John Zic

We’ve seen widespread losses in global equity markets this year. After a decade-long bull run, many venture capital funds have found themselves holding overvalued shares of companies whose IPO prospects have been either eliminated or significantly delayed.

The markets have now become skittish, as evidenced by widespread correlation across asset classes. There are certainly structural factors sowing the seeds of pessimism such as severe inflation; a hawkish U.S. Federal Reserve leading a global trend of interest rate hikes; an evolving European energy crisis; the first land war in Europe in 70 years; various supply chain disruptions; an ongoing global pandemic; growing global trade tensions, and, to top-off the sundae, a slowly collapsing Chinese credit bubble.

While public markets have priced in some of these headwinds, their severity and duration remains unclear. With respect to the U.S. technology sector, the Nasdaq composite index is down sharply year-to-date, price-to-earning multiples are at six-year lows and venture funding has slowed significantly. Large-cap public technology company revenue and earnings have generally held up well to date but are expected to falter in the coming quarters as a result of Fed-induced, demand destruction.

Despite all these current and high-profile pressures, it is our view that the technology and innovation supercycle narrative remains unchanged, and many companies are poised for growth. Private technology companies are refocusing on fundamentals, and valuations are returning to reasonable levels.

It is also our view that the current economic conditions create a unique opportunity for venture capital funds holding dry powder to earn significant returns, as was the case for VCs that deployed in the 2010-2014 time period.

A sound investment process analyzes both macro trends and fundamental data to assess the probability of various potential outcomes. We have identified two distinct potential outcomes for the U.S. private technology sector over the next six-12 months.

Scenario 1: Additional pain before recovery

A few weeks ago, Federal Reserve Chair Jerome Powell forecast that the Federal Reserve’s efforts to contain inflation would entail a “sustained period of below-trend growth” that would “bring some pain to households and businesses.”

This implies a period of lower range-bound U.S. equity price stagnation over the next 12-24 months. Such an outcome is probable in the near term if the following negative economic and geopolitical developments were to occur:

Aggressive Federal Reserve

An overly hawkish Federal Reserve in the face of deteriorating U.S. economic conditions could trigger stagnation in the public equity markets and potentially cause another 20%-25% drop in public equity prices. Such circumstances would continue to repress price-to-earnings multiples and negatively impact top-line performance.

While certain parts of the economy remain strong, it now seems obvious that Fed Chair Powell is having a Paul Volker moment: a single-minded focus on breaking inflation’s back, no matter the consequences. Orchestrating a “soft” landing was a “hopeful” strategy that is proving increasingly elusive.

Assuming we see more interest rate hikes over the short and medium terms, the prospect of long-term profitability for the U.S. technology sector, perhaps counterintuitively, remains strong. A repressed market would likely lead to above-average returns for the tech sector (in particular SaaS and cloud-enabled businesses) due to its ability to quickly scale without the additional infrastructure and supply chain ramp-ups that will be required by traditional brick-and-mortar businesses.

Higher geopolitical tensions over Ukraine

It’s been more than six months since Russia invaded Ukraine, and the economic impact of commodity price increases are beginning to percolate throughout Europe. While it is too soon to predict the military outcome of the conflict, it is clear that Europe and the U.S. are morally and financially invested in preventing Russia from successfully annexing parts of Ukraine.

Current circumstances suggest a stalemate as the best-case scenario. The Ukraine conflict resembles the Soviet-Afghan War of the 1980s, a protracted war of attrition wherein the West funds, trains and arms local combatants in an effort to stress the Russian economy and thereby force a withdrawal from the region. A threatened and cornered Russia could resort to last-ditch temper tantrums, either including nuclear threats or restricting/eliminating Europe’s access to its energy and commodities resources.

Greater geopolitical tensions around Taiwan

An escalation of the U.S.-China conflict over Taiwan could also have dire consequences. These tensions have intensified, with a recent visit to Taiwan by U.S. House Representative Nancy Pelosi; the Biden Administration’s recent restriction on sales of advanced microchips to Chinese companies; the recent passage of two U.S. warships through the Taiwan Strait; and President Biden’s impending executive order restricting U.S. investment in Chinese technology companies.

An overt conflict in, or over, Taiwan would create a major global semiconductor shortage (since Taiwan controls the majority of global semiconductor production). It would likely cause China to restrict access to its rare-earth materials, over which it holds a global monopoly. Such an outcome would have a severe negative impact on the global production of technology hardware and the broader U.S. technology sector.

De-globalization

These and other geopolitical tensions around the world would increase and accelerate the reversal of decades of globalization. Economies will need to find productivity enhancement in technological innovation and digitization instead of supply-chain and labor-cost optimizations.

