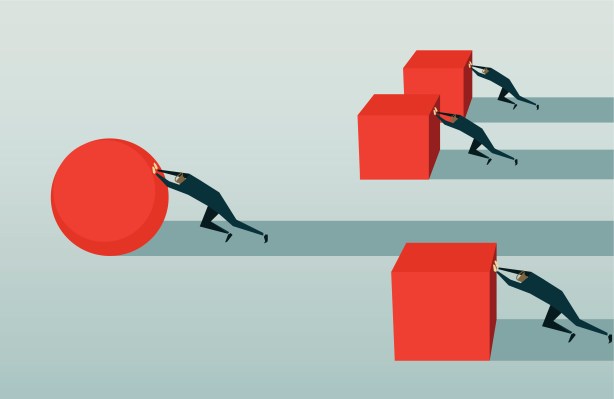

A lot of entrepreneurs are incredible idea generators and hackers; they have a knack for seeing something that’s broken or something that could be better and creating a solution around that. The problem is this: It’s rare that even very good features make good companies.

It’s rarer still that companies built on a feature make for VC-investable companies with the potential for VC-scale returns. A lot of no-code products fall into this category.

So do you have a company or merely a feature? Let’s explore the red flags investors will look for to determine which bucket your startup falls into.

Startups often fall into the trap of writing off incumbents as too big to act, too clueless to know what customers want and too incompetent to deliver good products. That’s a convenient story, but it often isn’t completely true.

A nontrivial percentage of the companies that come to me for advice about how to make their pitch decks better have a problem far bigger than a subpar deck. Fundamentally, the idea doesn’t work as a VC-scale startup; and if that is true, it doesn’t really matter how good your idea is. You will never raise money because ultimately, the risk your would-be investors are taking is higher than the reward that is available for them to reap.

The red flags fall into three categories:

- Your company is 100% dependent on another product or company.

- Your company could very easily be put out of business if an incumbent adds your product as a feature of theirs.

- The market size for this feature is too small.

Let’s take a closer look at all three scenarios, as well as how you can evaluate whether these conditions are true for your company.

Your product is dependent on another company

This scenario often comes up when a product is a result of a hackathon or if you’re essentially building on top of another company’s infrastructure. One example we often see is music discovery products: A team of smart, music-loving entrepreneurs thinks they have a way of surfacing new or interesting playlists in ways that companies like Spotify, Apple Music, Amazon Music, Tidal and others cannot.

Perhaps the company has created an algorithm that makes it possible to predict what music you like; or maybe they’ve created an automatic playlist generator that recognizes the music on your favorite TV shows and automatically adds them to a playlist so you can enjoy them when you are out and about; or a tool like Playlist Machinery, which helps you order your playlists.

Another example is the many products that were built on top of Twitter’s APIs, creating various analytics tools, bots or other products that somehow interact with Twitter. That could be a product like Semiphemeral, for example, which automatically deletes your old tweets.

Yet another example is a product like the HudWay, which adds a heads-up display to Tesla vehicles.

The main problem with all of these examples is that, to investors, they are incredibly risky. At any given moment, Apple Music, Spotify, Twitter or Tesla could change something about their end user license agreement (EULA), product or APIs that makes your product completely worthless.

One famous example was Twitter killing an API that effectively put third-party clients out of business, even though millions of Twitter users were using them. The company also axed the ability to auto-follow other accounts — a feature a lot of Twitter users were using.

When your company is completely dependent on another company’s whims, that’s bad news. That doesn’t just go for integrations but also for core technologies. If your company doesn’t make sense if a tool you rely on goes away, that’s a risk that needs to be mitigated.

AWS probably won’t go away anytime soon, but smaller services can disappear without warning. For example, a chatbot technology one of my previous companies relied on got acquired by Apple and subsequently shut down. We were faced with the challenge of rebuilding our entire tech stack on a different platform or throwing in the towel. We chose the latter.

If your product is their feature, you’re in trouble

If a product you love is missing a feature, you can often use APIs or workarounds to build your own. The challenge is that a feature added to an existing product — whether that is the power to make better playlists, add an accessory to a car or append advertising or scheduling features to a social media platform — is very risky.

Startups often fall into the trap of writing off incumbents as too big to act, too clueless to know what customers want and too incompetent to deliver good products. That’s a convenient story, but it often isn’t completely true. Yes, incumbents often have a large install base, and their priorities may be different than that of a certain type of users. But that doesn’t mean that the bigger companies don’t have the resources to fight you.

To take the example of “make better playlists” — to some folks reading this, that may seem like a bad idea for a business. And yet, I’ve seen half a dozen pitches for “better Spotify playlists” in the last couple of years alone.

The problem is this: Spotify is actually extraordinarily good at surfacing new music and letting people make new playlists. They also have bigger data access and smarter big-data algorithm nerds than most startups. That means that if you come up with something significantly better than what Spotify has, it’s likely that they can copy it — and make it better than you did — without breaking a sweat. If your whole company becomes a feature in another company’s product, you’re screwed.

Tile is another such product — such a good idea, but it had one major problem: How do you find your devices when your phone is out of Bluetooth range? It turns out there was another company that had an enormous platform it could leverage to build the same product with a far better implementation. AirTags.

Netflix took a different approach to the “what should I watch next?” challenge and created a $1 million prize for someone who could come up with a great algorithm to do film and TV show recommendations.

Ultimately, the problem remains the same: If it is relatively straightforward for a company to take your whole business and turn it into a feature of its own — especially if you have no patents or other protections — the investment risk simply becomes too high. It doesn’t really matter how good the product is; it’s a bad investment.

The market size for this feature is too small

The final trap I see people falling into is creating an incredibly useful feature that simply isn’t helpful to that many users. This often shows up in the WordPress plugin world, for example. There are thousands and thousands of plugins to WordPress that make the internet publishing platform better. (We should know — the entire TechCrunch site runs on WordPress.) Ditto Shopify and Adobe products (Premiere, Photoshop, etc.).

The “problem” here is a combination of the problems above — WordPress, Shopify and Adobe could easily implement a feature you’ve built your entire company around. Squarespace, to take one example, was “just” a simple website builder until it introduced Squarespace Commerce, which added a whole e-commerce solution on top of the platform. Suddenly, it became a competitor to companies like Shopify. Was it as flexible or as expandable as Shopify? Not even a little, but many website owners simply didn’t care and were happy to be able to stop paying Shopify for the privilege of running a simple shop.

The challenge comes if the feature you are building is too niche. The upper limit of how big your total addressable market could be is the number of users of the platforms you support; that’s already a hard sell to investors. However, you are going to get less than 100% adoption of your product, and the real question becomes how much less. If you, as an entrepreneur, can’t make a compelling case for the market size of your product, you’re going to struggle to raise funds.