Syneroid recently raised a $500,000 round of funding to bring something halfway between microchips and dog collars to market. The company is finding some interesting slices of the market, but the deck, overall, leaves a few things to be desired. We learn more from mistakes than from perfection, so I figured it’d be a great one to dive into for this week’s pitch deck teardown!

We’re looking for more unique pitch decks to tear down, so if you want to submit your own, here’s how you can do that.

Slides in this deck

Throughout this pitch deck teardown, you’ll see the company referred to as Syneroid and GPC Smart — the company’s official name is the former, but the brand they are using for the pitch deck and its products is the latter. The company told me it raised this round at a $3.9 million valuation.

The company used a tight, 12-slide deck for its pitch, and no information has been redacted or omitted.

- Cover slide

- Problem slide

- Competition slide

- Solution slide

- Competitive advantages slide

- History/traction slide

- Market-size slide

- Target markets/go-to-market slide

- Team slide

- Operational financials slide

- Ask slide

- Contact slide

Three things to love

Syneroid is entering a market that’s very easy to understand: Lost animals are something that most of us have an experience with in one way or another. That’s an advantage in that you don’t have to explain the market in detail. It also means that the company is facing a wall of potential competitors even as it is trying to gain traction. That’s a challenge, and it’s interesting to see how Syneroid is tackling it.

Cover the gap between the perceived and the actual

Because the company is throwing itself into a market that is relatively well understood, its challenge isn’t to explain what it is doing but how it is moving the market forward. The company’s second slide is labeled an “overview” slide, which rapidly helps get a picture of the overall challenge this particular market segment is facing.

An investor likely knows at least some of this, but these bullets augment (or gently correct) any preconceived notions an investor might have, smoothing the delta between their perception of the market and the realities of being in that market. This slide — while fairly wordy — does a really good job of ironing out any misunderstandings an investor may have.

Having said that, it also brings up some important questions. Lost pets are just one part of the challenge; stolen pets will have their collars removed, and animals that go astray are on occasion able to shed their collars. Syneroid doesn’t really address either scenario.

Great competition overview

It’s pretty rare to see a startup put its competitor overview front and center, but I think that was a really shrewd move in this case. Again, this is not a deep tech play or a market shrouded in mystery. I suspect that most would-be investors would be able to come up with the two major competitors. Tackling that head-on does seem a little defensive, but given the market, I think it makes a lot of sense in this case. Here’s how the company addressed it:

There are a number of obvious competitors in this space, including the most common ones, existing engraved metal tags or injected microchips, which both have their own pros and cons. There’s also the latest generation of GPS-enabled dog collars, such as the ones from Fi, Whistle, Fitbark and others, which aren’t addressed in this competitive landscape.

This slide shows an understanding of the competitive landscape. I love that the company chose to tackle this upfront. I think it’s important, and it’s a great way to get out ahead of the most obvious pushback from investors.

Like on the previous slide, although its presence is encouraging, it raises some questions. I think an NFC/QR code dog collar is interesting, but I’m struggling to see how they are inherently better than standard engraved tags. The exact laser-engraved tag in the photo doesn’t cost $15, as listed on the slide, but can be ordered from Amazon — fully personalized — for $4, with four lines of text on each side of the metal tag.

Sure, you can’t “update” the information, but pet owners are probably able to afford the $4 every time they move or change their phone numbers. You can’t include location information, but someone who is willing to catch a stray pup is probably able to text or call the owner with an address and details. Again, if the animal is stolen, the thief will simply discard the collar altogether, and at that point, it doesn’t really matter what’s on the collar. As far as tracking goes, an Apple AirTag might be a good solution for those situations (but it’s as easy to throw an AirTag into the bushes as any other collar).

This slide shows that the founders understand the challenges with their messaging and positioning, but it also shows that its answers are a work in progress.

A beast of a market

The pet market, both in the U.S. and globally, is fantastically big. Investors know that, but adding a reminder can’t hurt. You don’t have to capture that big of a market share to build a very significant business here.

One of the things investors love more than anything else is a huge and growing market. Pet wearables definitely qualify in that world, and my gut tells me that smart wearables (especially GPS-type trackers) are going to be the value driver on that front. There probably is a space for a product like GPC in there, if it is able to play its cards right and find a good beachhead market for its customers. Pricing is going to be crucial here; this will be a product for people who want something fancier than an engraved tag but something simpler (or cheaper/easier to use) than a GPS tracker.

