Latin Americans seeking the ability to invest in companies trading on the Nasdaq and New York Stock Exchange now have a new option in Vest, a startup that has launched a mobile-first brokerage app with zero-commission trading in the Americas.

CEO and co-founder Aaron Polhamus said he, Miguel Arroyo and Jaime Rodas were driven to start Vest in December 2020 because of their belief that while Latin Americans work hard for their savings, “historically their savings have not worked hard for them.”

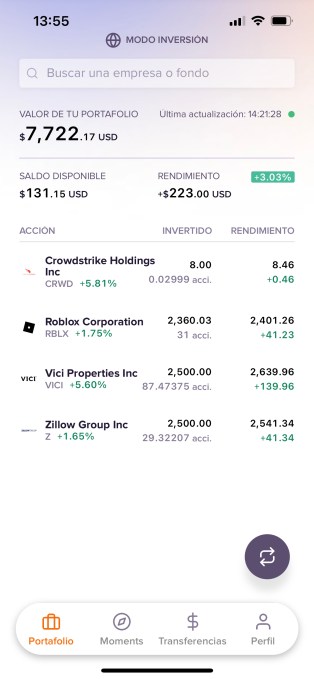

To help remedy this problem, Vest aims to provide direct access to U.S. equities investments to retail investors in all major economies in Latin America, as well as in the United States. Today that means the startup operates an active brokerage so that users may buy stocks listed on the NYSE and Nasdaq. But soon the company plans to expand its platform to include a passive investing product (robo funds) and crypto. It plans to have both the active and passive products built with the same user interface so that investors “can use both strategies in the same place, rather than having the fragmented, multi-platform experience that is the norm today,” said Polhamus, who is the former CTO of Mexican fintech Credijusto.

Recognizing that not everyone who wants to invest might have the financial literacy to do so, Vest has also developed what Polhamus describes as “a market simulation environment for learning and practicing” for those who have no previous financial exposure. It also provides in-app content to educate on investing fundamentals and provide insight into current events and economic trends as well as native multi-lingual support.

Vest’s platform is live and its app is available for download on iOS and Android throughout Latin America, and in the U.S. states of Arizona, California, Florida, Georgia, New Mexico, New York, Texas, Washington and Puerto Rico. The startup currently offer users integration to local banking in the U.S. and is building direct local banking integrations into other major markets in LatAm.

To further its mission of building the “next-gen” investment platform for LatAm, the company is also announcing today that it has raised $6 million in a seed round led by Founders Fund that included participation from Nazca, Class 5 Global, FJLabs, Tamarack Global and angel investors such as Kavak founder Carlos García, Tiger Global’s Scott Shleifer, Loft founder Florian Hagenbuch, M1 Finance Founder Brian Barnes (Founder, M1 Finance), Nico Barawid and Gerry Giacomán Colyer (founders of Casai and Clara) and the Moons founding team. It is valued at $22 million, post-money.

“We want to empower investors throughout the Americas to build their financial future via a world-class investment and education platform….Financial services for investing and cash management in the U.S. offer best-in-class efficiency and pricing, and Vest is making these benefits accessible to a surging regional retail investment market across Latin America,” Polhamus said. “New investors don’t just need a transactional medium, but a framework for making wise investing decisions.”

Vest’s founding team is not deterred by recent stock market turmoil. In fact, they view it as an opportunity — to communicate with its users about what’s most important as they build their financial foundation: investing for the long-term, in high-quality companies and assets that compound over time, without obsessing over perfect timing.

“Some trading apps focus on promoting a high volume of transactions, where customers are enticed by visions of hitting a home and growing their net worth considerably overnight,” Polhamus said. “That’s not us. We are a far more AUM-focused business, both philosophically and in terms of how we are building our product roadmap for 2022….Although things may get rough in the short term, historically speaking, time is the investor’s friend.”

“Businesses that promote quick profits may struggle in volatile market moments, while businesses that promote sound investing disciplines oriented toward the long-term will ultimately win the trust of their customers – through the market’s ups and downs,” he added.

Presently, Vest has 36 employees, up from five a year ago.

The company plans to use its new capital mostly toward hiring across its product, content and operations teams, acquiring the necessary licenses to operate in its various markets and to engage strategic partners.

Founders Fund Partner Matias Van Thienen said his firm had been looking for an investing and savings platform in Latin America that could offer global equities with a high-quality product and a suitable regulatory approach. It was introduced to Vest by one of its portfolio founders, Carlos Garcia.

“We invested based on the founding team’s strong engineering background combined with deep understanding of the regulatory complexity required to scale this type of business,” Van Thienen wrote via email.

Because Vest is structured as a U.S. brokerage, it can offer global equities while operating in the Latin American countries where it has obtained the required local licenses, unlike most local offerings in the region, the investor points out.

“Beyond that, Vest’s product has the breadth to appeal to a wide range of users, from highly active stock traders to those looking for a more passive savings product,” he added.

Van Thienen is originally from Argentina and grew up between there and Miami, so he’s naturally always had an eye on LatAm. Founders Fund has also backed Brazilian fintech giant Nubank and auto marketplace Kavak.

A wave of LatAm fintechs are laying down new global commerce rails

Comment