Global geopolitical pressures will continue to provoke a short-term flight to the relative safety of the U.S. dollar and U.S. assets. Both of these trends will benefit the U.S. private technology sector.

The Chinese credit bubble collapse

The 2021 credit default of China Evergrande Group, China’s second-largest real estate developer, has raised many questions about just how over-leveraged the Chinese real estate market is. After decades of massive expansion and infrastructure spending, the inability to satisfy even a portion of the resulting debt has the potential to send shockwaves throughout the Chinese economy as well as the broader markets.

Evergrande’s aggressive expansion took on debt to finance too many new projects in too many disparate areas with insufficient demand. Many unfinished projects have been halted and are thus unable to generate income to service the interest accruing on a nearly $300 billion debt burden. Since then, 20 other Chinese property developers have defaulted on their debts. Because of the lack of transparency in the Chinese economy, the full extent of these conditions is unknown.

In addition to developers, millions of highly leveraged individual Chinese home buyers and speculators may be negatively impacted. A Chinese credit bubble collapse could threaten the stability of the Chinese banking system at large (similar to the U.S. in 2008). An unstable Chinese economy and banking system could further lead to contagion throughout the broader global credit and capital markets and emerging economies reliant on Chinese credit and trade.

In addition, as discussed above, rising global instability could prompt a flight to the safety of the U.S. markets.

Scenario 2: Broad economic upturn

In contrast to the scenarios described above, a low-friction resolution to some or all of the above headwinds could lead to positive economic outcomes and acceleration of the global technology supercycle. As discussed in greater detail below, the U.S. private technology sector is positioned to receive an outsized share of the upside.

Eased monetary policy

In contrast to Powell’s recent statements, the U.S. Federal Reserve could at any point determine that the inflationary trend has been sufficiently stemmed by higher interest rates, tapering of the fed balance sheet and a general sentiment of weakened economic activity. Some evidence of such conditions already exists, such as the rapidly cooling housing market (supply is increasing dramatically with inventory now approaching 2009 levels) and consumer sentiment remains historically low, the impacts of which will begin to be seen in the balance sheets of consumer-focused companies.

Further, as strong organizations implement hiring freezes and weaker companies pursue layoffs, the labor market will rapidly replenish itself and equilibrium will be restored. Wage growth will begin to stagnate, driving a continued drag on consumer spending, and prices will begin to moderate across all observed CPI input categories. Ten-year U.S. Treasury Note yields may see a resultant drop from their highs, leading to buying signals across all asset classes.

Because U.S. private technology valuations have been right-sized, and given the ability of venture capital to deploy it’s $290 billion of dry powder quickly, the U.S. technology sector may find itself poised to take advantage of the changing landscape quicker than other industries and sectors.

Resolution of the Russia-Ukraine conflict

Russia and Europe are substantially weakened and will have to eventually sit at the negotiating table. If the U.S. emerges from the November elections with a Republican-controlled congress, it could revert to a more isolationist stance, which would place added pressure on its European allies to pursue settlement negotiations.

Diffusing this crisis may also lead to a softening of the food and energy markets and accelerate a slowdown and containment of global inflation, the main driver of everything “economy” in the short term and an amplifier of political and social conflicts around the globe.

Containment of the Chinese credit bubble

The Chinese central bank has been actively employing quantitative easing tactics to allow its currency to depreciate in comparison to the U.S. dollar in an effort to stimulate exports and lower interest rates. In addition, the government has been buying corporate debt to address corporate insolvency. While the size and scale of China’s corporate debt issues is not fully known, it is already clear that it will be difficult to contain.

However, to the extent China can isolate the spread of insolvency to real estate developers and subsidize exposed banks and lost tax revenues for municipalities, the economic consequences could be limited to mainland China and emerging economies that rely on access to its credit.

Easing political tensions between China and the U.S.

It is in the interest of both the U.S. and China to reach a peaceful and productive resolution to their mounting political tensions. The U.S. is China’s largest trading partner, and both nations benefit from open trade routes. In addition, a global recession would put additional pressure on extracting value from existing commercial relationships. However, the U.S.-China relationship is exceedingly complex, such that a detente would likely play out over the medium to long term.

We believe that the U.S. private technology sector may have six-12 months before it can get back on solid footing, and that during this time frame, additional pain is probable. Fortunately, this translates to better valuations and investment opportunities in the venture capital space.

Software and technology multiples have reverted to below their long-term pre-COVID average. We may continue to see compression of multiples and a follow-on round of revenue contractions, which would lead to valuation expectations adjusting further downward.

We are firm believers that the innovation economy will continue to be the solution to difficult-to-find returns in all the above scenarios, and that venture capital still presents a less volatile and more attractive channel for capturing the mega-trends.