This slide shows the overall size of the market, which is awesome, but I would have liked it even better if the company said something about what it believes its serviceable market is and how it is going to go after those customers.

The thing you can learn from this slide as a startup? Have clarity on your market size and show off that it is big and trending toward growth.

In the rest of this teardown, we’ll take a look at three things Syneroid could have improved or done differently, along with its full pitch deck!

Three things that could be improved

At the earliest stages, there are a lot of things you can do to prove out what you’re building. None of the tech the company describes is particularly complicated, and I would have thought that showing that you’re able to attract customers is the biggest hurdle.

Unfortunately, that’s where the company comes up a little short, and that would probably be my deciding factor around whether to invest. The way the deck is currently presented, I’d probably decline to invest.

Where’s your traction?

The traction/history slide shows a lot of things that aren’t real traction, which leaves me with a few questions for the company’s founders.

The biggest challenge I have with this company is that it doesn’t have any actual traction, which is a cardinal sin in this particular market. It’s impressive to have an issued patent and one pending. It’s great to have a prototype and to launch mobile apps. it’s awesome to have partnerships and manufacturing lined up. Distribution agreements are impressive. But none of this is actual traction. How many users do you have? How many pets have you reunited with their owners? What revenue are you generating?

The unfortunate truth is that I could replicate this entire business model in an afternoon. For $15, you can buy 100 blank pet tags, and you can buy a laser engraver for $100. You can generate QR codes using a Google Sheet. Or you could use something like Rebrandly, which generates QR codes and enables you to re-point the links at a later date to anywhere you need to go. Call it $200 and an afternoon of work, and you have a concierge MVP.

Now, you can get started on the hard thing: Starting to figure out what your customer acquisition cost is. Can you build a company around this idea? Are people willing to pay for it? How much? How often? Those, more than the technical limitations of this, are the questions I would have about this startup, and the questions are almost entirely unanswered in this deck.

The lesson here is that it’s important to have really deep clarity on what’s difficult about what you are solving. Unless I missed something about the tech involved, the company appears to be over-indexing on an aspect of the business that seems relatively trivial and under-covering some of the truly hard parts of the business.

Where’s your business model?

I’m psyched to see that the company has an operating plan (Slide 10) as part of its deck. What’s missing, however, is a business model. It doesn’t say nearly enough about how it is planning to acquire customers and make money. It appears it will be selling tags, and possibly a subscription model of some sort, but it seems curious to omit this from the deck. How much are the tags? How will they be distributed, and at which margins?

