I have now been an investor for two years after 15 years of entrepreneurship. If I had instead been an investor for two years and then gone out on my own, I would have saved myself a lot of heartache!

I have spent most of the last two years investing at Series B and helping portfolio companies prepare for this first “growth-y” round. There is a marked difference in what a Series B company is expected to look like versus a Series A company. As an entrepreneur, you have limited time to project that maturity to prospective funds.

This is one of the lessons I wish I understood when raising a Series B, so I hope you find this advice helpful when you navigate your larger raises. In this column, I will cover the key materials and collateral that will help you communicate your ideas successfully across a partnership.

A key complication as you progress from seed to Series A and then to Series B is that the bigger check size invariably means more people are involved in getting to a “yes.” Every venture firm has its own idiosyncrasies in how it votes, but understanding that you are truly “dating” the entire firm when you get to larger rounds is a vital insight that I never appreciated. This means you need to understand how to create materials that survive a brutal game of telephone from associates out to prove their smarts to founding GPs managing insane travel schedules.

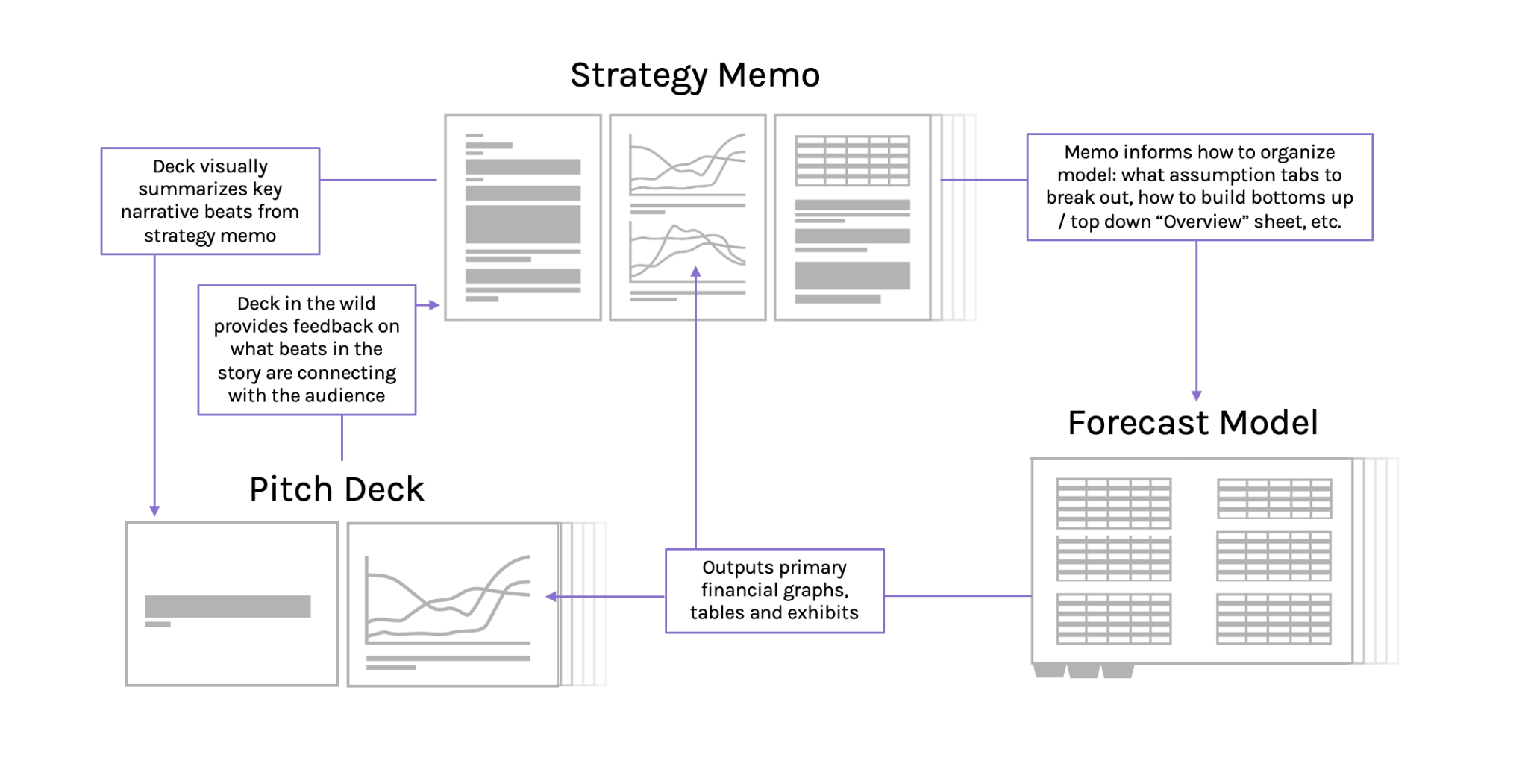

A Series B data room can be overwhelming. You want to proactively manage the order in which people access information and focus their attention on a few key documents that they can return to when they fall down a rabbit hole. Founders should think of three primary documents as their “holy trinity”: the deck, the strategy memo and the forecast model. These documents should do most of the heavy lifting for capturing people’s attention and ensuring that information is transferred within the partnership with high fidelity.

You want people to focus the vast majority of their attention on these three pieces of information. This is a great way to control the narrative and ensure that what you want to be transmitted is received by the other parties.

