market big enough, and is the problem worth solving big or pertinent enough to give this company a possibility of success?

- Are the founders the right people to solve this problem? Do they have the connections, skills or experience that gives them an unfair advantage?

Here’s the truth: When considering very early-stage companies, if you can’t say “Yes” to both of those questions with 100% certainty, you shouldn’t invest. If the market isn’t big enough, don’t invest. If the founders are smart, friendly and amazing, but they don’t have something special that gives them a head start, don’t invest.

It was against that backdrop that I received the pitch deck for the Palau Project. Its founder, Jerome Cloetens, is a professional kite surfer (!) with an economics degree and an MBA, and he’s taking on climate change.

Let’s take a closer look at how all those pieces come together in a pitch deck.

We’re looking for more unique pitch decks to tear down, so if you want to submit your own, here’s how you can do that.

Slides in this deck

This pre-seed deck has 22 slides, but it could probably have been 10 slides or so. That said, it looks good, and although it jumps from topic to topic a little, I can see how the presentation would take shape. Cloetens notes that the slide deck has been slightly updated since the fundraise, and he mentioned it’s “not precisely as pitched; some of the design and small content changes (auch as our traction metrics) have been updated.”

- Cover slide

- Problem impact slide

- Problem slide

- Solution slide

- Product slide

- Product slide

- Product slide

- Challenge slide

- Value proposition slide

- Business model slide

- Market size slide

- Market slide

- Traction slide

- Metrics slide

- Milestones slide

- Team slide

- Founders slide

- “Seed round” interstitial slide

- Mission slide

- The Ask slide

- Milestones slide

- Equity for “thrifthers” [sic] closing slide

Three things to love

As I mentioned in the intro, this is a pre-seed deck. As per slide #20, the founders were trying to raise $500,000, and they closed on about $125,000. That isn’t entirely uncommon at early stages. Slightly later on, your plan needs to match the funds, which needs to match the milestones you’re trying to hit.

At this stage, “I just need some money to prove what we are trying to do” will work, and if the angel investors think it makes sense, you’ll raise money.