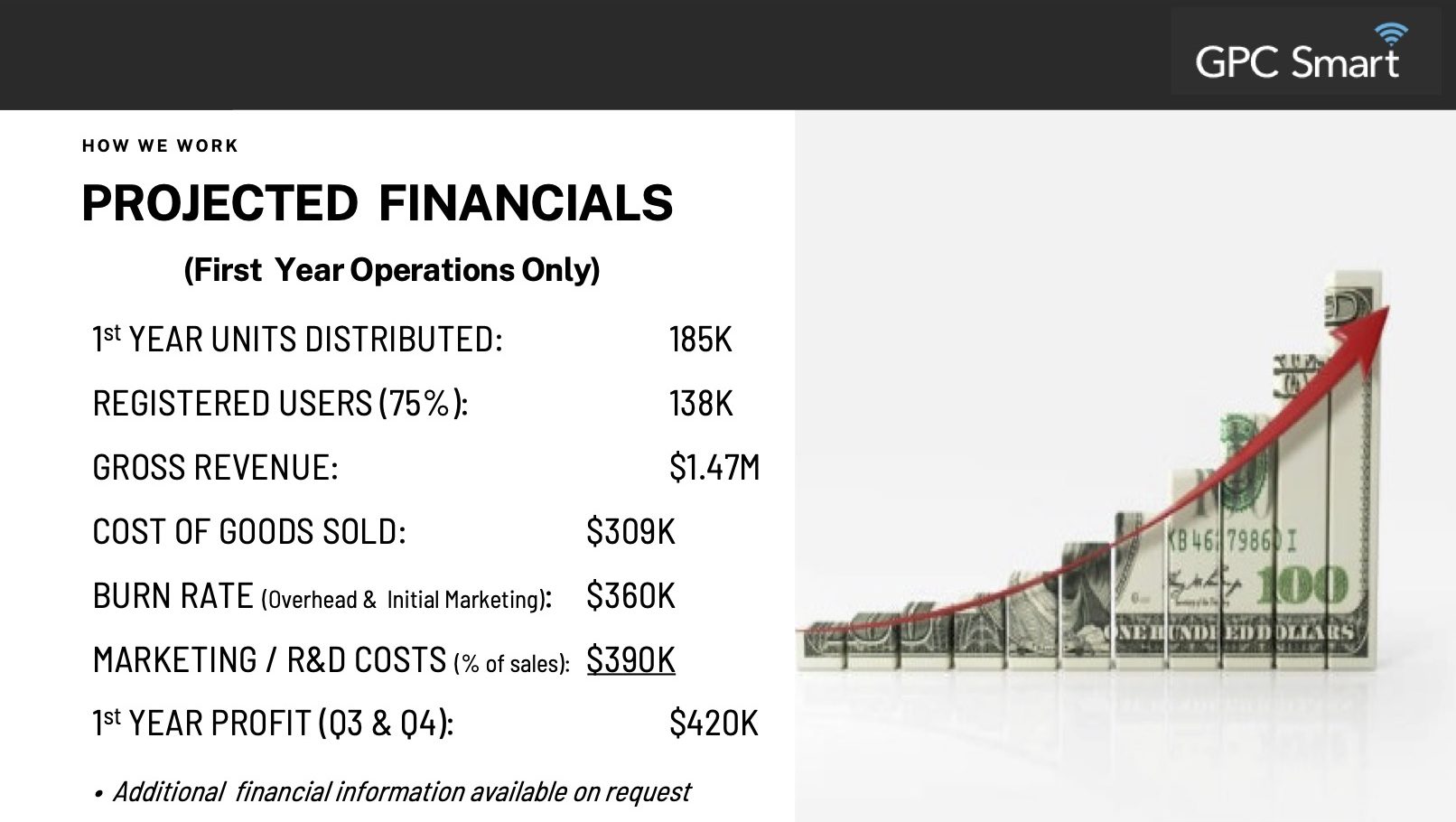

Slide 10 suggests that the company is aiming for 185,000 users and gross revenue of $1.47 million. Divide one by the other, and you end up with gross revenue of $8 per customer. If that is the lifetime value of a customer, I get a little bit scared — deduct the COGS (cost of goods sold), marketing expenses, unit costs of supporting a customer and the retail markups that need to happen for this product to make sense through the various sales channels, and it seems as if the business is running on razor-thin margins. I’d certainly be eager to dive in and talk about those numbers in some detail.

You need to be able to tell your story in numbers. Outlining the business model and the unit economics at scale is a crucial aspect of that.

Let’s talk about brand

I rarely give a crap about what a pitch deck looks like, and neither do investors. There is one exception, however, and that is B2C brands. Syneroid Technologies Corp. and its GPC Smart Tags need to compete against some truly well-established, well-loved brands in this space. Brands with names like Fi, Whistle and FitBark; brands that are starting to find customer brand recognition.

We live in a world where customers are becoming increasingly brand conscious, and if you want a fighting chance in an industry like this, you need a brand that really hits home. “Iconic” may be a stretch, but if you’re not at least gunning for a lovable brand, you’re probably getting something wrong.

I promise that as soon as I hit “publish” on this post, I will forget Syneroid and GPC. If someone asks me in a few weeks if I remember anyone doing something in this space, I’m going to have to Google my own article. That’s not good news.

In combination with the missing go-to-market specifics, lacking traction and underwhelming business model, as an investor, what I see is a good idea that’s been poorly executed in a market where competition is fierce. Based on this deck, the founders would have to start a pretty epic uphill battle for me to be interested as an investor. That’s not a great starting point when I see dozens of decks where my curiosity is piqued from Slide 1.

Syneroid seems to have a solid team. It’s entering an enormous market. It may have a solid contender as a product. But the deck doesn’t actually connect all of the dots that need connecting.

The full pitch deck

If you want your own pitch deck teardown featured on TC+, here’s more information. Also, check out all our Pitch Deck Teardowns and other pitching advice, all collected in one handy place for you!

Comment