Are you tired of bad news for startups? Bored of the layoffs, budget cuts and sermons from folks who suddenly discovered the efficiency gospel?

Well, how about some good news? I have some for you: Software valuations staged a modest comeback this year.

When we refer to startups, we generally mean tech-focused upstart companies. Sure, there are restaurant chain startups and, I suppose, ceramics startups and all sorts of quickly growing businesses out there. But startups with a capital S mean little tech companies hoping to grow quickly, often powered by venture capital dollars. And that means, in practice, software companies.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

So if software valuations are recovering this year, we can infer that startups, in general, are seeing some valuation pressure roll off their back. Given that we expect that a host of startups — both early- and late-stage — need to raise capital this year, any positive movement in valuation terms is more than welcome; it could smooth the path to more capital for many companies at prices that are less miserable.

Are we seeing a massive improvement in the value of software revenues? No. But given how far valuation multiples have fallen, even a 1x gain is material. Let’s explore.

Are we seeing a massive improvement in the value of software revenues? No. But given how far valuation multiples have fallen, even a 1x gain is material. Let’s explore.

Up, up, down, down, up

It took less time to deflate the startup valuations spike that we saw through late 2021 than it took to fill it. By mid-2022, it was clear that upstart tech companies were operating in a different environment and that prior prices for their equity were no longer going to wash.

You know this. It’s been perhaps the most important story of the tech world in recent years; as tech valuations came down, investor preference switched from growth to profitability, adding a push for cost cuts at startups suddenly staring down the barrel of high burn rates, dwindling runway and a more complicated fundraising market that they were not financially tuned for.

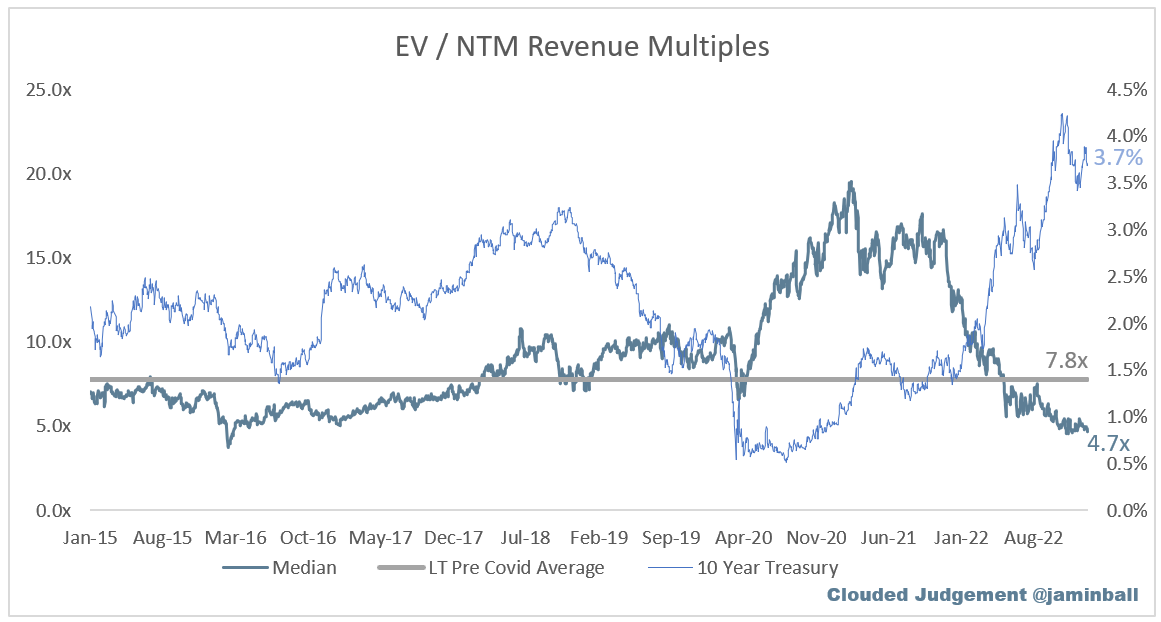

Blah, blah, bad news. The good news is that things are getting better. Observe the following dataset from Altimeter’s Jamin Ball from January 6, 2023:

