Julio Vasconcellos

More posts from Julio Vasconcellos

Over the past year, Latin America has been covered heavily in the international news as the COVID-19 pandemic led many to question our endurance in the face of a crisis. But the region’s mega-fundraising rounds and shiny new unicorns have countered with optimism around its budding tech ecosystem.

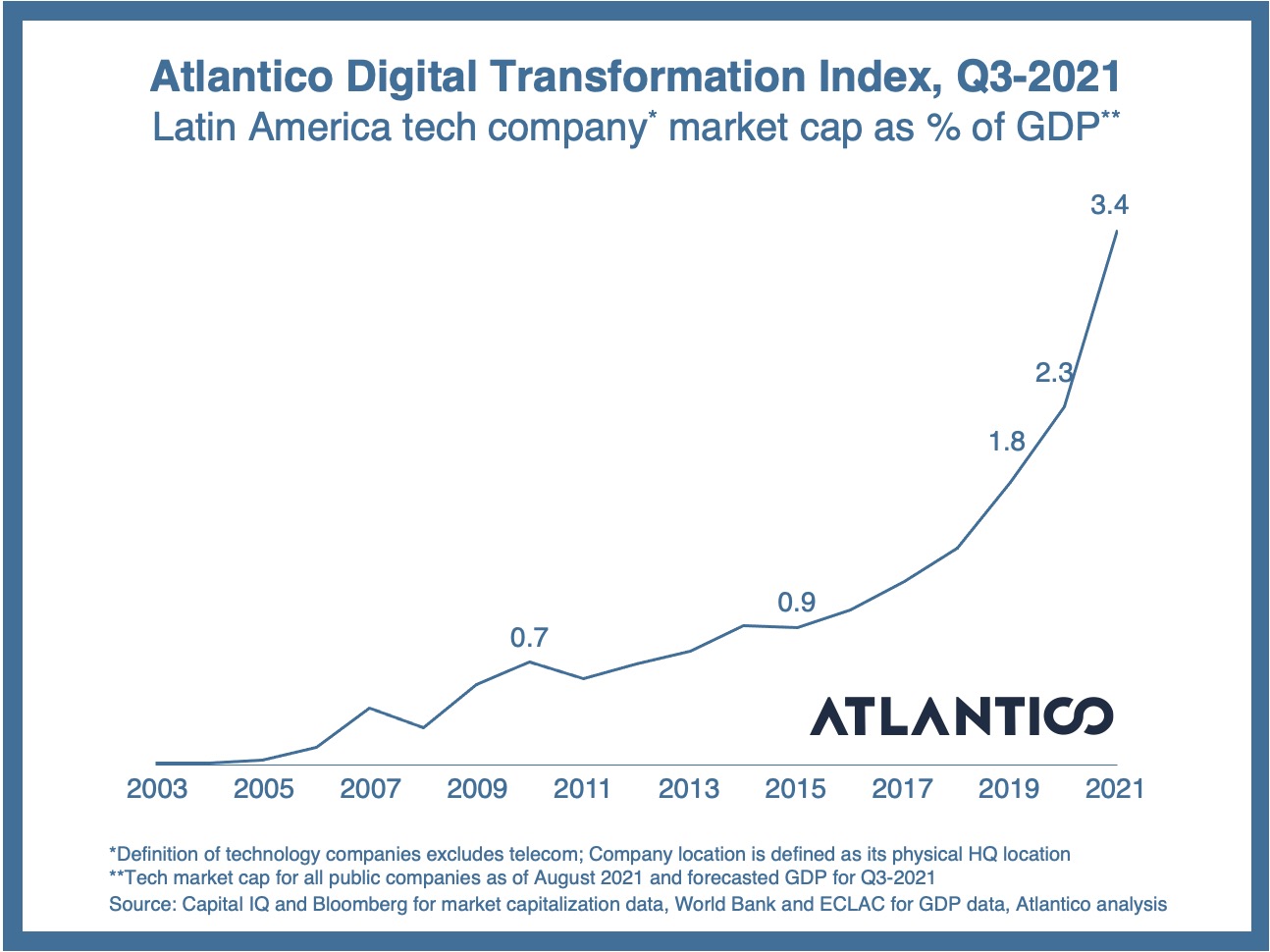

When we first shared LatAm’s digital acceleration story in last year’s Latin America Digital Transformation Report, we believed we were at the peak of digital growth catalyzed by the pandemic. E-commerce penetration was at an all-time high and the market cap of public technology companies was growing much faster than the region’s GDP. But with 2021 came all the second- and third-order effects of the crisis, further accelerating a continentwide tech expansion to a pace beyond any projections.