Simple product, testable now

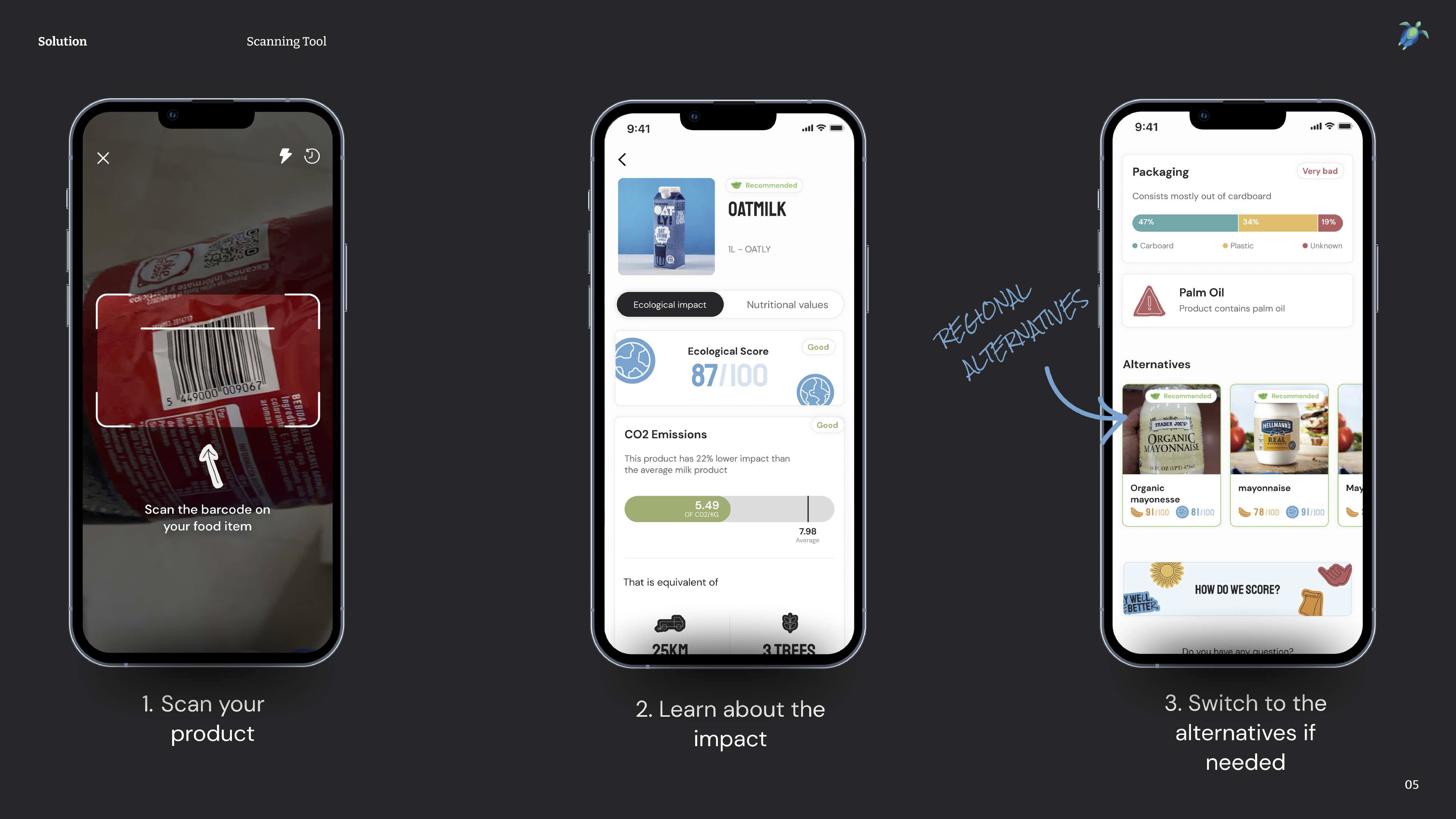

I mentioned earlier that all that matters is the market size and team, and I’ll get to that in just a moment. For now, I was really impressed at how simple the idea is, and how easy it is to imagine this in use. Scan a barcode, get information about a product and get nudged toward products that have less impact on the climate.

As an investor, I would immediately have three questions:

- How good is the database and how many products are captured there?

- Will people actually use this when they are walking around, shopping?

- This use case appears to be in-person, but the business model refers to a commission. How would the manufacturers know that a user has changed their behavior as a result of using an app?

You can learn two things from this slide: Make your product demos this simple if you can — it’s easy to understand, visual and impactful. The second step is to tie it to your value propositions: What’s in it for the consumer? What’s in it for the product manufacturers? What’s in it for your company (i.e., how does this help you gain or retain customers, and how does it help you generate value)?

Traction!