Image Credits: Jamin Ball

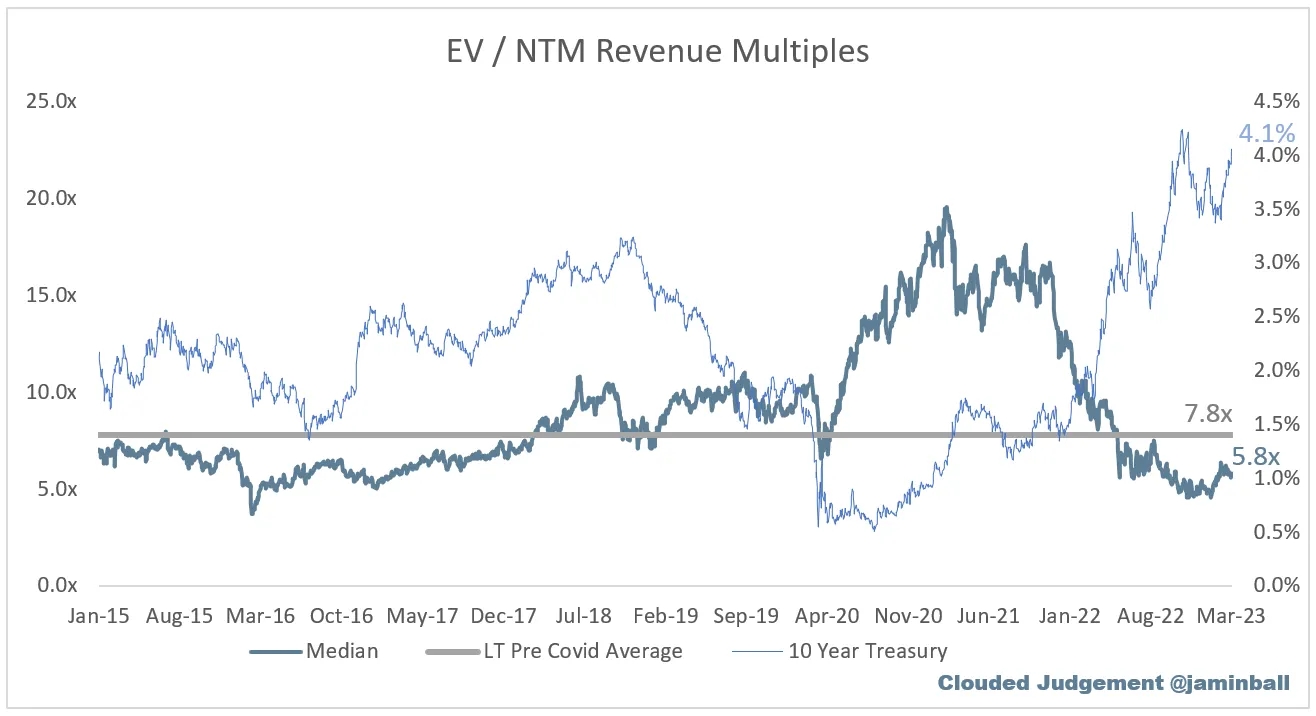

And the same chart from last Friday:

Image Credits: Jamin Ball

(The above charts, per Ball, are enterprise values for public software companies, divided by their next 12 months’ revenue, in case you want to get granular.) Supposing it’s a bit early for you to run the math yourself, a change from 4.7x to 5.8x is a 23% recovery. That’s incredibly material.

And in a good way. A startup generating $50 million in revenue over the next year at January’s median public software multiple would be worth $235 million. At the more recent number, its worth rises to $290 million. That’s $55 million in free valuation gains just thanks to the market’s evolution. (As startups tend to grow faster than public companies, they also tend to be worth a bit more per dollar of revenue, so the example math here using public medians is likely a bit bleaker than reality.)

Sure, that same startup would have been worth $1,000 million when valuations peaked in the 20x range during the last boom, but that’s really not too important. The market has been digesting the downside for ages now; the fact that we’re now seeing some upside is the real news.

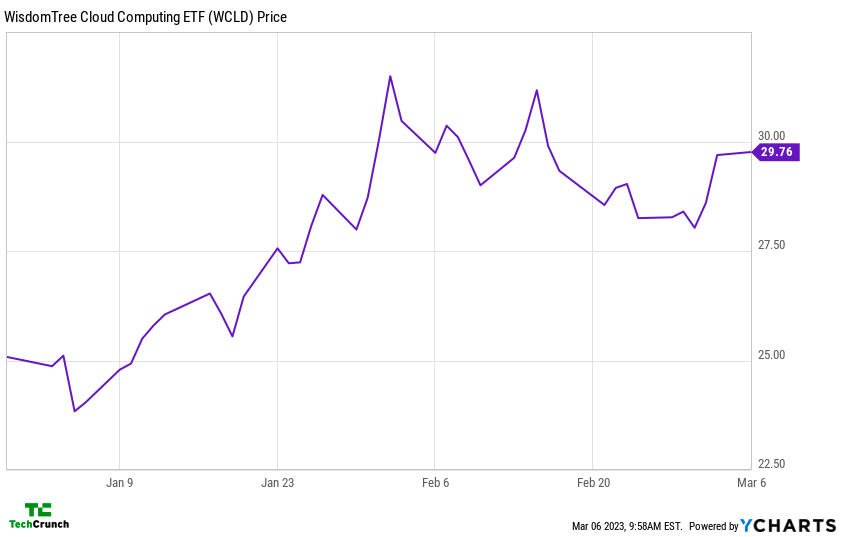

Naturally, we should not merely trust Ball. To check his work, here’s a year-to-date chart of the ETF version of the Bessemer Cloud Index:

Image Credits: YCharts

Sure, back in late 2021, the same index peaked at over 65 points, or more than double its current level, but gains are gains, and gains are welcome for startup founders and their backers alike.

The recent modest recovery in the value of software revenues would become even more welcome if it continues. No one seems to expect things to go back to the way that they were. But better? Who doesn’t love that?