In this year’s report, we dedicate 200 slides of data-rich analysis, primary research, private company data and case studies to tell the story of this “second wave” of change we are witnessing. Ranging from the rapid adoption of sustainable technologies to the welcoming of a new local creator economy, we detail the surprising changes the pandemic has brought to consumer preferences, workplace dynamics, business models and the geopolitical influence on the fast-changing tech sector.

An initial top-down view paints a clear picture of a region at an inflection point. The Atlantico Digital Transformation Index, which measures tech penetration by tracking the value of public technology companies as a percentage of GDP, rose to 3.4% in 2021 from 2.3% in 2020 for LatAm as of August.

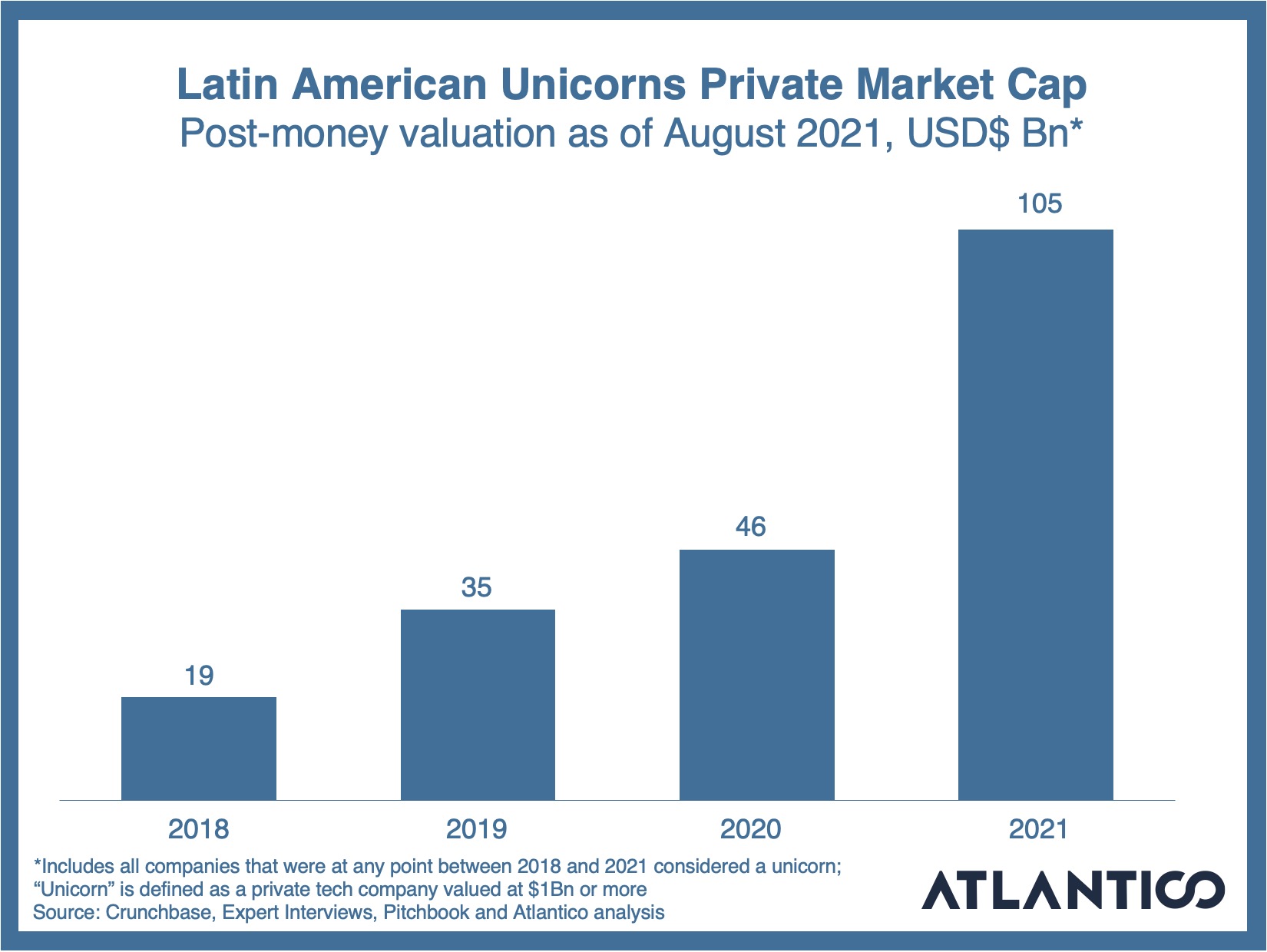

Similarly, based on an internal analysis of private company data, we estimate that the value of regional unicorns reached $105 billion, more than double last year’s figure of $46 billion. Eight new unicorns have already been minted this year, nearly reaching 2020’s rate by midyear.

Much has been written about Latin American fintechs, which last year drew 40% of the region’s venture capital investment. The revolution witnessed over the last five years, which produced the likes of Nubank (the world’s largest digital bank), was sparked by a mix of changing consumer demands, a concentrated banking sector and a pro-innovation regulatory environment. We are now seeing the second-order effects of the fintech boom, as the same set of conditions arise in other soon-to-be disrupted sectors.

In the insurance space, similar changes are giving way to innovative models like 180o in Brazil and Betterfly in Chile. The former, founded by prior Nubankers, takes embedded insurance to the max, pioneering an insurance-as-a-service model that enables any company to create bespoke insurance products for its customers and seamlessly integrate them into their core experience. In the case of Betterfly, we see the rise of a novel benefits platform that lets companies offer a life insurance product that rewards healthy habits and charitable donations.

Turning to e-commerce — Latin America’s bedrock in the technology sector — we can quickly spot the second-order effects of the pandemic. E-commerce penetration of retail is expected to reach nearly 11% by the end of 2021, more than double the pre-pandemic levels, and Mercado Libre continues to lead the region as the most valuable technology company around.