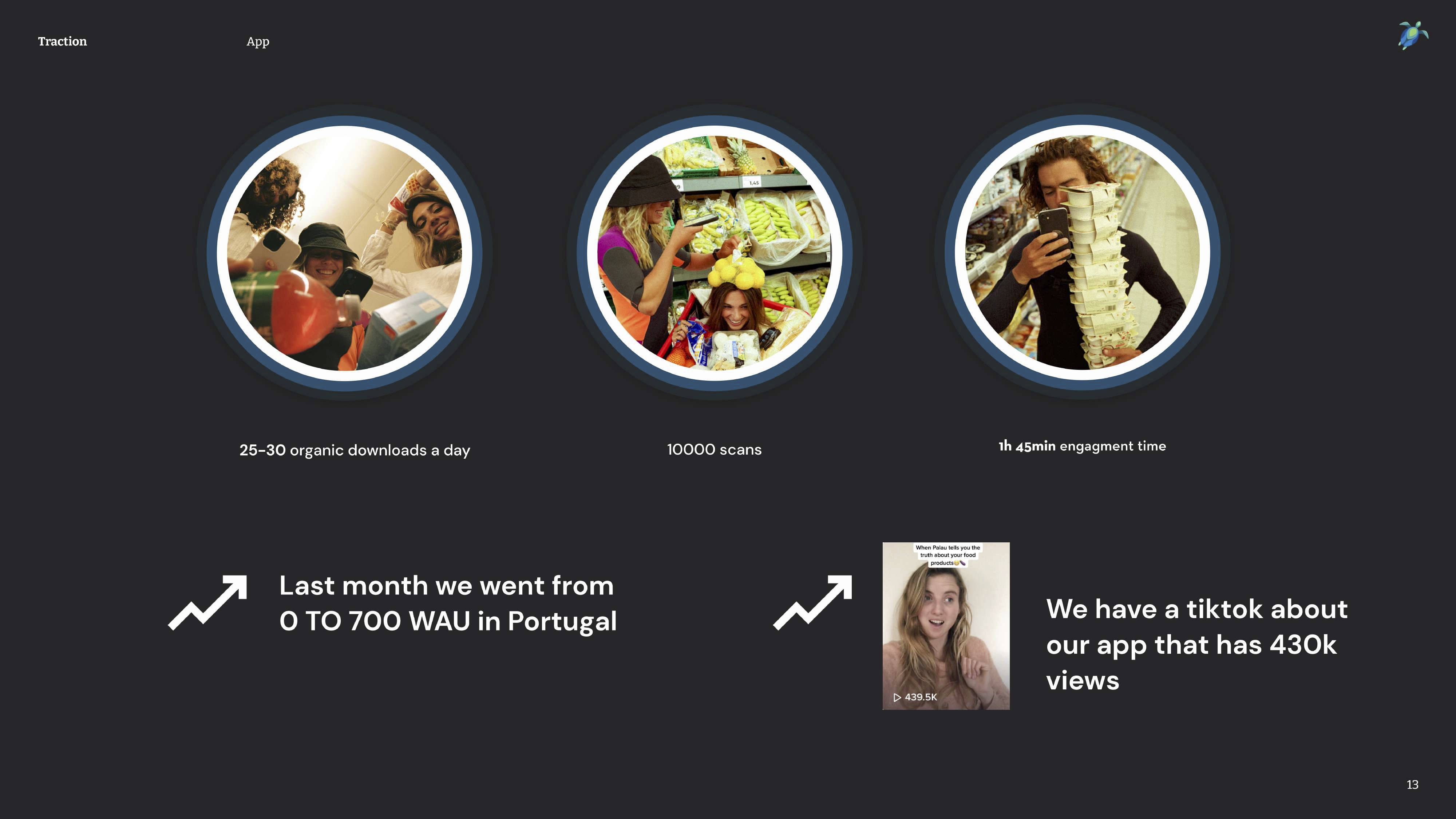

When a company is raising its first round, it’s unlikely that it has a product at all, never mind a product with actual traction. If you do happen to have such a product, scream about it from the rooftops. Having 30 downloads per day is impressive, and 10,000 scans shows that the app is working and getting some user engagement. Engagement time is cool, too — there are a lot of early indicators showing up here that the founders may be on to something. Going from zero to 700 weekly active users in a new market (Portugal) is impressive, too.

Again, the slide raises questions for me:

- Scans are great, but I want to know what percentage of those scans were successful (i.e., had products in the database). If users scanned 10,000 items and ended up with 600 hits and 9,400 “We don’t know this product,” that will make a lot of users turn away immediately.

- 25-30 new users per day is impressive, but show us a graph and the total number of sign-ups.

- TikTok videos are cool, but that’s a vanity metric that means nothing unless it moves the needle on the business side. Did the video result in downloads? More scans? More inquiries?

