Jamil Wyne

More posts from Jamil Wyne

While global tech and finance leaders have suggested that the world’s first trillionaire will be someone tackling climate change and that many climate unicorns are on the way, current VC levels are dwarfed by the mind-boggling funding amounts that are needed to give humanity a fighting chance.

As of October, climate-tech startups had raised over $32 billion in 2021 and, according to Dealroom and London & Co., U.S. VCs invested nearly $50 billion in climate-tech companies between 2020 and 2021. However, depending on whom you talk to, the climate finance gap currently sits at $2.5 trillion to 4.8 trillion.

To put this gap into perspective, total global VC funding (across all sectors, including climate) in 2021 was at an estimated $643 billion, and most countries in the world, aside from a handful, have a GDP under $4 trillion. Additionally, a sharp uptick in the number of climate funds and startups has some experts worrying about the potential of a bubble, and doubters may argue that traditional VC investment strategies are too risky to make a meaningful contribution to addressing climate change.

So where precisely do VCs factor into global efforts to address climate change? Indeed, a vast portion of the investments will be allocated toward infrastructure investments, as well as emergency funding, which will not yield venture-like returns. By the same token, new policies and national programs will be spearheaded by governments, and as conditions worsen in certain countries, foreign aid agencies will be crucial players.

Accordingly, we won’t be looking to VCs to write billion-dollar checks, create new policy incentives, or provide shelter and food to populations in need. However, VC funds and their investment strategies and networks have unique features that give them an important position in these global efforts.

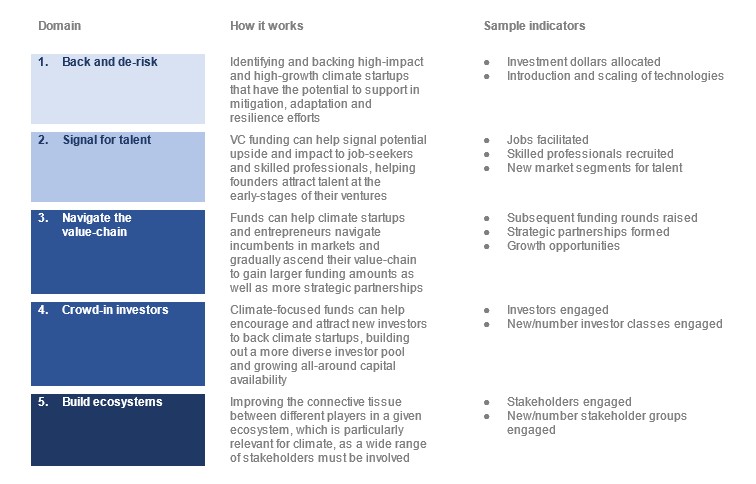

Below we outline five key areas where we believe VCs can play a role in addressing climate change:

Backing and de-risking proven climate technologies

Venture capital has a vital role to play in de-risking climate technologies, which can help bring costs down, accelerate adoption rates and transform markets to enable a decarbonized future. Any hope of addressing the climate crisis requires helping entrepreneurs to mitigate technology risks and scale their innovations quickly and cost-effectively.

This is a role that the venture capital world is used to playing, and it’s critical now more than ever because there is such a wide spectrum of new climate-focused technologies the market has yet to embrace. Venture capital, and especially early-stage venture capital, can create a material impact by working with companies at this stage. Those that are successful will find a big pot of growth capital angling to scale their technologies.

“Early-stage VCs can play a pivotal role in helping climate tech startups with both capital and expertise for commercial technologies,” said Daniel Goldman, managing partner at Clean Energy Ventures. “For instance, a more sustainable approach to decarbonizing heavy industry by enabling a diesel engine to run on low- or zero-carbon fuels at the same cost and performance would have a material impact on long-haul trucking, agriculture and construction equipment, and backup resiliency-based power generation.”

Early-stage signaling for talent

Despite the growing number of headlines, climate tech is still a young sector and must demonstrate credibility to talented professionals. It may be obvious, but every founder will ultimately need tens, if not hundreds or perhaps even thousands of employees to follow them.

Once climate-focused startups convince investors to back them, they will need to recruit employees to follow suit. Second to dollars, inward talent flows are critical to the climate-tech sector, both in terms of augmenting its legitimacy as well as ensuring that these firms have access to the best and brightest.