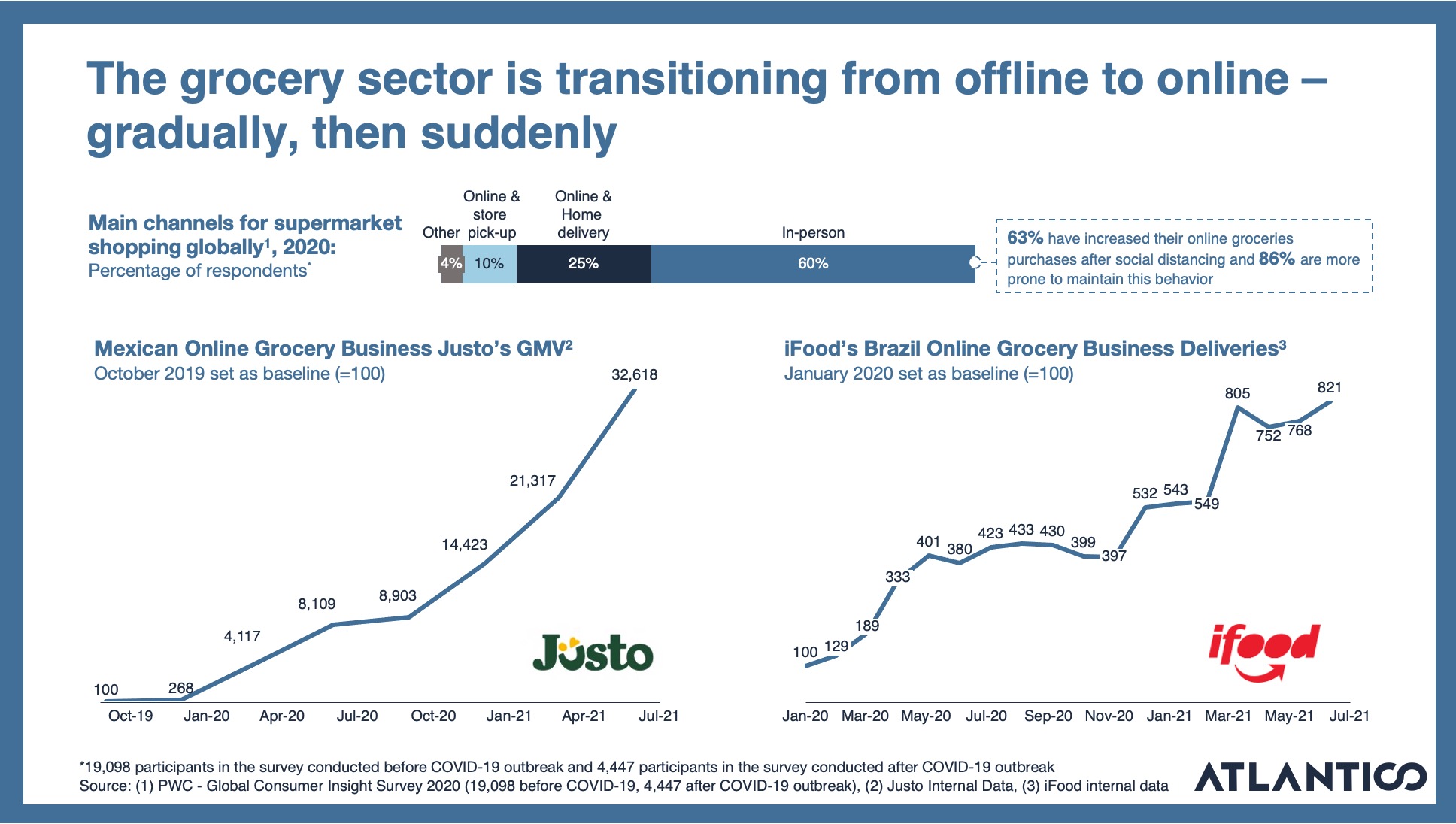

Catalyzing this growth are previously unimaginable changes to consumer preferences. Latin Americans are flocking to e-commerce for commodities that were traditionally bought in person, purchasing everything from groceries to cars and even real estate online. Globally, social distancing measures led 63% of people to increase their online grocery ordering, and behavior in Latin America was no different.

Based on internal company data, Mexican online grocer Jüsto has increased sales by more than eightfold from pre-pandemic levels, while Brazilian delivery unicorn iFood posted a 4x increase in grocery volumes. When it comes to selling cars, Mexico’s Kavak became the country’s first unicorn, and in the realm of real estate, two Brazilian unicorns, Loft and QuintoAndar, have been taking property sales and rentals online.

This magnitude of expansion required a significant evolution in the quality and scale of the infrastructure provided by logistics, payments and e-commerce platform companies. Brazilian logistics unicorn Loggi increased the total number of packages it handled by 115% over the four quarters following the start of the pandemic. Similarly, e-commerce platform VTEX, which went public on the NYSE earlier this year, said the GMV transacted by merchants on its platform nearly doubled.

On the payments front, three-fourths of e-commerce transactions are already conducted with payment cards or digital wallets. Cross-border payments, useful for both international e-commerce and digital services and media, saw EBANX in Brazil and dLocal in Uruguay emerge as major players in the region, with dLocal’s Nasdaq IPO this year giving it a market capitalization equivalent to more than 35% of Uruguay’s GDP. In time, it was this dramatic evolution in infrastructure that enabled the second wave of e-commerce growth.

But while digitalization advanced, globalization retreated. Already stressed U.S.-China relations worsened during the pandemic, leading many to proclaim the end of globalization. As Chinese companies saw their prospects for growth in the U.S. being stunted, they, along with Asian neighbors, increased their attention to emerging markets like Latin America.

This year, we estimate TikTok has reached one out of three Brazilians each month to become the sixth most used app in the country. Social video network Kwai has also become a major source of content creation since it was formally launched in Brazil in 2019, and this year, it officially made its way to Mexico and Colombia. Meanwhile, Chinese capital continues to flow in, with Chinese juggernaut Tencent, already an investor in fintech unicorns like Nubank and Ualá (Argentina), co-leading a $120 million round in Brazilian real estate unicorn Quinto Andar earlier this year.