It is imperative, however, to have the right tools to make out which companies are most likely to outperform. We have observed a proliferation of more high-quality sources of data and information about the private markets, particularly late-stage private tech companies. The natural extension of this is the application of data science and quantitative investment approaches to generate more consistent alpha across longer time periods and economic climates.

VC generally outperforms following periods of economic uncertainty

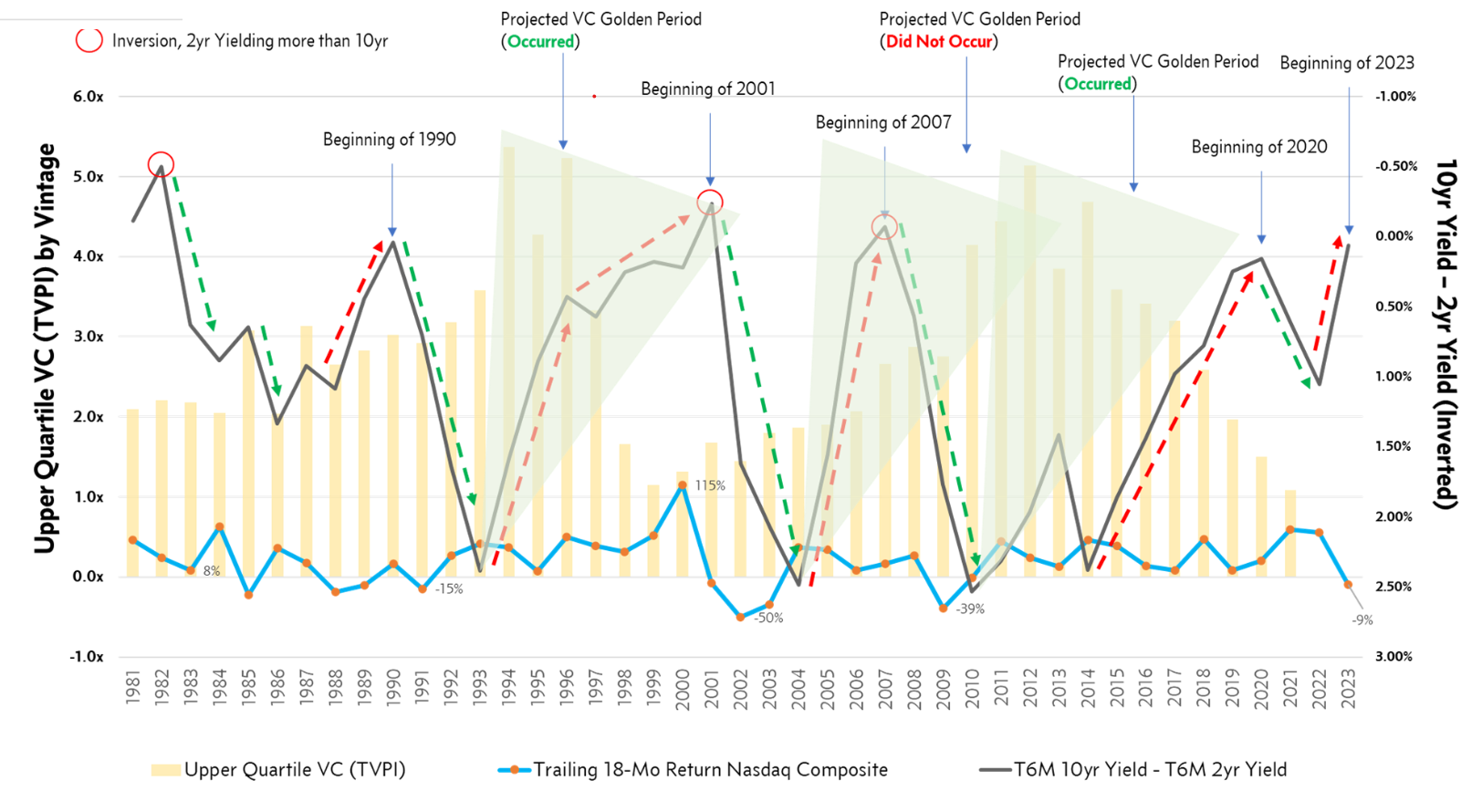

We analyzed historical venture capital vintage performance over the past 42 years and have identified certain factors and circumstances that create ripe conditions for VC outperformance. Below, we present the summary of our research and the current setup that bodes well for an H2 2023 “launch point” for exceptional venture capital vintage(s).

The critical components of the table below are:

- Upper quartile venture capital performance (TVPI), represented by the light yellow bar graph: We chose to use TVPI (the ratio of the total value of investments and cash distributions in/by a fund to the total amount of capital paid into the fund) as it corresponds to total generated value. This is in contrast to IRR, which can be easily manipulated with large, early exits, or very slow capital calls.