What you can learn from this slide as a startup is to think about the story you are telling with your metrics, because you could be telling the wrong story, or it could raise more questions than it answers.

Pretend to be a VC for a moment and ask yourself: If a company told me these numbers, what caused the numbers to happen, and what do they tell me about where the company is going?

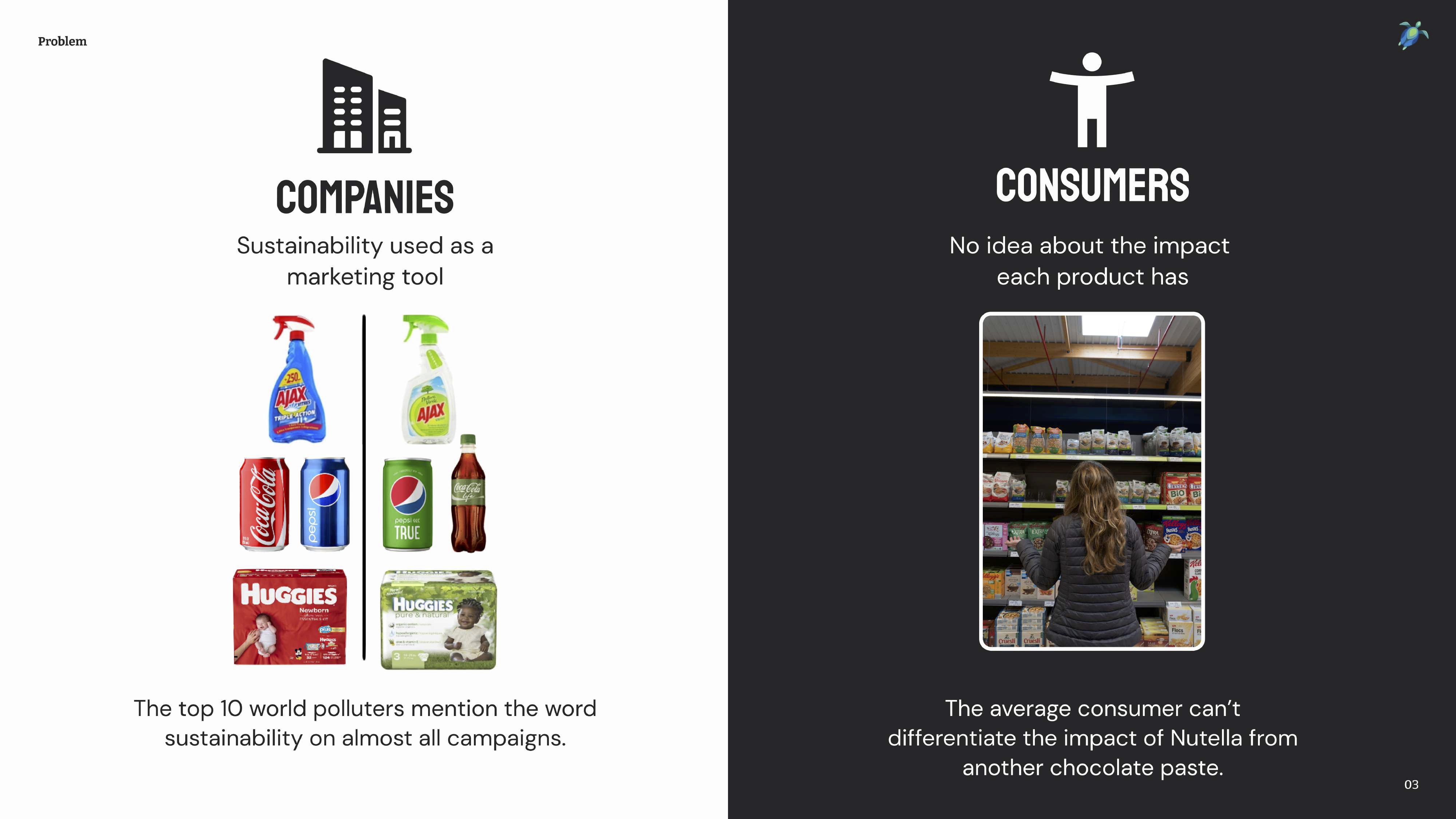

Elegant value proposition

The graphic on the left really rams home a point: Corporations blatantly using greenwashing to pretend that they are sustainable, tree-hugging hippies is real (and Coca-Cola, in particular, wraps itself into some curious green pretzels trying to prove how much it cares about the environment), and as consumers, you can’t trust large corporations to truthfully represent what they are doing.

So what is a poor consumer to do? The Palau Project’s take on this is a masterful set-up to a pitch and a wonderful way of opening the door to a story.

This slide is a great example of a good opener that can help drive the conversation forward. Having a clear value proposition or painting a picture for your raison d’etre is a great way to engage your listeners.

Remember when I said “team” and “market” are the two most important parts of a pre-seed slide deck? You’ll notice the absence of either in this “things I loved” section. There’s a reason for that, so let’s take a closer look at what could be improved in Palau’s pitch.

Three things that could be improved

Try as I might to feel otherwise, I find myself really worried about this company. Neither the team nor the market are an immediately obvious “Hell yes” for me as an investor.

What’s the founder-market fit?

As I wrote some time ago, due diligence at the earliest stages is one of the biggest challenges for startups. It’s where the majority of deals fall apart.

The Palau Project has two slides, and both present a different set of challenges.

Typically, you would lead with your strongest slides. In an early-stage startup, that’s going to be your founders, your market size and positioning. That’s not happening here. The Palau Project has two team slides — slide 16 for the team and slide 17 for the founders.