Asian companies have also made significant headway in Latin American e-commerce. Most notable has been the growth of Shopee (developed by Singaporean internet giant SEA Limited), which has surpassed every Brazilian e-commerce company by many measures, including in monthly active users on its app. Chinese online fast-fashion company Shein has also made significant inroads, emerging as a newer example of cross-border commerce success in the mold of AliExpress, already a major player in LatAm for many years.

Besides providing fertile ground for Asian tech companies, Latin America has benefited hugely from Chinese business models, which serve as a major source of inspiration for fast-growing local companies. Brazil’s Facily, whose model borrows much from Pinduoduo, has topped the Android download charts. Meanwhile, Peru’s Mercado Favo and Colombia’s Muni are quickly expanding in other countries in Latin America (namely Mexico and Brazil) by adapting Shihuituan’s model of selling low-priced groceries through local community leaders.

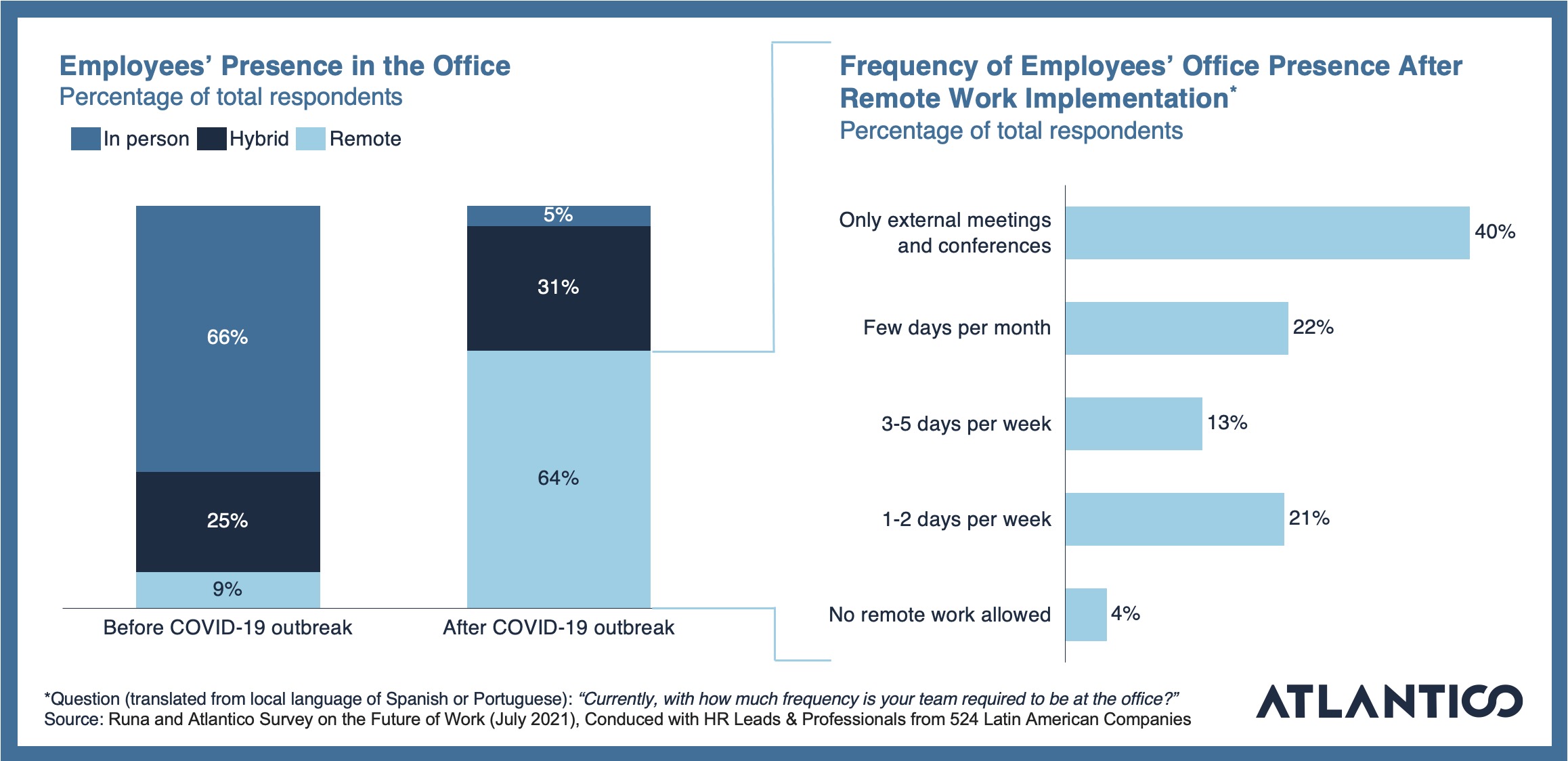

While geopolitical barriers built up, the historical barriers of physical workplaces were forever dismantled. Fascinated by the much-discussed concept of “future of work,” we teamed up with Mexican payroll and HR software company Runa to survey human resource leaders across 520 Latin American companies on what they expect from the workplace in the coming months and years.

Prior to the pandemic, 66% of companies reported operating in a predominantly in-person model (with another 31% in some type of hybrid setup). Today, a mere 5% of all companies report having employees primarily present in the office, and for the vast majority that follow some type of remote model, only 38% of employees go to the office once a week or more.

Remote work has brought with it some unexpected benefits: 95% of respondents now find it easier to hire more diverse candidates. Curiously, 8% also said that they suspect employees of secretly working more than one job at a time.

Latin Americans are global leaders in media consumption, reaching 14.5 hours per day across all media formats (North Americans come in second at 13 hours per day). Not surprisingly, these habits have carried over to social media, with 88% of internet users being on social networks (the number is 73% in North America). Brazil, Mexico and Argentina alone account for over 250 million social media users.

As the media landscape shifts away from its traditional form — where content is produced and curated primarily by media companies — we’re seeing the rise of a new creator economy, where influencers and independent creators lead the way in creating abundant amounts of content for all types of audiences.

Latin America’s historical consumer preferences and behavior have placed it at the forefront of this movement. 39% of Brazilian internet users (the number is over 30% for Argentina, Colombia and Mexico) follow influencers on social media, compared to 21% globally and 17% in the United States. Not only do more Latin Americans follow creators, they also report a greater level of influence in their purchase behavior. At double the global average, 41% of Brazilians claim they’ve purchased a product because a creator promoted it.