According to Susan Su, a partner at Toba Capital, VC can create a significant impact by simply building legitimacy around climate tech, which has high importance in the eyes of job-seekers and talent. “It can be harder for early-stage startups to attract top-notch talent if you’re not VC-backed. Early-stage fundraising isn’t just about getting capital; it’s just as much about sending a signal out to the broader market of potential candidates, future employers, partners or even eventual acquirers that your company has been underwritten by professional investors who believe in its growth story,” she said.

Su argues that VC is an especially potent early signal for pre-revenue and pre-profit startups looking to build credibility with diverse stakeholders.

Navigating the value chain

VCs and their portfolio companies are essentially at the early stage of a value chain — at the beginning is a young business idea, and at the other end is a market with consumers, investors and partners.

VC funds tend to find companies when they’re still in the early days of that value chain. If companies find efficient ways to grow, they can attract larger ticket sizes at the later stages, and attract partners and customers in the process. Even the largest global tech corporations once started out at the beginning of this value chain.

Robert Murphy, a fellow at Breakthrough Energy and former World Bank economist, explains this value chain as a funnel: “The earlier-stage ideas will be the ones at the top of the funnel that will naturally evolve to the later stage, necessitating the larger funding rounds and more strategic partnerships that can open up new markets.”

By being an early-stage champion, VCs can help ensure that there is a smooth ramp for climate-tech companies as they enter this funnel, and, ideally, become primed for the journey toward scaling.

Ushering in new types of investors

VCs have the unique position of being able to encourage atypical investors to take climate change more seriously. Both incumbent and new VC funds that place capital in climate-focused startups can draw the attention of investors still on the sidelines.

Manu Schoenfeld and Andrew Kalish, CEO and head of business development, respectively, at PowerX, a YC-backed climate-tech startup, point to the work of groups like Fifth Wall Ventures and its Climate Fund being indicative of this effort. “The aggregation of capital from major real estate firms by Fifth Wall into a climate-specific fund shows how VCs can be a bridge between major industry players and the companies tackling climate change head-on,” said Kalish.

Clean Energy’s Goldman also observed the same trend: “We’re seeing incredible receptivity from a wide range of investors, including traditional institutions such as pensions, endowments and insurance companies, but also large family offices and major financial institutions.” He added that not only are more asset owners and managers entering this field, but venture capital is increasingly serving as an important component of their overall investment strategy.

Building the ecosystem

Beyond providing capital to early-stage companies, VCs can help orchestrate strategic partnerships and shape markets for their portfolios.

Climate change is unique in that it requires many actors from the public, private, civil and academic sectors to collaborate. Murphy feels VC funds are “well-placed to help startups develop strategic partnerships, navigate regulatory hurdles, and out-maneuver incumbents when needed.” They can also bring disparate actors together to help ease the pathway to revenue.

Successful climate mitigation and adaptation projects will be fundamentally multi-stakeholder, and climate VCs with deep industry and technical experience in the sector are among the few with the networks and ability to move fast, which is necessary for helping shape these ecosystems.

Where do we go next?

While the VC funds of the world indeed have a growing and prominent role to play in global climate change efforts, it is important to keep in mind that they are just one of many players in this equation, and there are limits on how far they can take us.

For example, It is widely documented that developing countries are the most vulnerable to climate change and the least prepared to deal with it. Goldman pointed out that while the U.S. and China are the largest carbon emitters in the world, emerging markets are in need of more financial and technological support to address emissions.

The cost of decarbonization in these countries is likely far higher than in OECD countries. Schoenfeld expresses a similar concern, saying that many VC-backed climate-tech solutions are hard enough to implement and scale in the U.S. and EU alone, while developing countries, with their limited infrastructure and purchasing power, are in more need of these solutions but are less equipped to absorb them.

While most VC verticals will be assessed in terms of how much they return to investors, climate tech may be unique in that its success will also be determined, essentially, by its contribution to the preservation of our livelihoods and how much it can avoid a winner-take-all dynamic. We are still in the early days, but optimism and anticipation are high, and VCs with their unique vantage and positioning can be leaders by creating credible, investable and scalable investments shifts in the climate space.

“We’re seeing unprecedented increases in valuations, but we may not appreciate the long game and the extraordinary paradigm shift at its embryonic stage, and therefore fail to appreciate the future scale of the opportunity in the coming decades,” Goldman said. “There’s a chance we’re being myopic — could this be like the Internet x100, impacting all sectors of society on a global basis?”

Comment