Alan Feld

More posts from Alan Feld

For an asset class that should be reinventing itself all the time, it is surprising to see how resistant some venture funds are to change.

As a partner in a fund of funds, I attend a lot of annual meetings, talk with a lot of venture fund general partners and review a lot of investor decks.

What has particularly surprised me is how many funds tell exactly the same story and invest in exactly the same areas: B2B SaaS, cybersecurity, cloud infrastructure tech, e-commerce brands and crypto/fintech.

As I have written many times before, venture is about elephant hunting. Great funds have at least one, and ideally a few, enormously successful, fund-returning investments. Ownership and letting the great companies “ride” (and not selling them early) is crucial to getting outsized returns.

But, the outsized returns only come from companies that are market leaders in enormous markets. The second-place company, and sometimes, the third-place company can win, too, but of course will not be as large. But the companies that end up at #300 or #99 or even #20 in a market do not end up as good investments.

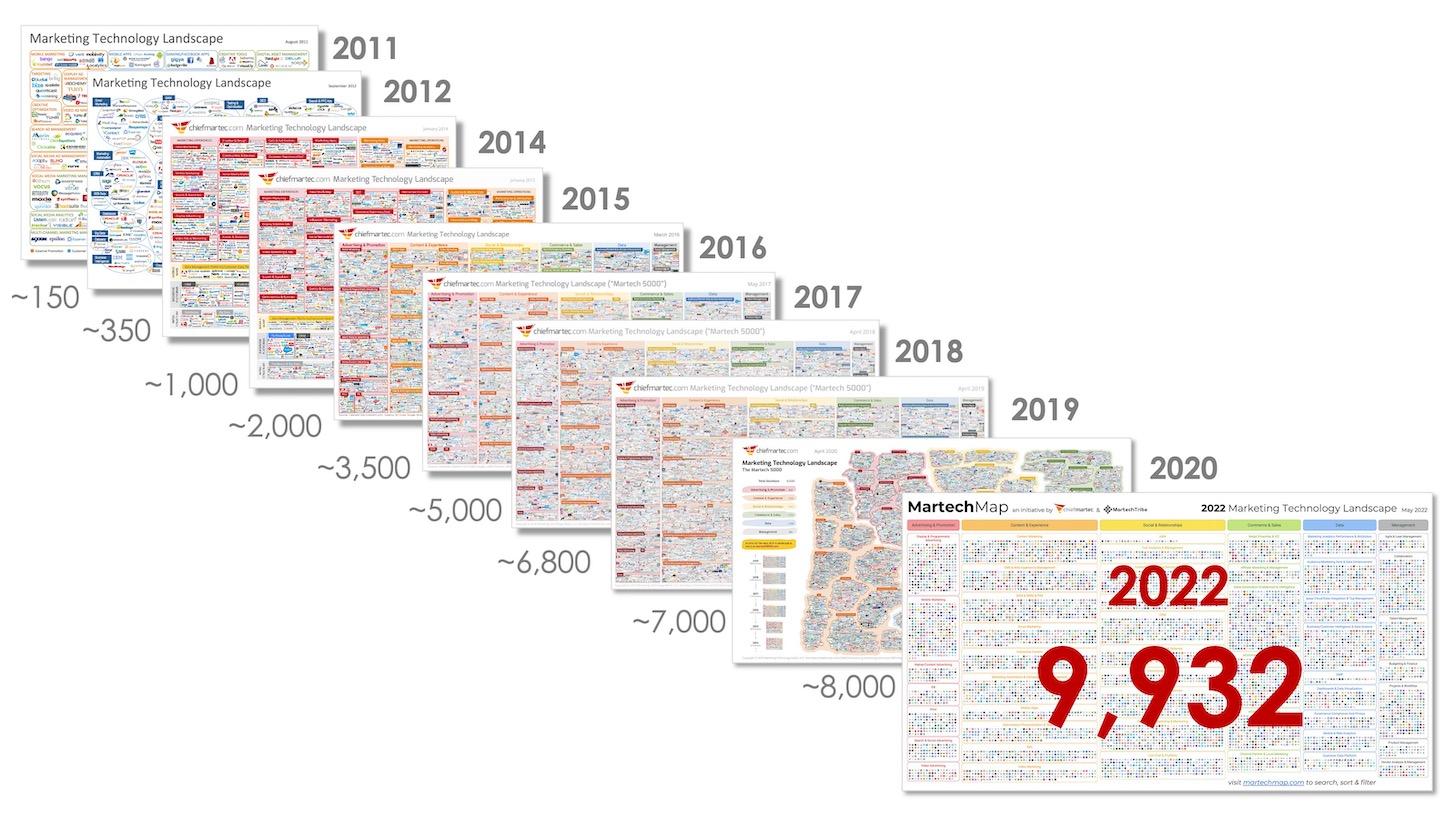

I was thinking about this recently when I looked at a map of martech SaaS companies that chiefmartec and MartechTribe prepared recently. What is amazing is how many marketing SaaS companies still get funded:

While not nearly as bad as marketing tech, we are seeing a huge inflation in the number of cybersecurity and fintech companies as well.