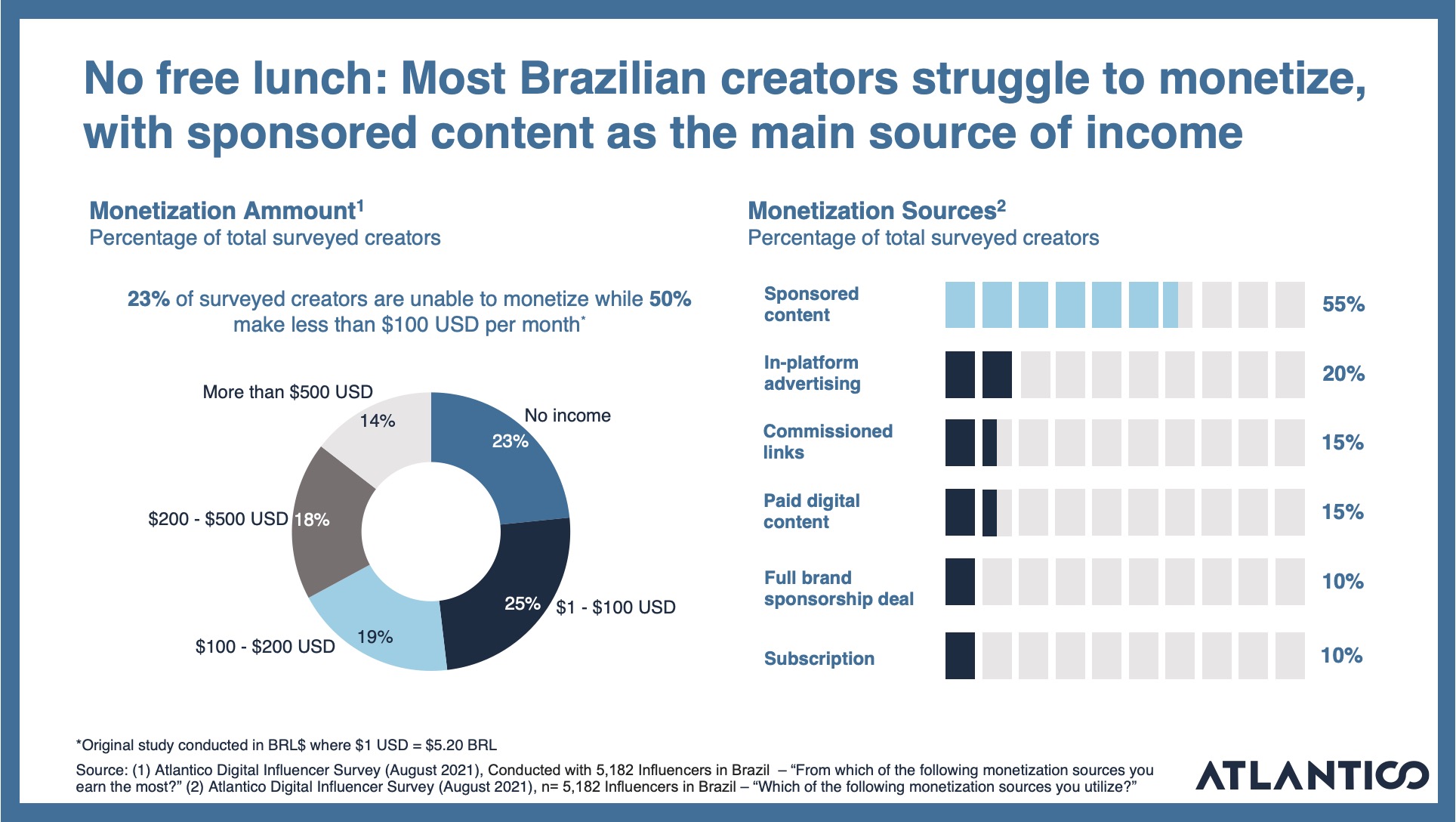

To understand this new creator class, we surveyed more than 5,100 creators in Brazil. While it may seem that making money as a creator is easy, our survey surprisingly indicated that 23% of creators don’t monetize their influence, and another 25% earn less than $100 dollars a month. The primary form of monetization comes from sponsored content (55%) followed by in-platform advertising provided by the tech companies (20%).

To fully grasp the extent of the digital transformation in Latin America, we dove into the agricultural sector, which accounts for a considerable portion of the region’s production and 21% of Brazil’s GDP. Although Latin American farmers are eager to become more digital, barriers are abundant. Limited internet access in rural areas, high investment requirements and lack of information for decision-making were all identified as major obstacles for digitizing agriculture.

However, we identified key areas of innovation, ranging from fintech services to precision agriculture powered by robust data solutions. While advances in agriculture technology are expected to aid the region in increasing production volumes per acre, consumer preferences have been pressing for more sustainable practices, not only in food production but also in our energy consumption.