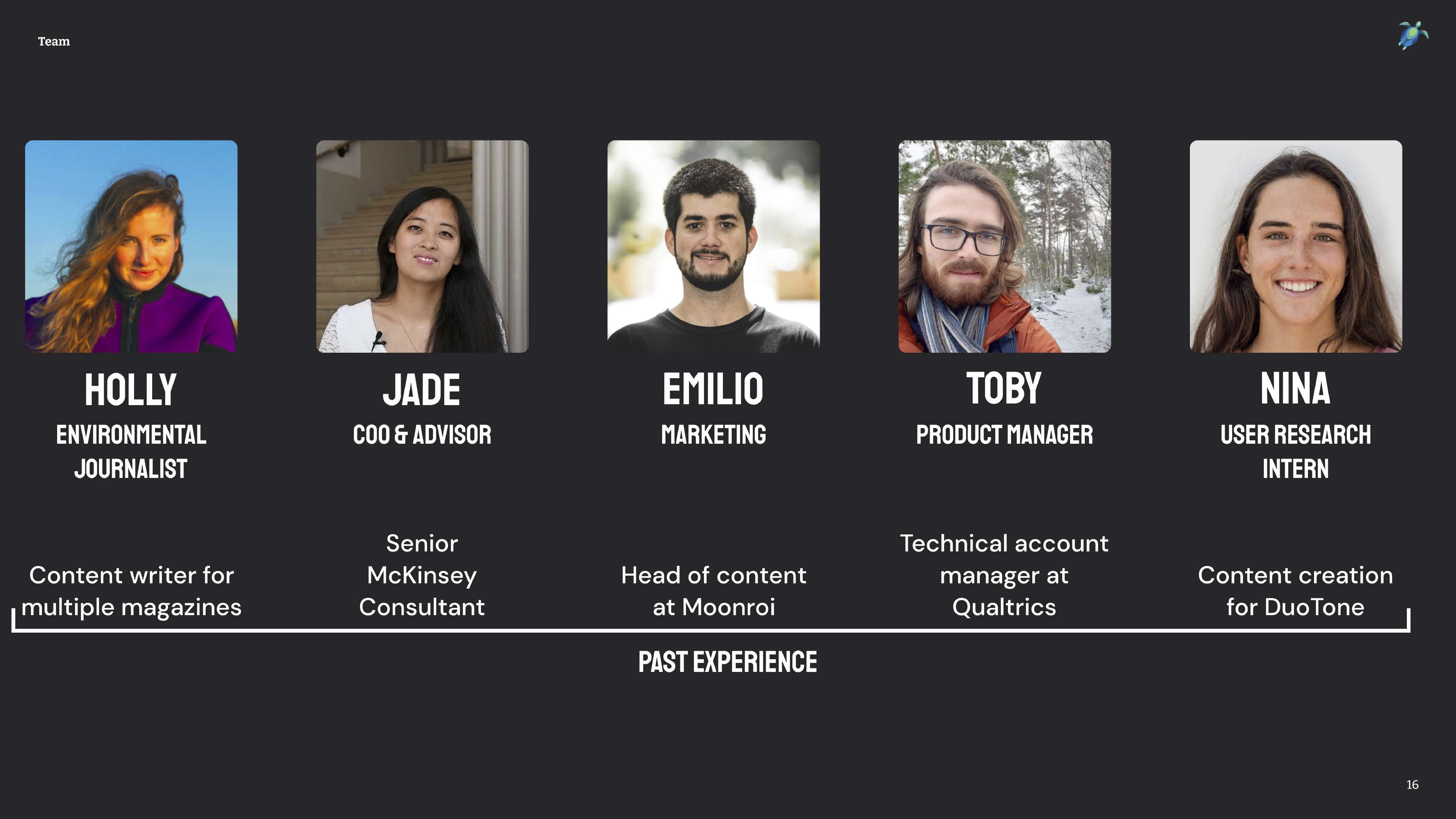

That set off some pretty major alarms for me. The team, in general, is irrelevant at the earliest stages because early team members typically don’t have enough equity to be locked in, they aren’t paid a lot and they often change. I’m not saying they aren’t important, but they certainly aren’t more important than the founding team.

Finding the team information at the 16th and 17th slides in a 22-slide deck makes me think they aren’t very good, so that in itself could be a challenge. Putting the “team” slide before the “founder” slide seems like misplaced humility, too, and doesn’t make sense on a number of levels. Even if it did make sense, slide 16 does not dole out particularly impressive information: There’s an environmental journalist and a series of people from various work backgrounds. It’s unclear if they are contractors, full time, part time, how committed they are or how important they are to the future success of the company.

You might include this in the appendix, but honestly, as an investor, this slide is detrimental to my eagerness to invest.

The next, and far more important, slide is the one about the founders:

This slide has some interesting dynamics. It needs to answer an important question: “Is this team the best one to solve the problems the company is trying to solve in the market it is going after?” There’s very little here that makes me think this duo can meet those criteria.

Jerome has grit and staying power, for sure; completing business school while seemingly traveling to 60 countries is a feat of performance and perseverance. But being a content creator, documentary filmmaker and having an ocean obsession doesn’t shout “entrepreneur uniquely positioned to solve this problem” to me.

Simon has similar challenges. The slide says he interned as a full-stack developer, which makes me worry how deep his experience is. Being a perfectionist isn’t actually a good thing in a startup context, and making music is cool, but it doesn’t make me think “Yes! This is the person I want to back with my investment dollars to build a company.”

That isn’t to say that Jerome and Simon are bad founders, but as an early-stage investor who cares about climate, you’d better believe I see a lot of pitch decks. Many of them are from people who have a lot more relevant experience as startup founders, climate experts or in the specific markets they are in. Can the pair build a fantastically successful company? Maybe. But they are also against a wall of other entrepreneurs in the same space who all have 20+ years of experience, a more relevant network and better understanding of what it takes to be successful in this space.

