The pace at which new billion-dollar startups are minted is in freefall.

Given what we’ve seen recently concerning the late-stage funding market, we shouldn’t be shocked. As late-stage dollars retreat and capital served up in mega-rounds — deals worth $100 million or more — evaporates, the fuel that once lifted many a startup rocket into the valuation stratosphere has sputtered. It makes sense that fewer companies would reach unicorn altitude.

Initially, I wanted to make an argument crossing falling M&A activity and initial public offerings with the decline in new unicorn creation, pointing out that without the ability to exit, of course the pace at which new unicorns were created would fall. If paper marks failed to turn liquid, paper marks would become worth less, right?

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

That’s too generous an interpretation, because it rests on the assumption that the unicorns minted in the past were actually worth what they were purported to be.

Sure, the last venture capital supercycle really did build some real unicorns. Uber is worth north of $60 billion; Coinbase is worth a bit more than $16 billion this morning — you can fill in other names. But those are the outliers: Most unicorns have not found an exit, and as the market discovers that most billion-dollar startups aren’t natural, the capital flowing into them has slowed to a trickle.

Sure, the last venture capital supercycle really did build some real unicorns. Uber is worth north of $60 billion; Coinbase is worth a bit more than $16 billion this morning — you can fill in other names. But those are the outliers: Most unicorns have not found an exit, and as the market discovers that most billion-dollar startups aren’t natural, the capital flowing into them has slowed to a trickle.

Let’s take the argument one step further: If most unicorns did not exit during the boom and now cannot do so with their real valuations being lower than their last private mark (and is likely under the $1 billion threshold today), was the startup in question ever really a unicorn?

I would posit that the answer is no. Most unicorns never were what they were purported to be. Instead, a lot of startups were granted big budgets to LARP as unicorns thanks to outsized venture capital funds, in turn predicated on a combination of low interest rates and a choppy global economy brought on by COVID.

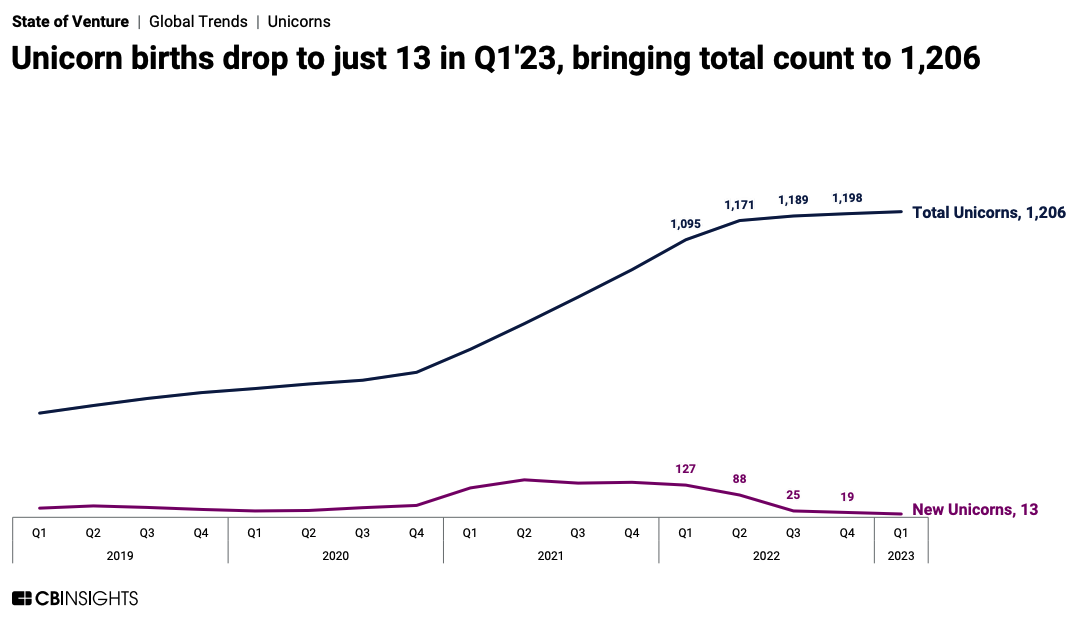

Don’t believe me? Check this chart from the new CB Insights Q1 venture report:

When did the pace of unicorn creation really kick off? The back half of 2020, per this chart, after which the rate was supercharged by investors thinking that the potential for tech growth was, if not unlimited, at least far greater than previously anticipated.

Given slowing tech growth in the wake of the COVID era, it appears venture investors and public-market money managers did understand that they were betting against a demand pull-forward instead of a new normal of incredible tech revenue expansion.1

So capital went to work predicated on a misunderstanding of future cash flows and valuations were built on the same misconception.

That resulted in several months of everyone getting prices wrong, which led to a massive spurt in the number of “unicorns” under accidental pretenses. And now we’re stuck with the aftermath of a failed experiment.

I don’t want to point fingers, mostly because I don’t care too much about the money in question. It’s not mine to invest, not mine to value and not mine to worry about. But it is worth understanding that unicorn valuations were mostly like the mythical animal they wanted to represent. They were not rare or even real; they were at best a shared fantasy.

You could argue that if we saw more IPOs during the 2020-2021 boom, we could have “confirmed” more unicorns. But I think the result of those debuts would have been largely carnage. Let’s use Allbirds as an example:

- Allbirds raised around $200 million while private.

- Its final private-market valuation was $1.7 billion (September, 2020), per Crunchbase data.

- Allbirds raised $300 million in its IPO by pricing above its range, at $15 per share, and soared to $28.64 per share on its first day of trading.

- From a market cap of more than $4 billion, Allbirds’ value has eroded to less than $200 million today, or $1.32 per share as of this morning.

Of course, we’re looking at a tech-enabled business instead of a pure-tech offering, but the situation is still illustrative given how many tech-enabled unicorns were built. It’s an extreme example, sure, but it shows how far off the mark both private and public-market investors were during the so-called unicorn era.

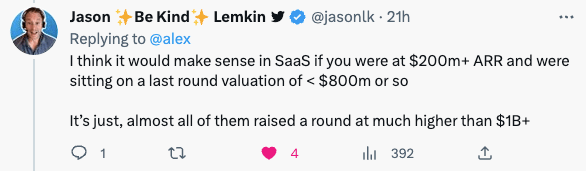

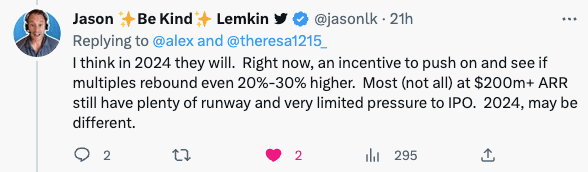

That’s not to say that we aren’t going to see great startups go public. We will. As well-known SaaS investor Jason Lemkin told us yesterday, there are a fair number of software startups out there with mega revenues and a valuation that fits today’s market. The problem lies with the companies still sitting on prices that are more fantasy than reality:

There is less of a unicorn traffic jam than I anticipated. The actual number of unicorns that have yet to exit, companies that can actually defend a billion-dollar price tag, is not too large to be insurmountable. The real problem is late-stage startups that simply have no shot at raising capital or exiting without a haircut that will feel more like a decapitation.

- For a good example of this, check Zoom’s pre-, during, and post-COVID growth rates.

Comment