The last five years have seen a plethora of fintech applications in Nigeria (and Africa, in general) grow at an astonishing rate. But most of these companies and developers find it difficult to access real-time banking data. This, in turn, creates a bottleneck when onboarding and verifying customers.

Since 2019, Plaid-esque companies, but with different twists to their offerings, have emerged to solve these issues. Today, Nigeria’s Okra, arguably the first to gain mainstream attention, is announcing that it has closed a seed round of $3.5 million.

U.S.-based Susa Ventures led this latest tranche of investment. Other investors include TLcom Capital (the sole investor from its $1 million pre-seed round in 2020), newly joined Accenture Ventures and some angel investors. In total, Okra has raised $4.5 million in two rounds and the company will use the investment to expand its data infrastructure across Nigeria.

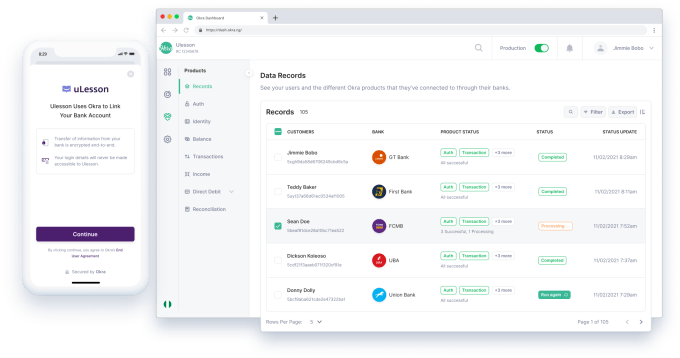

Okra likes to describe itself as an API “super-connector” that creates a secure portal and process to exchange real-time financial information between customers, applications and banks.

Fara Ashiru Jituboh and David Peterside founded the company in June 2019. Since its launch in January 2020, Okra has aggressively pushed by connecting to all banks in Nigeria and even claims to have a 99.9% guaranteed uptime.

Its business model provides integrations to developers and businesses into existing banking services and takes commissions off subsequent transactions. These integrations include accounts authorization, balance, identity, income, payments and transactions. Per partners (developers and businesses), they are well over 100 with some big names like Access Bank, Aella, Interswitch and uLesson.

Ashiru Jituboh tells TechCrunch that besides making APIs, Okra is in the business of selling “digital first-experiences and transformation”.

“We are building an open finance infrastructure that enables developers and businesses to offer digital-first experiences and financial products,” she said. “We’re at a point where businesses are realizing that digital transformation is one of the most conversation happening in most boardrooms. So for us, we’re essentially just making tools and services needed to achieve digital transformation at scale with our APIs.”

Positioning the company in such a way might be the reason for its immense growth in over a year. The company says it has recorded an average month-on-month API call growth of 281%. Okra has also analyzed more than 20 million transactions; last month, it analyzed 27.5% of this figure at over 5.5 million transaction lines. For a bit of context, Plaid has analyzed more than 10 billion transactions in its eight years of existence.

“I think it’s a good indicator that we’re on the right trajectory in terms of traction,” COO Peterside added.

If anything one can learn from the Nigerian fintech ecosystem over the past two years is that with growth comes regulatory scrutiny. Since last year, different regulatory moves from some of the country’s financial bodies have been targeted toward payments, crypto and wealth tech startups. While these regulators claim to foster the interests of the Nigerian public and protect consumers, their moves reek of innovation stifling and jurisdictional play.

So far, these regulators appear not to be concerned with the activities of API fintech infrastructure startups. But will these companies be prepared to deal with the situation should that change?

According to Peterside, Okra is preparing for unforeseen circumstances by taking the initiative and engaging with the regulators in its space. Since 2018 when the EU released the General Data Protection Regulation (GDPR) to deal with data protection and violations resulting from it, most African countries have mirrored these laws for their region. In Nigeria, there’s the Nigeria Data Protection Regulation (NDPR), and due to its similarities with the GDPR, Peterside believes Okra has nothing to worry about — at least for now.