I also found it jarring to see them describe themselves as a hacker and a hustler. It’s not because I hate the designations, but because I recognize the quote: “A perfect startup team needs a hacker, a hustler, and a hipster.” By choosing to use these labels, the first question they’ll get from me is: “Where’s the hipster?” It shows that they know what is needed and that they are aware that something is missing from the founding team. There’s an easy way around that; just don’t use those labels.

The market analysis is … not great

The way the company presents its market makes me think they are uninvestable. There’s no doubt in my mind that the company is tackling a huge market, but this is not the way to build a TAM/SAM/SOM:

I’ve seen many ways to size a market, and you typically take a bottom-up or top-down approach. The above is neither, and it makes me wonder if the company understands how markets are sized. It also makes me wonder about the founder’s business degree. I’m curious what his professors would say about this.

When I read this slide, I see a market that consists of 57 million people, and the competitors are already serving 17.5 million people. The company suggests it is going after the remaining 67% of the market. The alarm bells are so loud that my eardrums are ringing.

Here are a few reasons why:

- If your competitors have already gobbled up 33% of the market and you are suggesting you’re not going after the same customers, that’s terrifying. Why? Because not all consumers are the same. Some don’t give a crap about the environment; others are too busy or don’t care for other reasons. Your competitors have already taken the “easy” 33% of the market — the people who care the most, the early adopters, the vanguard. Choosing to ignore them and going after the much harder market segment is making life impossibly hard for yourself.

- There are no dollar (or euro) figures here. I see no market size here from a top-down or a bottom-up approach. I guarantee that your market sizing will be wrong, but making an attempt at sizing your market is a crucial part of showing that you understand it. This slide shows that the founders don’t, making them less believable as high-quality founders.

- The company suggests that competitors serve 33% of the market, but there’s no competitor slide that explains how the company is positioned differently from them. Slide 12 tries, but lists Greenpeace and the Sea Shepherd Conservation Society. Those aren’t really competitors and it leaves me wondering who else is solving this.

You need to show your investors that you truly, deeply understand the market you are going after. It needs to be big enough to make it possible to capture a huge slice of it. My gut tells me that is true for this company, but this slide doesn’t tell that story.

Slightly chaotic order

I look at a lot of pitch decks, and usually, it’s pretty obvious — even without a voice-over from the founders — to understand how the story will flow. Most of the time, based just on a pitch deck, I could make a pretty convincing pitch to an investor without any additional information. That isn’t true for this deck. It seems to be unsure of itself and jumps around from topic to topic, sometimes jumping back to subjects that are already covered.

The final slide of the deck is a great example of that last point. It seems to be a rallying cry, but there are also several other rallying cries here (see slides 2, 4, 8, 19). Such slides can be a powerful storytelling device, but they need to be used sparingly.

The challenge I have with this one is two-fold: Nowhere in this deck does the company really explain what “equity” means in this case, nor does it segment its audience into “thrifters.” So instead of being a rousing finale, the final slide just leaves me confused. That’s not really the impression you want to leave with your investment pitch.

A final note

If you are one of the founders of the Palau Project, I realize this tear-down may be hard to read. I see the passion the team has for this problem space and the project. And I know that it can be absolutely brutal out there on the fundraising circuit. I hope this helps this team — and others — understand what investors are looking for and how to tell those stories.

When I work with founders with my pitch coaching consultancy, I sometimes advise that they abandon the startup to instead go build their network, skills and experience so they are better positioned to be successful at their company. I know that as a founder, it can often feel like some problems need to be solved by you, right now. Often, that isn’t 100% the truth. The really big problems in the world will still be around five to 10 years from now, and sometimes you need to collect the building blocks to build a foundation to be successful.

What is also true is that founders are legendarily stubborn. If you have to start this company right now, no amount of feedback from some random dude on TechCrunch is going to change your mind. In that case, godspeed, and may you be able to build the world you want to live in.

The full pitch deck

If you want your own pitch deck teardown featured on TC+, here’s more information. Also, check out all our Pitch Deck Teardowns and other pitching advice.

Comment