- Trailing 18-month return of the Nasdaq composite index, represented by the bright blue line: This data point was included to highlight the clear pressure on publicly traded technology equity following times of economic uncertainty.

- Trailing six-month average UST 10-year nominal yield minus/Trailing six-month average UST two-year nominal yield (the axis is inverted): When the two-year yield approaches or, in rare cases, exceeds the 10-year yield, the short-term outlook on the U.S. economy tends to be extremely bleak with significant market volatility expected. However, as the chart shows, these periods tend to be short-lived and are followed by a period of economic expansion typically beginning 18-36 months following inversions or near-inversions.

- Dotted line arrows: The red arrows indicate periods of increasing economic risk, the green arrows indicate periods of declining economic risk.

Key observations:

Venture capital golden periods

These are periods where the top-quartile VC TVPIs exceed 4.0. They tend to occur three to four years after a yield curve inversion or near inversion. The typical trigger point occurs when the 10-year yield exceeds the two-year yield by about 2.5% (i.e., 1993, 2004, 2010). For instance, a yield curve near-inversion occurred in late 1989/early 1990. The yield spread then stretched back to about 2.5% by 1993, and the 1994 VC vintage went onto deliver a 4.0+ TVPI along with the 1995 and 1996 vintages.

The next predicted golden period was set to occur in 2004, yet this period was curtailed by the arrival of the global financial crisis in 2008/2009. This devastating economic contraction decimated small, VC-backed businesses harming what would have otherwise been phenomenal vintage years. The next and final observed golden period began in 2010 and kicked off a five-year period (2010-2014) of extraordinary VC vintages, with every vintage (except 2013) delivering a TVPI of more than 4.0.

2020 through today is unusual thanks to an excessively aggressive Federal Reserve

A near-inversion occurred in early-2020 as the world began to grapple with the rapidly increasing risk of a global pandemic. Reports out of China were concerning, and those fears were realized as COVID swept its way through Europe and ultimately the U.S., causing a 30%+ drop in U.S. equity markets in just weeks and driving unemployment above 13%.

Had the Federal Reserve not stepped in to save the day, the U.S. economy would have careened into a recession (or depression) of historical proportions. However, the Fed chose to instead infuse nearly $5 trillion of economic stimulus into the U.S. economy, lowered interest rates to zero, and thereby kicked off one of the more ferocious equity rallies ever observed.

Unfortunately, the economic stimulus proved to be too significant, as demand soared and global supply chains struggled to keep up. These factors ultimately drove the Fed to reverse their dovish course and begin raising interest rates in early 2022. Coupled with the previously covered geopolitical events and near-term risks, these interest rate hikes have proven to be damaging for U.S. equity markets, with 20%+ drawdowns observed in the Nasdaq composite year-to-date and -9% drawdowns observed over the trailing 18-months through the end of August 2022.

It will be painful, but another expansionary period in our view is still likely to kick off in H2 2023

Despite the Fed preventing the natural three-year transition period from yield inversion to golden period, we still believe 2023/2024 vintages will indeed achieve golden period status. The path will likely be bumpy and involve a final, significant sell-off in public equity markets possibly in excess of 20% from current levels.

A sell-off of this magnitude after a 12-year period of economic expansion is a necessity to set the stage for an extended period of economic recovery (perhaps similar to 2010-2017 or 1994-98). If this substantial sell-off comes to pass, investors with dry powder and high conviction will reap the rewards as the masses sit on the sidelines.

Conclusion

The primary challenge of any investment strategy is correctly assigning and assessing probabilities based on available information. We believe that the Fed’s paradigm shift toward aggressively breaking inflation’s back at all costs will result in a final significant wave of pain for equity markets. However, this will ultimately set the stage for another VC Golden Period.

In addition, we remain convinced that data science and statistical analysis techniques employed by sophisticated, quant-minded venture capital firms are no longer a nice-to-have but a necessity to see through the noise of this volatile period.

Furthermore, the TVPI data presented above was for top quartile venture capital funds. So, despite our firm belief that the next few years will represent some of the best opportunities to deliver strong vintages, manager selection remains crucially important in any VC allocation decision.

Many historical top-quartile managers have been raising enormous war chests of capital over the past 12 months. While beneficial from a management fee perspective, these managers will face significant challenges in their ability to deliver strong returns as their enormous fund sizes (in some cases exceeding $10 billion) will force them into only the largest of private companies where value is quick to be arbitraged out. In contrast, emerging managers writing smaller, more tactical checks and pursuing highly differentiated strategies are likely to outperform these traditional VC giants during this next cycle of business expansion.

Comment