An elegant strategy memo is your most important document

Over the past few years, the strategy memo has emerged as a key part of initial diligence packages. Some people refer to it as a company-written investment memo, but I prefer the “strategy memo” title, because it’s not really an investment memo, which comes with scenario analyses, exit plans and other sections that would be awkward and a bit presumptuous for a company to externalize.

Tech and VC heavyweights join the Disrupt 2025 agenda

Netflix, ElevenLabs, Wayve, Sequoia Capital — just a few of the heavy hitters joining the Disrupt 2025 agenda. They’re here to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss the 20th anniversary of TechCrunch Disrupt, and a chance to learn from the top voices in tech — grab your ticket now and save up to $675 before prices rise.

Tech and VC heavyweights join the Disrupt 2025 agenda

Netflix, ElevenLabs, Wayve, Sequoia Capital — just a few of the heavy hitters joining the Disrupt 2025 agenda. They’re here to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss the 20th anniversary of TechCrunch Disrupt, and a chance to learn from the top voices in tech — grab your ticket now and save up to $675 before prices rise.

I have also heard it referred to as a “narrative deck” — basically a detailed, written version of your pitch. I also do not think this fully captures a great strategy memo, as it is more than just the deck. I see the deck almost as a derivative of the strategy memo.

What is it, then? A strategy memo is a cohesive written argument for your company’s strategy, traction and prospects, with sections for competition, financials, why now, etc. The best memos I have seen are very elegant “proofs” of the company’s viability. They include graphs, illustrations, pictures and visual tools to illustrate points and are clearly divided into different sections and subsections so that readers can easily find what they are looking for.

Y Combinator evangelized the format, and I have seen it pop up more and more over time (here is their overview, and here is a great example). I am a big fan of this because when a company of interest provides us with a strategy memo, we almost forget the deck and focus exclusively on the memo. It is a much more elegant piece of content to analyze and discuss among a team of decision-makers.

Going back to our main objectives, the strategy memo is tailor-made for post-pitch success. It is designed to maximize fidelity as information is transferred around the partnership. It also reduces the work of the investment team when they have to write their own memo — you can’t unsee the logic tree of an elegant memo.

A good strategy memo becomes the guideline for how the entire diligence process unfolds. Your due diligence questionnaire (DDQ), how you organize your data room and which breakout decks you choose to create all derive from the memo. Ultimately, it is the central document to which members of the investing team will return to over and over.

You should send the memo after your first meeting. If the partner is truly interested, they will read the memo and emerge a true evangelist with the necessary knowledge to proselytize.

A pitch deck should be pithy, not all-encompassing

I am not going to spend a lot of time on the pitch deck, because there are many great pieces on this topic out there. But I want to highlight a few key points.

The first is that the primary objective of your pitch deck is to capture attention and visually transmit information. Of all the materials you create, the pitch deck will best help you create that initial, emotional connection. If the strategy memo goes for the brain, the pitch deck goes for the heart. As such, it should be formatted as a story with a beginning, a middle and an end.

The beats should be clearly articulated so that after 30 minutes (the time you should give yourself to capture someone), a potential partner walks away understanding what you do well enough to remember why they are excited.

It is impossible to communicate all the information needed for an investment in a Series B company in 30 minutes. The best you can do is move a partner from curiosity (they took the meeting, after all) to enthusiasm. If you believe this is the true objective, then it becomes obvious that the deck should be visual and short.

You want the partner to walk away with the three or four points you want them to remember. If you fill it with a bunch of great ideas, they won’t remember anything. You are the master and expert of your own narrative, so you have to be the editor to ensure you increase your signal-to-noise ratio.

About 20 slides is ideal, and you can throw other, more detailed slides in an appendix. This will be useful if you go through a formal management meeting process and will let you jump to specific slides to answer questions. I have seen 20-page decks with 120-page appendices; don’t be shy about creating a pithy main deck.

Although I believe the pitch deck is a derivative of the memo, it is the document that sees the most action during a fundraise and therefore gets the most feedback, which drives its iteration. Some decks end a process looking nothing like how they started. Allow your deck to find its footing like a good comedy set that gets workshopped at comedy clubs. Remember that those changes should likely also influence your memo. When you start the fundraising process, the iteration cycle becomes a circular one involving these three documents.

A forecast model can be robust and simple

At the Series B, a robust financial forecast model is table stakes. This round is about understanding unit economics, timelines and multiples to exit. You likely have clear product-market fit, and the cash you are asking for is to meet the demand you have uncovered.

Do not confuse detail with complexity. Your forecast model can be robust and long while being easy to understand. The key is to start with an overview sheet that explains the business in financial numbers exactly how you explained the business in your deck and memo. From that overview sheet, you can link to more detailed assumption tabs, but now you have a summary that is easy to understand. The forecast model is not only your financial statements — the statements should be an output of how you run your business, not the other way around.

Whenever I hear someone tell me that their forecast model is “complex” and they want to take 45 minutes to walk me through it, I see red flags. If the forecast model is not self-explanatory, it will not be communicated across the partnership. You can’t have every single partner do a 45-minute call to decipher your model. Build a model that is understandable even if it has a lot of detail. “War and Peace” is long but simple. Do not write “Finnegans Wake.”

At the end of the day, investors look at a lot of pitch materials. If they require you to explain your business, you will fail to meet all three of your objectives: You will not capture their attention, you will not easily transmit information and you are not minimizing their work.

How to create a due diligence road map for Series B investors