A comment that I increasingly hear in my conversations with CISOs, for example, is that they are not looking as much for new point solutions as much as a broader platform that will replace tens of the many cybersecurity applications they have in their systems. In a market where capital will be increasingly difficult to raise, many of the thousands of “me too” cybersecurity companies will find themselves becoming increasingly “insecure.”

The same is true for some areas of fintech. How many more payment companies can be created? How many more e-commerce finance companies can survive and flourish?

Marc Andreessen once said that “software is eating the world.” Unfortunately, me-too investing is eating returns.

So, what should venture funds do?

As an early-stage VC, it’s not important to invest in what is hot today, but investing what will be hot in five to 10 years from now. The VCs that invest in the leaders of tomorrow’s markets will be the ones who generate outsized returns.

That does not mean one needs to stop investing in SaaS, cybersecurity or fintech. There will always be disruptive companies in those segments, but the balance needs to shift to the massive markets ripe for disruption by technologies that are underfunded.

In my view, there are four relatively underfunded areas that could produce huge winners over the next 10 years:

Alternative energy

For years, “cleantech” has been more of a “four-letter” word than a “nine-letter” one. Several funds lost enormous amounts of money in this space 10 to 15 years ago.

In 2005, neither market awareness nor the technology had reached where they needed to be to generate businesses with positive unit economics. For example, the only way to make money in solar energy back then was with huge government subsidies.

That is no longer the case. Moreover, the growing awareness, genuine concern and treaty commitments around climate change have not only forced governments to address this issue but industry as well. General Motors committing to a full shift to electric cars by 2035 and Delta Airlines’ commitment to carbon neutrality are excellent examples.

Remote and home healthcare

I recently sat on a panel with Dr. Isaac Kreis, the director general of Tel Hashomer Hospital, Israel’s largest, and ranked as one of the top 10 hospitals in the world. Dr. Kreis noted that as we live longer, the more healthcare each of us will consume. For example, fewer people will die immediately of cancer because, as Dr. Kreis noted, cancer will become a chronic condition that needs to be managed over far more years.

As we all saw with the COVID crisis, there simply are not enough hospital beds out there — certainly not enough to deal with the huge number of aging baby boomers and the treatment of their long-term chronic illnesses. There are now approximately 100 startups at Tel Hashomer working to help patients spend less time in the hospital or never get there in the first place.

This is all happening at a time when insurers and HMOs have started to realize that doctors should receive compensation for remote care that is reasonably analogous to what they receive for patient visits. Our guess is that healthcare will end up hybrid — both virtual and in-person. There is a huge hardware and software opportunity that relatively few traditional healthcare funds feel comfortable to address and many software-focused VCs have yet to address. A very significant exception is our portfolio fund, General Catalyst.

Education

Anyone who has children of school age experienced firsthand how poorly available technology performed during the COVID crisis. Frontal teaching is increasingly less effective for children with decreasing attention spans and that is compounded when that frontal teaching is communicated over Zoom.

Children are technologically savvy much earlier than ever. If they are getting almost all their entertainment and all their news online, then it is not surprising that somehow they will get their education that way as well. Gamification and community/social technologies will become a huge part of education.

In fact, K-12 is not the only part of the education system that is broken. Collectively, around 44 million Americans owe a combined $17 trillion in student debt, which doesn’t even begin to address the millions of young adults who cannot access advanced training and/or are ill-equipped for the jobs of the future. For all these reasons, we invested in educational technology fund, GSV.

Food tech and agtech

Emerging areas where we do see a rapid increase in investment are food tech and agricultural technology. We’re seeing a perfect storm of four trends that will dramatically boost demand for agtech: global warming, disappearing fresh water sources, a growing middle-class that’s consuming more food and the death of the family farm/consolidation of farmlands by larger companies that are tech buyers.

Agtech companies historically had very long ramp times. I think that will gradually change as the “storm” gathers wind.

Food tech companies raised $5.5 billion in Q2 2022, but the majority of this amount was in a handful of large growth rounds. There is far too little Series A and B money being invested in the sector. That is why we recently committed to an interesting fund called Synthesis that is investing in alternative proteins.

Venture capital has always prided itself on investing in disruptive companies. It is hard to disrupt by me-too investing. I believe that venture funds that do not reinvent themselves and broaden their range of investments (and the domain expertise of their team) may find that they are the ones being disrupted.

Comment