Autumn on planet Earth didn’t start until the equinox a few weeks ago, but the axis shifted months ago in Startupworld, where VC winter has desperate founders smashing up the furniture for firewood.

Metaphorically speaking, of course.

We’re definitely in a down market, but for entrepreneurs who are eager to build and scale, venture capital is always scarce.

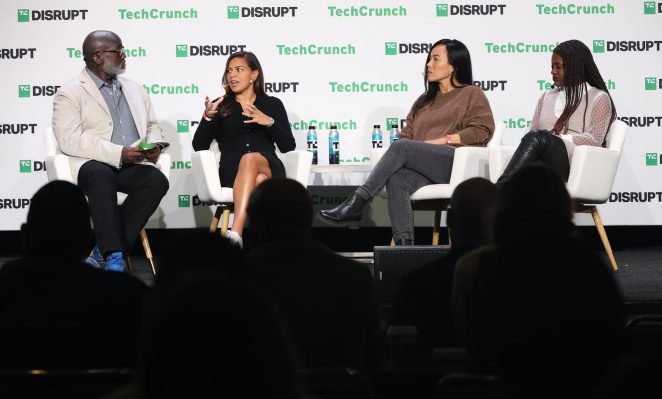

At TechCrunch Disrupt, I spoke with three investors to hear how they’re advising founders (especially first-timers) on how to calculate total addressable market (TAM), how it differs by sector, and how the TAM slide often reveals whether a founder is even ready to start raising capital:

- Jomayra Herrera, partner, Reach Capital

- Helen Min, co-founder and managing partner, Phenomenal Ventures

- Monique Woodard, founder and managing director, Cake Ventures

This was a jargon-heavy conversation, so before we get into the recap, let’s define terms:

- TAM: Total addressable market

- SAM: Serviceable addressable market

- SOM: Serviceable obtainable market

If we use the example of a startup that makes and sells plant-based dog treats:

- TAM: Everyone who visits a store that sells dog food

- SAM: People who specifically want healthy dog snacks

- SOM: How much you think you can sell (go-to-market strategy)

Investors use TAM to get an idea of your company’s upside potential, while SAM and SOM help them offset their risk, regardless of macroeconomic conditions.

Does calculating TAM change during a downturn?

Nope.

“As an investor, the TAM calculation doesn’t really change whether we are in a more flush environment or a less flush environment,” said Monique Woodard. “You’re still going to be looking for companies that are addressing large markets and trying to figure out the biggest TAM they can get to.”

“The truth is, there is no right or wrong, like, ‘Here’s the exact number!’ It’s more about whether we have overlap and agreement in the assumptions around your driver.” Jomayra Herrera, partner, Reach Capital

Jomayra Herrera agreed: “What hasn’t changed even with a down market is the size of our funds and the exits that we need to realize in order to return those funds,” she said. As a result, “the calculation essentially stays the same.”

Founders should strive to offer more than just eye-popping TAM numbers, said Helen Min. “I think most investors would also say they want to see a small initial market, a market that is just your customer base that’s just obsessed with your product.”

To avoid spinning out in a hype cycle, she encouraged teams to concentrate on building “something that stays evergreen, regardless of what the market looks like.”

Before setting up a meeting, Min said founders should ensure that the TAM they’re pitching aligns with the size of an investors’ fund: “Having a 10x or 100x return on their investment in you, if that doesn’t return their fund, it probably doesn’t make sense for them to invest.”

Show your work to receive extra credit

A bottom-up approach to calculating TAM reveals more nuance than a top-down summary, but it’s critical to show your work so investors can see how well you understand the market you hope to conquer.

“You want to do bottom-up, you want to do top-down, [and] you want to do a ton of market research to triangulate,” said Herrera. “What’s the zone the TAM is in?”

Min said VCs are open to the idea that TAM shifts over time, since some new products and services can build a platform of related offerings or expand internationally. “If you’re a leader in a growing category, you actually can just explain what your unique role would be,” she said.

“A market can look small today, but it’s really up to a founder to convince me that that market is growing,” said Woodard. “If the market is big, but not growing, that’s also a problem.”

The TAM slide in a pitch deck is likely to spark some conversation, so be prepared to present the data and methodology that helped you get there. “I would say that ‘show your work’ is actually the point,” said Min, adding that founders are sharing more supplementary materials these days.

“It’s similar to the classic consulting interview exercise of how many ping-pong balls can you fit in a 747? They don’t really care what the actual answer is. They want to see how you arrived at that number.”

So don’t worry about nailing TAM perfectly, Herrera said. “The truth is, there is no right or wrong, like, ‘Here’s the exact number!’ It’s more about [whether] we have overlap and agreement in the assumptions around your driver.”

Image Credits: Eric Slomonson The Photo Group (opens in a new window) / Flickr (opens in a new window)

When a founder just doesn’t understand their TAM

If a company targets everyone who drinks water or consumers who like bargains in their pitch deck, their TAM is off the mark. Each panelist shared examples of market slides that were red flags.

Min’s firm typically cuts checks between $100,000 and $250,000, but she recalled passing on a pitch “because we actually felt like the TAM was a little bit small” for her firm. “Even if you start out with a small TAM and you have a big vision, you can see how a product will be able to extend itself into other sectors,” she said, but this pitch simply lacked sufficient upside potential.

According to Woodard, rapid market shifts can cause founders to lose their sense of direction, particularly if they’re overly attached to their initial vision. “Sometimes, you fall in love with the solution or the product, but what you should actually be falling in love with is the problem,” she said. “When I see an inability to shift and modify, or being in love with that product so much that they don’t want to change course, it’s a reddish flag.”

It’s a big planet, so don’t flatter yourself: Someone out there is already working on the same problem you’re solving. “My biggest pet peeve is when someone says, ‘We have no competitors,’ and I’m like, ‘You always have a competitor,’” Herrera said.

Whatever you do, do not make up a TAM number. “I would rather have an ‘I don’t know’ than pure jazz hands,” Woodard said.

How to make a strong TAM slide when you don’t know what you’re doing

You can’t calculate TAM on the back of an envelope. It’s a methodical process that requires nuance and research, so quoting the latest Gartner study won’t be sufficient. To gather data that supports your pitch, reach out to potential customers, academics, investors, or even everyday workers who embody your ideal customer profile.

“I would talk to other people who are in that sector,” said Min. “One way to really reach into more pockets of your TAM is to have a diverse set of investors, a diverse set of founding members of the team, a diverse set of early customers.”

Founders who approach investors with genuine insights instead of copy-paste facts will always stand out from the crowd, said Woodard.

“I think we’re all looking to be taught something by founders who we want to invest in, so you can use many different parts of your deck to do that,” she said. “It’s not just the TAM slide.”

“The best founders are not going to be great investment analysts or finance folks,” said Herrera. “I don’t expect you to produce this amazing TAM analysis or an amazing financial model that shows you have everything put together. I just need you to be willing to learn and be open to having that conversation.”