“In terms of what the law says, I think the fine print is clear not just in Nigeria but globally, so how we operate as a business is straightforward. But in terms of what we think, the regulators whether they make the necessary decisions… we can’t really speak about that but generally, the laws and global standards are clear,” he said.

If the company succeeds in keeping harmful regulations at bay, it can grow at whatever pace it wants. However, a bane that might threaten this pace is hiring, according to the CEO. “The one challenge I’ll say we face has to be hiring,” Ashiru Jituboh said.

Now, one of the significant reasons Okra proves attractive despite just over a year in operation is how it prioritizes speed. The company claims to onboard new clients in 24 hours or less while supporting them through the use cases specific to their product.

An increasing clientele means increased problems which means more personnel to handle them. So besides using the recent check to expand its data infrastructure across Nigeria, Okra will put a sizeable chunk into sourcing for talent.

“We want to ensure that we’re solving our customers’ problems as fast as possible and give the clients the support they need. We want to make sure our hiring speed is the same as the speed of our growth and I think being able to raise capital is one of the solvers of that problem… making sure we’re bringing great talent and building a great team,” she added.

Ashiru Jituboh understands the need for great engineering talent because of her engineering-heavy background. Before starting Okra with Peterside, she worked with JP Morgan, Fidelity Investments and Daimler Mercedes Benz. At Okra, she doubles as the chief executive and CTO, staking a claim as one of the most promising founders in Africa’s male-dominated fintech scene.

Omobola Johnson, a senior partner at TLcom Capital, maintains that these qualities and Okra’s proposition made the company its first fintech investment. It was more than enough to convince the firm to follow up in this round.

A year on, Okra has managed to make its investor list more impressive. Susa Ventures, its lead investor, has made notable early investments in Robinhood, Flexport and Fast. However, Okra is the only African-based startup the VC firm has invested in asides from Andela.

Andela begins global expansion in 37 countries months after going remote across Africa

“We’re thrilled to partner with Okra as they enable developers across the African continent to transform digital financial services,” general partner at Susa, Seth Berman said. “We’re blown away by the quality of Okra’s team, pace of development and the excitement from the customers building on their API.”

As part of a Fortune Global 500 company, Accenture Ventures has invested in more than 30 startups. However, Okra is the first Black founded startup in its portfolio. Tom Lounibos, the firm’s president and managing director, said the reason behind the investment stems from partnering with Okra to bring open finance to Africa, the calibre of founders and their technology.

The founders tell me that Accenture and Susa represent smart money investors aligned with Okra’s vision and technology infrastructure play.

“For us, if we’re building an API infrastructure for the continent, we thought Accenture would be a really good partner because we’re essentially building an API which is a technology-based infrastructure,” said the CEO.

Besides, the investors will be pivotal to the company’s hiring and imminent pan-African expansion plans to Kenya and South Africa, where Okra is currently in beta.

Accenture coming onboard to Okra as an investor marks the latest in a line of major companies jumping in on the African fintech wave — Stripe with the acquisition of Paystack and Visa and WorldPay partnership with Flutterwave.

In terms of investments, Accenture Ventures continues the list of first-time U.S. investors in African fintech. Names like Bezos Expeditions in Chipper, Tiger Global and Avenir Growth Capital in Flutterwave and Valar in Kuda come to mind.

Beyond Susa and Accenture Ventures, Okra also brought on three angel investors to the round. Rob Solomon, chairman at GoFundMe and former partner at Accel; and two ex founding engineers at Robinhood — Arpan Shah and Hongxia Zhong.

Okra is not the only company looking to capitalize on the budding API financial infrastructure space. Stitch, another South African API fintech, came out of stealth with $4 million in funding. Pngme raised $3 million in February. Others like Nigeria’s Mono and OnePipe have raised six-figure pre-seed rounds and are backed by Y Combinator and Techstars.

Despite seeming competition, the infrastructure business, unlike a commoditized business, is one with room for many winners.

How fintech and serial founders drove African pre-seed investing to new heights in 2020

Comment