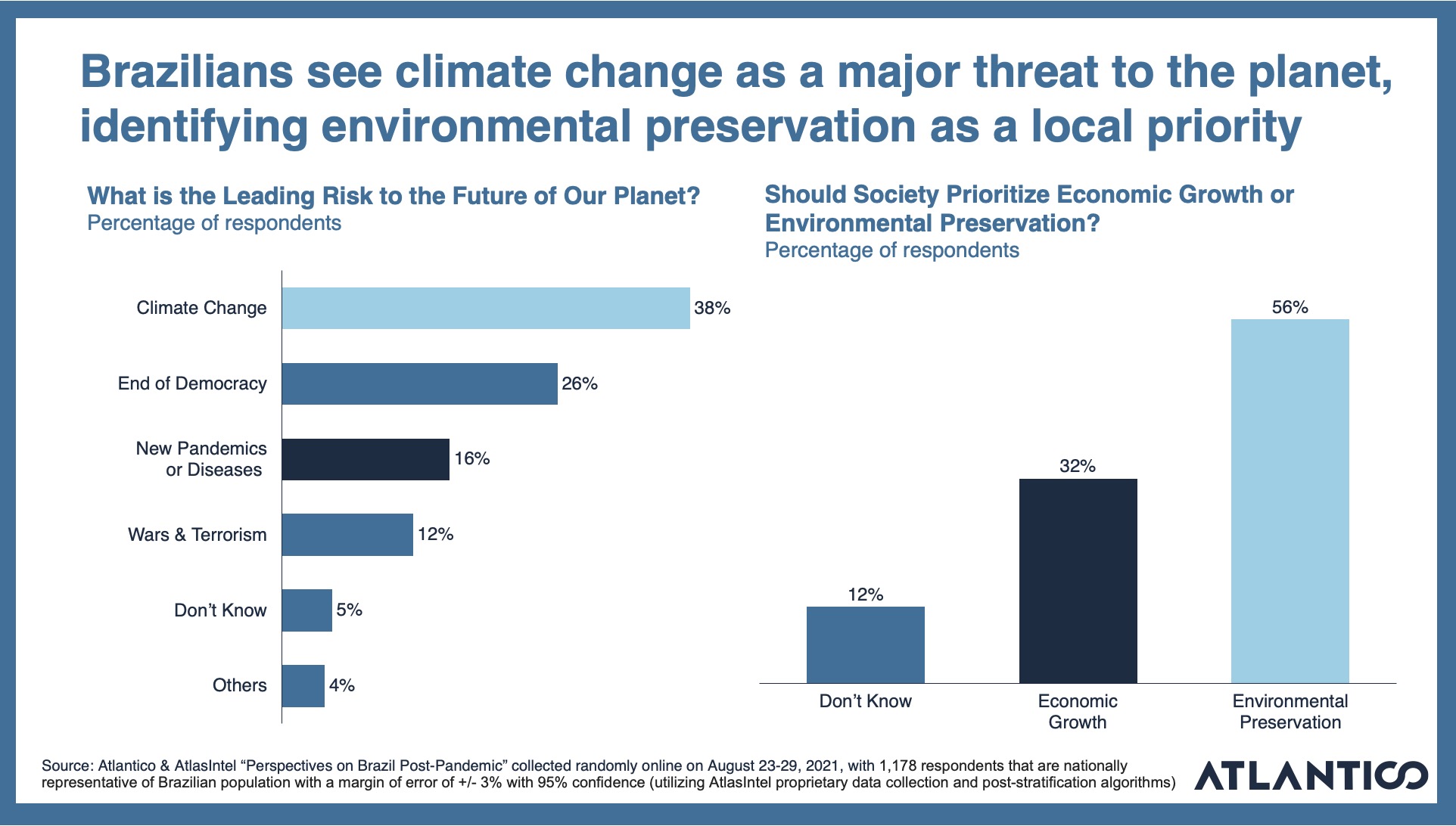

We teamed up with Atlas Intel, a survey and big data analytics company, to understand sentiments toward sustainability in the Brazilian population. Respondents identified climate change as the No. 1 risk to the future of the planet (with 38% of people selecting the option), with over half the population stating that society should prioritize environmental preservation over economic growth.

Armed with hard data on consumers’ demand for sustainable practices, we explored how technology is furthering sustainability goals in the region. It is clear that Latin America is uniquely positioned to benefit from growing global demand for carbon offsetting. Peru and Brazil are already among the top five global sources for forest offsets transacted in the last few years.

Consumer demand for alternatives to animal protein may also position the region for global success. Many believe that Latin America may be able to leverage its position and expertise as the world’s leading meat exporter to pivot to the plant-based alternatives sector. Companies like Chilean unicorn NotCo and Brazilian Fazenda Futuro are some of the most promising in the region, having already made early inroads into the U.S. with their products.

When it comes to energy, Latin America is already ahead, with a significantly cleaner composition in its electricity sources than a large portion of the world given its strong hydroelectric and renewable energy matrix. Additionally, we see significant growth in solar energy production (especially distributed generation), where noteworthy startups like Solfácil, Lemon and Clarke are making their mark.

As we cataloged the myriad second-order impacts of the digital transformation in the region, we saw how it not only provided financial gain but also brought greater access to the financial system, more flexible jobs into the economy and more sustainable solutions for society. This year’s report brought with it a sense of optimism for Latin America’s future, one that we believe will be amplified by every subsequent wave of digital penetration we experience in the coming decades.

Comment